The State of Online Travel Agencies — 2022

Full year 2021 results for 10 publicly traded online travel companies: Booking, Expedia, Airbnb, Trip.com, eDreams Odigeo, Despegar, MakeMyTrip, lastminute.com, TripAdvisor, Trivago

****NOTE: I included the wrong link on newsletter 147. Please find the 2024 State of Online Travel Agencies — 2024 here***

The State of Online Travel Agencies — 2024

2023 results 1. Revenues With the exception of Trivago, all companies increased their revenues from 2022 to 2023. Year-on-year revenue ranged from -42% (Trivago) to +113% (Trip.com). Compared to 2019, only lastminute.com and Trivago had revenues below pre-COVID. Airbnb doubled its revenues in 2023 compared to 2019.

Summary

All ten companies increased their revenues in 2021 vs. 2020

Only Airbnb had higher revenues in 2021 vs. 2019 (+25%). Its share of total revenues of these ten companies continues to grow, from 12% in 2019 to 17% in 2020 to 19% in 2021.

Of the 10 companies, 82% of revenues in 2021 came from Booking, Expedia and Airbnb.

Every single company grew marketing costs in 2021, but Airbnb did so by only 1%.

At 82%, eDreams Odigeo had, just like in 2021, the highest marketing/revenues ratio, double the ratio from the next OTA, Expedia (41%).

All travel companies, except eDreams, had improved EBITDA from 2020 to 2021 (calendar years). MakeMyTrip has yet to post a positive EBITDA year since 2013 (at least)

Growth in revenues in the first half of 2022 is off to a good start for all competitors, with lastminute.com and eDreams showing the highest year-on-year growth (259% and 169%, respectively).

Content

2022 results

1.1. Revenues

1.2. Marketing

1.3. EBITDAQuick Company Notes

2.1. Expedia Group

2.2. Booking Holdings

2.3. Trip.com Group2.4. lastminute.com

2.5. Tripadvisor

2.6. eDreams Odigeo

2.7 Airbnb

2.8 Trivago

2.9 Despegar

2.10 MakeMyTripJan - Jun 2022 Revenue

Subscribe to the Travel Tech Essentialist newsletter to receive every two weeks an email with the top 10 trends in the travel technology sector.

1. 2022 results

1.1. Revenues

Not surprisingly, all ten companies increased their revenues in 2021 vs 2020. Year-on-year revenue increases ranged from +11% (Trip.com) to +146% (Despegar). Compared to 2019, only Airbnb had higher revenues in 2021 (+25%). Booking and Expedia had the next best results vs 2019 (-27% and -29%, respectively), while Trivago and lastminute.com were -57% and -59% in 2021 vs 2019.

Airbnb’s share of total revenues of the 10 online travel companies in this report continues to grow, from 12% in 2019 to 17% in 2020 to 19% in 2021. Booking.com, Expedia and Airbnb’s share of revenues climbed from 77% in 2020 to 82% in 2021. Trip.com saw a significant decrease from 14% in 2020 to 10% in 2021. The remaining 6 competitors (Tripadvisor, Trivago, eDreams Odigeo, Despegar, MakeMyTrip, and lastminute.com) saw their overall share of revenues constant at 8% in 2021.

When we look at the universe of the “Other” 6 players, the two metasearches (Tripadvisor and Trivago) decreased their share while Despegar saw a significant increase from 2020 to 2021.

1.2. Marketing

Every single company grew marketing costs in 2021. Interesting to see how Airbnb increased marketing costs by only 1%, but this did not prevent the company from having the second largest revenue growth. lastminute.com and Trip.com also increased their marketing costs by a modest 6% and 14% in 2021. All the others ramped up their costs aggressively, from 40% on the lowest end (Trivago) to 158% on the highest end (MakeMyTrip). All of these companies still had a lower marketing spend in 2021 compared to 2019.

The marketing over revenues ratio can point to the relative efficiency of marketing spend. The higher the ratio, the more marketing pressure the company requires to drive sales, although we also need to take into account the nature of the product. Travel companies slashed all non-essential marketing investments in 2020.

At 82%, eDreams Odigeo had yet again the highest marketing/revenues ratio, more than double the ratio from the next OTA, Expedia (41%). It’s also significantly higher than Trivago, which used to be the travel player with the highest marketing/revenue ratio in previous years. This is somewhat surprising as we would expect that their much-touted Prime subscription program launched in 2017 should be showing some impact by now in their high marketing/revenues ratio. All OTAs except eDreams have lower or flat ratios compared to 2020. Airbnb’s strong brand and its lower reliance on performance marketing are reflected in its low 20% ratio.

1.3. EBITDA

All travel companies had improved EBITDA from 2020 to 2021. The only exception was eDreams which went from -€1M EBITDA in 2020 to -€11M in 2021 (and far away from the €118 million in 2013). The world’s two largest OTAs, Booking.com and Expedia had very strong EBITDAimprovements from 2020 to 2021. MakeMyTrip has yet to post a positive EBITDA year in all the years in this analysis.

