Airline Ancillary Revenues Take Off

Already one of the largest revenue categories for airlines, ancillary products are well positioned for continued growth

Already one of the largest revenue categories for airlines, ancillary products are well positioned for continued growth

Source: The Guardian

Booking Holdings, the world’s leading Online Travel Agency, generated more than $1 billion in advertising revenue in 2018 and 80% of its inventory is now in non-traditional properties. Marriott, the world’s largest hotel company, recently launched Homes & Villas in 100 destinations to compete in the home-sharing business. Ryanair is generating more than $2 billion in ancillary products. Airbnb launched its tours and activities business in December 2016 and is reported to have exceeded 1 million bookings in its first year of operations, and had a 7x increase in bookings in 2018.

These are only a few of the examples of travel companies searching beyond their core business for new revenue sources. OTAs, airlines and hotels are dedicating significant resources and attention towards new revenue lines. In this post, I will take a look at airline ancillary revenues, a category that represents around 20% of total operating revenues. And growing.

First, let’s define ancillary revenues in the airline industry as I am applying it in this analysis. Ancillary revenues refers to non-fare revenue derived from products and services sold to the passenger beyond the core transportation from origin to destination. Such products and services can include bags, seats, priority boarding, insurance, hotel bookings, car rental, transfers, tours & activities, parking, pets, change fees, on-board offerings. Excluded from this definition: cargo revenue, sale of frequent flyer miles to partners, loyalty travel awards.

2018 Airline Ancillary Revenue Calculation

My starting point for this calculation are a group of 15 airlines for which I have gathered ancillary revenues information from their 2018 financial statements and other public information materials. As we see below, the airlines represent a wide range of size (from Volotea’s $465 million in revenue to Delta’s $44 billion), geography and service model (low cost, regular, premium).

Source: airlines financial reports and public information. (1) The only exception is for Volotea, which has not yet released 2018 ancillary information. I have applied the same ancillary ratio than the one Volotea disclosed in 2017. For jetBlue, I am only including ancillary revenues for Even More Space, as they were the only ones that were disclosed. For Emirates, ancillary revenue shown is only excess baggage revenues. Other ancillary revenues was not disclosed.

Overall, the 15 airlines add up to $163 billion in operating revenue, 981 million booked passengers and 4616 aircraft in 2018. This is equivalent to:

• 19% of 2018 worldwide airlines operating revenue*

• 23% of 2018 total flight passengers transported*

• 20% of aircraft currently in service*

* Source for worldwide revenue data and total flight passengers: IATA. Source for # of aircraft currently in service: Ascend

Given the proportions above, we will assume that the $12.3 billion in ancillary revenues for these 15 airlines represent roughly 20% of the airline industry’s ancillary revenues. As a result, my estimation of 2018 worldwide airline ancillary revenues is $61.6 billion. Both Emirates and jetBlue only disclosed one ancillary category (bags and additional space, respectively), so it is likely that the $61.6 billion in total airline ancillaries is underestimated.

In 2018, CarTrawler and IdeaWorksCompany collaborated on a report on airline ancillary revenues, in which they estimated a total of $92.9 billion for 2018. This amount included frequent flyer and commission based revenue from hotel bookings. Excluding these two categories, they projected $64.8 billion in “a la carte” ancillary revenues, which is in the same range as my estimated $61.6 billion. (I am not including cargo nor loyalty and frequent flyer revenues).

Ancillary revenue growth and share of total operating revenues

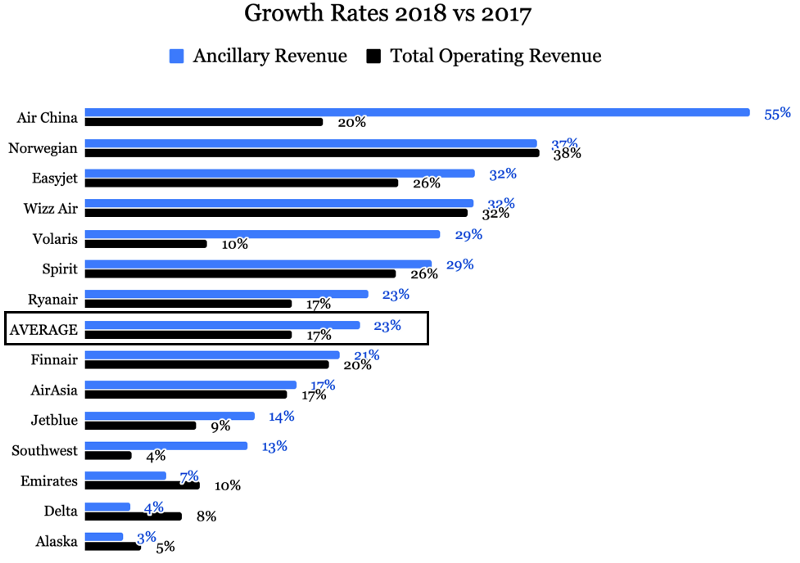

The average ancillary revenue growth rate for airlines in this analysis was 23% from 2017 to 2018, growing significantly above the 17% for total operating revenues. According to IATA, worldwide airline revenue grew by 8.5% in 2018, which points to ancillaries growing almost a 3x faster rate than total revenues. Of our 15 airlines, Air China had the highest ancillary revenue year on year growth rate, with 55%. Alaska Airlines had the lowest at 3%.

