by Mario Gavira

Note from Mauricio Prieto: Six months is a long time, particularly in a sector like online travel and in a time of Covid. I am delighted to have my good friend and former eDreams Odigeo colleague Mario Gavira write this guest post on how the Online Travel Trends report we published last July has aged. Mario is not only a great travel entrepreneur, visionary and executive, but also a gifted writer. Thank you Mario for bringing your talents to this newsletter!

“It’s hard to make predictions, especially about the future”, acknowledged Niels Bohr, the Nobel laureate in Physics. July last year, Mauricio Prieto and myself accepted the challenge to try to untangle the underlying tech trends shaping the travel industry beyond the pandemic rollercoaster, boiling them down into 11 themes.

After a flurry of investments, acquisitions and partnerships during the 2nd half of 2021, 2022 begins in the midst of the Omicron tsunami, but with hopes that the world is about to turn the corner from a pandemic to an endemic phase. Against this backdrop, it feels well-timed to revisit our trends and have some fun predicting how they will unfold during 2022.

Trend 1: Thinking outside the travel box

Narrative

The API economy provides the backbone for a sprawling array of complementary services such as fintech, micro mobility and experiential services in Travel.

Recent events backing the trend

Hopper raised another $175 million round in August and its B2B Fintech Arm Hopper Cloud signed at breakneck speed an array of leading global travel players like Kayak, Amadeus, Makemyptrip and Trip.com.

Travel payment service Fly Now Pay Later raised $75 million to expand in the US market.

Travel and payment platform Klarna, expanded into travel by acquiring Inspirock, an online trip planner.

Digital Banking Revolut, launched its own travel service offering up to 10% cashback.

2022 outlook

Travel and Fintech are gradually blurring the lines. Expect travel retailers to keep leveraging contextual shopping data to build financial products embedded into the consumer journey. Fintech Unicorns meanwhile will be busy partnering with travel players to increase their customer base stickiness and tap into new audiences with high purchasing power.

Trend 2: Mobility Enables NextGen SuperApps

Narrative

Asian Super Apps stickiness built on offering from noodle delivery to hotel bookings will take off once Western Apps start connecting micro mobility with long distance travel. Google Map will lead the path by gradually weaving the Search Giant’s travel ecosystem into a seamless mobile experience.

Recent events backing the trend

AirAsia kept expanding its super app business with the launch of ride hailing service in Malaysia and expanding its food delivery service in Thailand and Indonesia, on the back of Gojeks’s subsidiary acquisition, Vojex Technology. AirAsia Superapp’s current valuation is estimated at US$1 billion.

In the West, the only news-worthy development was Google Map announced the expansion of its payment parking solution to another 100 US cities in November 2021

2022 outlook

The trend towards Super Apps among travel brands will remain mainly the playground for Asian companies. However, expect Google to keep enriching Google Map features and add payment options for other mobility services, paving the way to become the ultimate Super App in the West.

Trend 3: Connecting the Dots

Narrative

Ground increasingly replaces Air transport for short distance travel, driven by door to door convenience and growing environmental impact concern. Players combining air and different ground transport types into a seamless travel experience will flourish.

Recent events backing the trend

Train keeps winning ground to Air transport in Europe with the successful launch of new high speed competitors in Spanish top selling route Madrid-Barcelona and Trenitalia breaking into the French market on the París-Lyon-Milán route. Private operator NTV Italo continues to expand its network across Italy.

Bans on domestic flights below 300 kms is likely to be enforced across several EU states over the coming years..

2022 outlook

Expect intra-European travellers increasingly demand a larger choice of transportation options than just flights.

Travel players who are capable of merging air with ground transport into a convenient and seamless transport offer, will reap the rewards of this paradigm shift in customer demand.

Trend 4: 4. Unbundling and Rebundling

Narrative

An increasing complex purchase funnel crammed with ancillary services is resulting into a wave of rebundling of services into consumer-friendly packages

Recent events backing the trend

According to the latest CarTrawler’s Worldwide Ancillary Revenue report, ancillary revenue per passenger was estimated at $12.13 in 2019, increasing to $27.60 over the last 2 years.

