An interesting industry analysis titled Airline Insights Review 2020 was recently published by aviation data and analytics company Cirium. In this post, I’ll summarize some of the key insights of this 70 page report and highlight what I found most revealing.

Big picture:

Global passenger airline traffic in 2020 was reduced to 1999 levels. Incredibly, 21 years of growth was wiped out in a matter of weeks.

Passenger flights flown decreased globally by 49% in 2020 vs 2019, while passenger traffic decreased by 67%.

At the recent IATA annual general meeting, it was estimated that the number of passengers would not return to 2019 levels until 2024. That is one of the more optimistic scenarios.

IATA also reported that airlines have added $220 billion of debt to their balance sheets. In June 2020, it was reported that airlines had a median of 8.5 months of cash left, so cash burn will be a critical factor for airline survivability moving in to 2021.

Cirium identifies 7 key trends which it goes into some detail in the report:

Consolidation of airlines. Over 40 airlines have ceased or suspended operations in the last year. The consolidation trend has taken place in the past in EMEA, the US and China. There might be particular activity in Asia Pacific, where the consolidation trend has not happened to the same extent in the past. In November, Korean Air already announced the takeover of rival Asiana. It is also likely that mid-sized carriers in the US will merge or will be acquired by their larger competitors.

New-generation aircraft in service. Newer aircraft will return to the skies, a huge monthly cost-saver on fuel burn.

Aircraft retirements and reconfigurations. With 30% of the global fleet grounded and with future demand looking slow, there is a clear surplus of aircraft.

A new way to forecast demand. Airlines have a harder time to use historical data to forecast future demand and need new indicators instead, including online searches people make, price comparison sales data, and social media activity.

Airline operational flexibility. The six- to eight-month flight scheduling window has changed to a quarterly or six to eight week planning process due to volatility.

Digital traveler experience. New technologies to improve real-time traveler information and improve the overall travel experience at the airport and in-flight will be critical in times of disruption and in order to build up traveler confidence.

The rise of aircraft leasing. With the financial struggles of airlines, Cirium expects to see leasing companies push past the 50% ownership share of the global fleet.

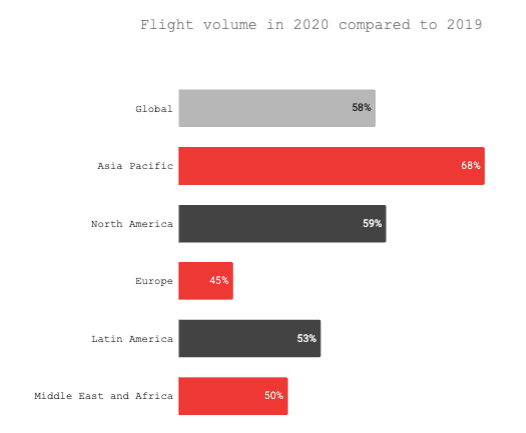

Passenger flights 2020

All regions experienced dramatic declines in passenger flights in March. US and China’s large flights domestic markets are behind the faster recovery seen in Asia Pacific and North America.

Largest airlines by region (by passenger flights flown)

The 4 largest airlines by passenger flights flown in 2020 we US airlines. China Southern was 5th.

Top 10 round trip flight routes 2020 (by number of flights)

Nine of the top 10 most flown routes in 2020 were in Asia. The only non-Asian in the top 10 city pairs was Jeddah - Riyadh in Saudi Arabia.

Busiest airports by region (by passenger flights)

The 4 busiest airports in 2020 were in Asia Pacific. The 5th was the Atlanta airport in the US.

Top 5 airports and airlines by flight volume 2020 compared to 2019

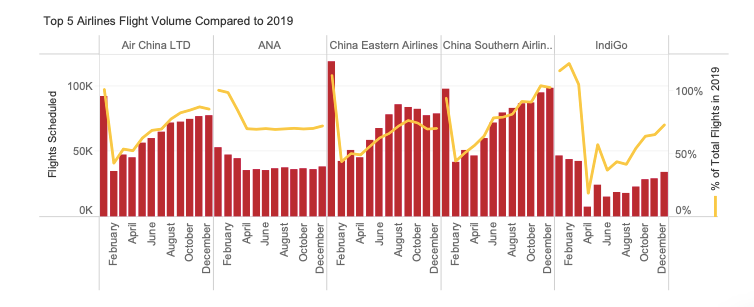

Asia Pacific

Looking at the top 5 largest airlines in Asia Pacific, China Southern Airlines grew consistently through 2020 and even surpassed their same month of previous year activity by November 2020.

Two of the top 5 airports in Asia ended 2020 with a higher number of flights than the same month of 2019. In June 2020, Chongqing Jiangbei International Airport (in China) had already the same volume as June 2019, and by December 2020 its activity was around 140% of what it was in December 2019. It took Chengdu Shuangliu International Airport (In China too) a couple of months longer to surpass its 2019 levels.

North America

Unlike in Asia, there is no airline which is near 100% of where it was in 2020. The best performing ones -Southwest, Delta and Alaska Airlines- barely reach 50% of their 2019 flight activity.

For the top 5 North American airports, with the exception of Orlando, they all ended the year well above 50% of their 2019 levels, with Dallas getting close to around 80% by December 2020.

Europe

Wizz Air is clearly an outlier, as the Cirium data shows that the airline had more flights during 9 months in 2020 compared to 2019. It seems like for the full 2020, Wizz Air was at around 30% above their 2019 flight numbers. It is worth noting that this data shows the number of flight scheduled, which is not the same as passenger numbers. According to a FlightGlobal analysis, Ryanair and Wizz Air had heavy traffic declines in December 2020, as respective passenger numbers fell by 83% and 80% against the same month in 2019. Still, the Wizz Air number of flights in 2020 as reported by Cirium seem a bit strange. I will look at this further, but if anyone has any insights on this, please leave a comment.

All the top 5 European airports were well below 50% of their 2019 flight volume. Only Amsterdam barely touched 50% in September before dipping again as a result of the Covid’s second wave.

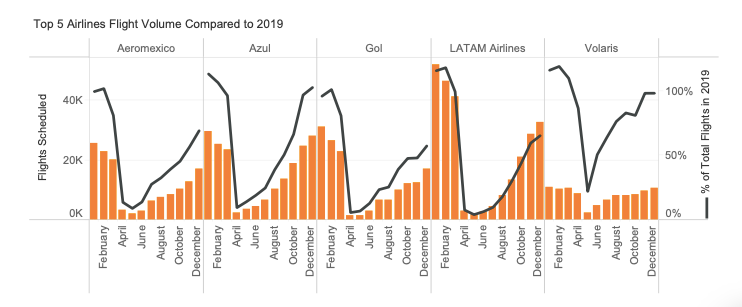

Latin America

From minimum levels in April, Azul and Volaris -two low cost airlines- saw consistent monthly improvements and recorded more flights in November and December 2020 than in the same months of 2019.

For sure the vaccine will bring much needed oxygen to airlines and the travel sector in general. It is now a matter of getting the world population vaccinated as fast as possible to get the world back in the air again. In 2020, 21 years of growth were wiped out in a few weeks. In all likelihood, 2021 will mark the year when the airline industry begins its path to recovery, and hopefully in 2 or 3 years we will be back to 2019 levels. To be continued.

And please, if you’re not yet a subscriber of Travel Tech Essentialist, sign up below to receive every 2 weeks a newsletter with 10 insights.