2. Company Quick Notes

2.1. Expedia Group

In May 2021, Expedia announced that it would sell its corporate business arm Egencia to American Express Global Business Travel. The transaction was completed in November 2021. B2B revenue (which includes Egencia) in 2021 was down to 17% of total revenue (down from 21% in 2019).

Lodging takes up 75% of Expedia revenues, slightly down from 2020. The share of air (3%) is above 2020 but significantly below previous years.

2.2. Booking Holdings

The year-over-year increase in airline tickets in 2021 was driven by strong growth at Priceline, which operates primarily in the US domestic travel market, a market that has recovered significantly faster than the global travel market from the impact of the pandemic, and to a lesser extent by Booking.com, which had a relatively small amount of airline tickets booked in 2020.

The share of Booking.com’s room nights booked for alternative accommodation properties in 2021 was about 29%, which was about the same as in 2019 and down slightly from 2020.

Merchant revenues in 2021 increased more year-over-year than agency revenues due to the expansion of merchant accommodation reservation services at Booking.com.

Total revenues attributable to Booking.com’s US operations increased 83% in 2021 compared to 2020. The US business grew more than the non-US due mainly to growth at Priceline.

2.3. Trip.com Group

Transportation revenues used to be Trip.com’s largest revenue line, but accommodations revenues have taken over as the largest product, with 41% of total revenues in 2021. “Other” revenue primarily consists of online advertising services and consumer financing services, and it now accounts for 12% of total revenues, up from 6% in 2019.

China travel restrictions in 2021 were much stricter than international markets, which shows in the 2021 share gain of international revenues.

2.4. lastminute.com

Lastminute’s revenue share has changed considerably in the past couple of years, with ancillaries becoming the top revenue source with a 44% share of revenues. The increase in revenues from ancillaries is mainly linked to the increased sales of insurance products since 2019. The share of sales of travel services was reduced by 21 percentage points from 2019 to 2021.

With 33% of total revenues, Dynamic Packages has the largest revenue share among all products, up from 20% in 2020. lastminute.com’s Dynamic Package technology gaining traction on B2B2C partnerships. has evolved from B2B to B2B2C, where it’s gaining traction with multiple white label partnerships with partners such as Booking.com, HolidayPirates, Palladium Hotel Group or Millemiglia. Dynamic Package revenues coming from white label partnerships was responsible for 38% of DP total revenues in 2021, vs 22% in 2020.

The share of flights has gone down from 46% of total revenues in 2020 to 29% in 2021.

2.5. Tripadvisor

TripAdvisor’s Experiences and Dining segment continues to gain in share of total revenues, going from 23% of revenues in 2018 to 34% in 2021.

Hotels, Media & Platform segment revenue increased by $188 million in 2021, primarily due to increased hotel auction revenue, particularly in the US, and to a lesser extent, in Europe.

In 2021, Tripadvisor launched Tripadvisor Plus, a $99 / year subscription-based membership that offers financial incentives, benefits and perks to members who book hotels and experiences on our platform. The company said that its new subscription product could become a new business line generating more than $1 billion a year, but in early 2022, Steve Kaufer said that “we have to recognize that, at this point, we haven’t found the product-market fit that we’re looking for.”

2.6. eDreams Odigeo

Another year of plenty of mentions of Prime subscribers and diversification revenues, but no visible impact in results.

eDreams has repeatedly stated for the last 7 years its objective to expand the weight of non-flights revenues. Up to 2018, the company reported its non-flight revenues, and results did not seem to show much success on this front (non-flights revenues went from 20.1% in 2015 to 20.3% in 2018). In the last 3 fiscal years, the company has not provided its flights vs. non-flights revenue breakdown. All the other companies in this report provide a breakdown by product.

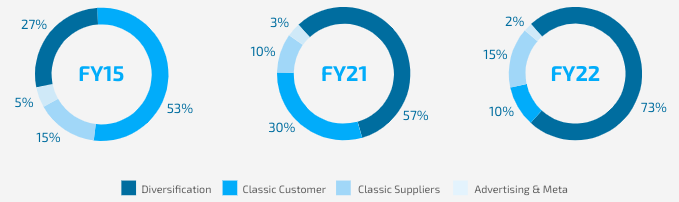

eDreams Odigeo does provide a breakdown of revenues that shows an increase in what they call “diversification revenues,” which includes flight ancillaries (reserved seats, additional check-in luggage…), flight insurance, as well as certain commissions and incentives directly received from airlines. As such, these “diversified revenues” continue to depend on the company’s ability to drive flight bookings. And also, these types of revenues follow a general market dynamic in flight pricing towards unbundling that is not particular to eDreams. To understand whether eDreams Odigeo is indeed succeeding in its objective to expand its revenue beyond flight-dependent products, hopefully, the company will start showing what its non-flight business (hotels, vacation packages) looks like, just like all other competitors do. The only non-flight business that eDreams gives details on is advertising and meta, whose share of overall revenues has gone down over the years to the current 2%.

eDreams has succeeded in growing its Prime membership program to 2.9 million subscribers in May 2022. A great accomplishment. This large base of subscribers should eventually result in a combination of the following three outcomes: increase the rate of repeat purchases, lower marketing costs, and improve EBITDA margin. However, five years into the launch of eDreams Prime, we have yet to see any noticeable impact in any of those three categories. We are seeing the opposite: lower revenue growth than its main competitors, lower EBITDA levels, and the highest marketing/revenues ratio in the industry.