OTA’s, who reacted swiftly to the pandemic outbreak by launching bundled services offering higher flexibility have stalled since then in their efforts to deliver more innovative service packages.

2022 outlook

Ancillaries will remain a major revenue diversification driver for both travel supplier and distribution. The challenge will be adding ancillary packages that reduce friction in the customer journey and deliver value for the customer. Expect Low Cost Carriers and major OTA’s to keep leading in this front.

Trend 5: Rewriting the Marketing Playbook

Narrative

Airbnb showed the virtue of a strong brand winning traveler wallets and hearts. Shifting marketing dollars from performance to brand becomes the new marketing adage, further fueled by the gradual sunset of 3rd party tracking capabilities.

Recent events backing the trend

With the exception of Airbnb, the industry swung back to the tried and tested performance marketing path to surf the travel recovery.

Google and Facebook last quarter blockbuster earnings with a +43% and +35% advertising revenue growth respectively clearly illustrate this trend).

2022 outlook

Despite all the criticism around Google’s expansion into travel, the reset opportunity during the pandemic did not materialise into a fundamental change of the marketing mix investment among most travel players.

Expect search to remain by far the largest marketing spending for most of the industry, but also a growing appetite to test more brand focused messaging further up in the funnel.

Trend 6: Subscriptions Everywhere

Narrative

Loyalty in travel has historically been linked to miles programs. Travel players are defying the common wisdom attracting travellers into a new breed of paid subscription programs promising recurrent discounts and perks.

Recent events backing the trend

No major movements in the travel subscription arena are worth reporting these last months, other than Tripadvisor’s Plus change from upfront discounts to a point based wallet, which was negatively perceived by the investor’s world, wiping out $374 million in the day after the news broke.

2022 outlook

Game changer or gimmick? Expect some other travel retailers to dip its toes into Subscription waters this year, but the jury is still out if subscriptions can become a significant revenue driver in the travel industry, considering the infrequent nature of the product.

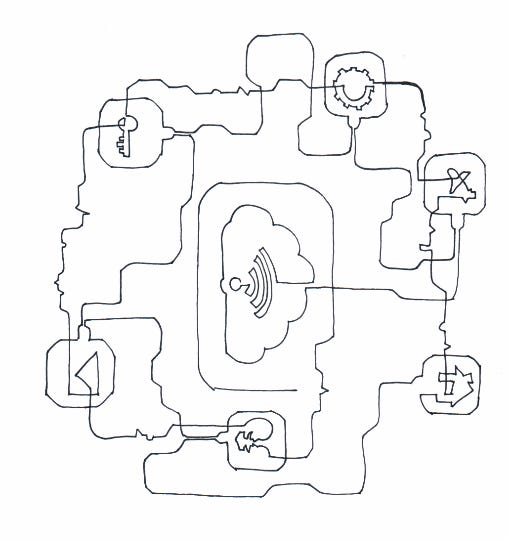

Trend 7: Apps Converging into a Travel Ecosystem

Narrative

Mobile native SDK’s standards turbocharge App capabilities to connect with other platforms. Travel Apps moving forward will self- generate Visas based on travel destination, offer voice-based translation at arrival and deliver check-in and room key function in the hotel, among other services.

Recent events backing the trend

The pandemic has accelerated the roll out of the IATA Travel Pass with 5 new airlines together with Emirates announcing its implementation.

2022 outlook

The catalyst for a seamless app ecosystem will be a so-called “decentralized digital identity” mechanism, an interoperable digital wallet that can share the relevant data of the traveler with each service provider.

Health certificate requirements for international travel might become the “Trojan horse” for a digital wallet that will provide foundations for a seamless travel app ecosystem

Trend 8: Consolidation Turbocharged

Narrative

Mid-size and regional players coming out of the pandemic with a weak balance sheet might face being acquired or extinction. Global players with a highly scalable tech stack will apply the classic economies of scale playbook triggering a wave of consolidation.