Source: Airlines Financial Reports

Ancillary revenues are not only growing, but they represent a sizable share of total revenues. The average share for the 15 airlines is 17%. Emirates is at the low end, but as mentioned earlier, they only disclosed their excess baggage revenue, so we are not seeing its true ancillary revenue size. Same comment applies to jetBlue, which only disclosed its Even More Space revenues. If we only took into account the remaining 13 airlines which are disclosing their full ancillary revenues, the share would be at 20% of total operating revenues. On the upper extreme, almost half of Spirit’s revenues are in the ancillary category. Also with a very high share are Wizzair (42%), Volotea (34%), Volaris (29%) and Ryanair (28%).

Elaborated with data from airlines financial reports

On average, airlines generated $17 per passenger in ancillary revenues in 2018. The range goes from Air China’s $1 to Spirit’s $53 per passenger.

Here is a breakdown of “non-fare revenues” for Spirit Airlines, the ultra low cost airline with ultra high add on revenue activity. The largest category is baggage, followed by passenger usage fee (a $18.99 fee per ticket for each way).

Ancillary Revenue Drivers

Before 2007, ancillaries represented well below 2% of operating revenue in the US (MIT analysis). From 2007 to 2010, their share tripled. Since 2010, worldwide ancillary revenues have grown fourfold (IdeaWorksCompany).

Source: Ancillary Revenues in the Airline Industry, Eric Hao, MIT

Price unbundling is at the root of this growth. Many of the ancillary products and services (meals, checked baggage, seat assignments…) used to be included in the ticket price. In the mid ’00s, airlines started unbundling these services from the ticket in order to be able to display a lower base ticket fare. By 2010, pretty much all airlines had unbundled pricing. As a result of this unbundling, a new airline revenue category took off.

These are some of the reasons for the growth of the unbundling phenomenon:

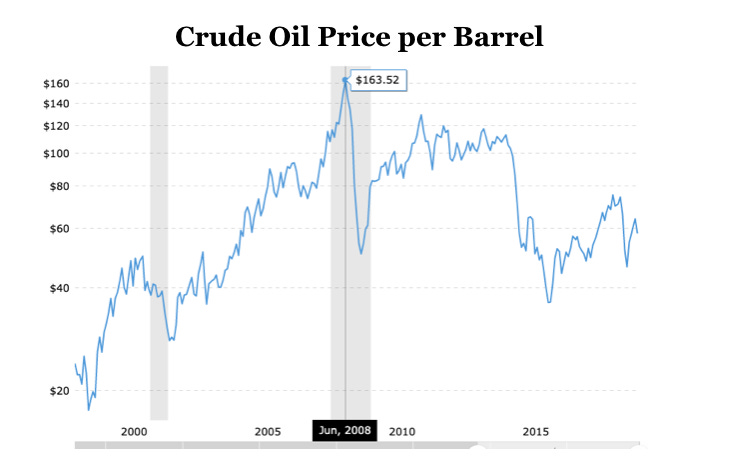

Oil. In 2008, the price of crude oil reached an all time high. Jet fuel is the largest airline cost component, representing 22% of total costs. Unbundling was a way for airlines to bring in additional revenue without visually raising ticket prices.

Data from Macrotrends

Technology . The emergence of OTAs and metasearches made it very easy for travelers to compare prices. By unbundling prices, airlines were able to bring back a level of opaqueness and made comparing more difficult. A $50 Spirit fare was not necessarily cheaper than a $70 Southwest fare.

Low Cost airlines. Increased competition from low cost airlines with a pricing model of visually discounted fares and hidden expensive add ons, drove legacy carriers to follow suit.

Taxes. In the US, ancillary fees are not subject to the 7.5% Federal Excise Tax, which applies to domestic airline tickets. This provides an incentive for airlines to shift revenues from base fares (on which the Federal Excise Tax applies) to non-fare revenues that are not regulated by the Department of Transportation, allowing them to even increase their ticket prices without incurring in higher taxes. We saw earlier how Spirit charges a “passenger usage fee” of $19 for every ticket booked by phone or online. This is $19 less per booking for which Spirit does not have to pay this federal tax.

New technology platforms and tools contribute to the continued growth of ancillary revenues.

NDC. Initiatives like IATA’s New Distribution Capability are accelerating the distribution and sale of ancillaries through OTAs, metasearches and other aggregators that get certified to enable instant booking of tickets and add-on products and services.

GDS have incorporated ancillary merchandising in their systems for OTAs and other travel intermediaries.

OTAs are also developing in-house solutions to better sell flight-related ancillaries. In the last 12 months, leading flight specialist OTA eDreams has sold over $110 million flight ancillaries (46% YoY growth), launched new ancillary products that are not available through airlines (such as Cancellation for Any reason) and grew by 27% YoY the flight ancillaries attach rate.

Startups. Where there is a large growing market, there are innovative startups (such as Gordian Software and Hepstar) emerging to provide agile solutions to travel players to help them expand the sale and intermediation of ancillary products.

Ancillaries still have plenty of room to grow. We will maybe not reach the extreme of having to pay to use on board toilets like Ryanair suggested some years ago, but what is certain is that airlines will continue to aggressively look for creative ways to generate much needed revenue to hang on to profitability.