Recent events backing the trend

During the 2nd half of 2021 Booking Holding grabbed the M&A limelight with two bold acquisitions serving very different purposes: Getaroom for $1.2 billion allowed them to further consolidate their stronghold in the B2B hotel distribution, while ETraveli Group €1.63 billion allowed them take ownership of a flight tech stack that fits into their connected trip vision.

2022 outlook

Expect 2022 to be a banner year in terms of M&A, both for opportunistic deals and strategic bets. Large players who sat out external growth opportunities during the pandemic are likely to actively seek for acquisition targets before they are being snapped up by their competitors. The industry's M&A wild card will be TripAdvisor, still the largest travel site in terms of visitors, but with an erratic track record of monetization and a lackluster stock trading performance in recent years.

Trend 9: Suppliers Strike Back

Narrative

In the past, OTAs provided a significantly better online booking experience than suppliers, but the quality gap is closing fast. A thriving ecosystem of marketing tech providers combined with a larger first party data pool levels the playing field in the online marketing front.

Recent events backing the trend

The 2nd half of 2022 saw a frenzy of funding activity in Hospitality tech providers signalling investors' bullishness in accommodation companies leveling up their digital capabilities. The players attracting the highest funding rounds were SiteMinder’s $74 million ahead of its IPO, Cloudbeds $150 million and OTA Insight $80 million.

2022 outlook

Hospitality players have learned from previous crises becoming smarter, faster, stronger on the digital front.

Expect Suppliers in the Western World to increase their direct share in 2022 and beyond, while Asia will remain dominated by the regional OTA champions.

Trend 10: Complexity Favors Retailers

Narrative

Everywhere we turn, the travel product is growing in complexity: air content, non-air transportation alternatives and non-hotel accommodation options, price unbundling, border travel restrictions. OTA’s flexible tech stack and a business model laser focused on aggregating and merchandising travel content gives them an edge in bringing order into the chaos for the end customer

Recent events backing the trend

Strong Q3 2021 Earnings of global publicly traded OTAs are a testimony how well retailers have adapted to these turbulent times. Booking.com and Expedia’s net income and adjusted EBITDA were close to pre-pandemic 2019 levels, while Airbnb 2022 Q3 was its best ever, 36% higher than 2019.

2022 outlook

Despite the previous trend signalling potential headwinds for retailers, expect global OTAs to keep successfully surfing travel recovery in 2022. Their diversified supplier base, massive tech resources, flexible marketing operations and wealth of customer data will allow them to keep navigating the increasing complexity of the post-pandemic travel era.

Regional and 2nd tier retailers are likely to face more challenging times, potentially becoming cut-price acquisition targets for the global players (trend 8).

Trend 11: Travel Wins Back Investors

Narrative

Pent-up demand is materializing and both private and publicly traded travel companies are seeing renewed investor interest.

Recent events backing the trend

As some major fundings of the previous trends illustrate, the 2nd half of 2021 has seen a flurry of investments activity in the travel sector.

Some new players jumped into the SPAC’s bandwagon, such as Vacasa($4.4 billion), Hometogo (€1.2 billion), Selina (€1.2 billion, American Express GBT ($5.3 billion) Mondee ($1 Billion) and Hotelplanner.

Other players announced their plans to go the traditional IPO path like Turo, Ixigo, Oyo and Rategain

2022 outlook

Last year's travel investment boom reflected a general investor's exuberance, flushed with cash and starved for returns in a world of near-zero interest rates. Enthusiasm for vehicles like SPACs might temper after disappointing post-debut results of some of these deals, such as $40 billion Super App Grab. However, as long as investors keep sitting on piles of cash, travel keeps proving its bulletproof resiliency and tech savvy travel players successfully surf the pandemic-driven digitalization wave, expect 2022 to be another blockbuster year in travel investments.

As Yuval Noah Harari exposed, “History cannot be explained deterministically and it cannot be predicted because it is chaotic.”

However chaotic 2022 turns out to be and to which degree these trends play out as predicted remains to be seen, but there is little doubt that these underlying themes will profoundly shape the travel industry in the years to come.