2.7 Airbnb

Airbnb had the second largest revenue growth (+77%) in 2021 among the companies in this analysis. Airbnb had a Q4 2021 EBITDA of $333 million, its most profitable fourth quarter ever, increasing significantly from losses in both Q4 2020 and Q4 2019. Airbnb has continued to post very positive EBITDA levels in 2022, with $229M EBITDA in Q1 2021 and $711M in Q2 2022.

Brian Chesky stated that in Q4 2020, more than 90% of Airbnb’s traffic was direct or unpaid. He was confident that this would continue in the future: “What the pandemic showed is we can take marketing down to zero and still have 95% of the same traffic as the year before. So we’re not going to forget that lesson." This is showing in 2021. Sales and marketing expenses for Q4 2021 decreased by 25% compared to the same period in 2019, primarily due to a reduction in performance marketing expenses. As we saw in the marketing section (Section 1.2 above), Airbnb has the lowest Marketing/Revenue ratio among all the companies in this analysis.

2.8. Trivago

Trivago revenues grew by 45% in 2021. Qualified Referrals grew by 17% (with Europe leading the growth), and revenue per referral by 25% (with Americas leading the growth). A “referral” describes each time a visitor to Trivago clicks on a hotel offer in its search results and is referred to an advertiser. Revenue per Qualified Referral measures how effectively Trivago converts Qualified Referrals to revenue.

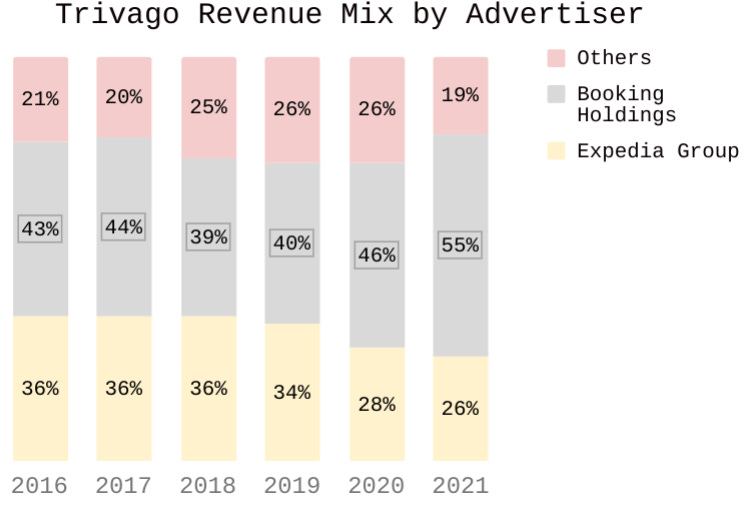

Trivago continues to generate the majority of its revenues from the largest two OTA groups: Booking Holdings and Expedia Group (majority shareholder of Trivago), and its dependency is increasing. In 2021, 81% of Trivago revenues came from these two groups, and Booking.com brands now generate more than half of Trivago Revenues.

2.9. Despegar

Despegar had the highest revenue growth (+146%) in 2021 among these 10 companies, but its EBITDA was negative.

In 2020, Despegar completed the acquisition of Best Day, an OTA with a presence in Mexico, Argentina, USA, Colombia, Brazil and Chile. Best Day derives 1/3 of its revenues from B2B white label partnerships with airlines, hotels, retail stores and banks.

Mexico’s share of total transactions has increased from 20% in 2020 to 27% in 2021, most likely as a result of Best Day’s strong foothold in Mexico. Other countries are responsible for almost 1/3 of total transactions, up from 22% in 2020.

Despegar has been successfully diversifying its revenue away from Air. Packages, Hotels, and other travel products represented 48% of total transactions in 2021, up from 40% in 2020.

2.10 MakeMyTrip

Looking at MakeMyTrip’s fiscal year ending in March 2022 (different from the analysis in section 1, which was taking into account calendar year 2021 to be consistent with the other companies), Hotels and Packages generate more than 50% of revenues althought they are responsible for 25% of gross bookings.

MakeMyTrip is the only company that has had negative EBITDA every year for the last 10 years (at least). It’s also the only company that has seen its stock price appreciate from September 1 2021 to September 1 2022.

3. Jan - Jun 2022 Revenue

Growth in revenues in the first half of 2022 is off to a good start for all competitors, with lastminute.com and eDreams showing the highest year-on-year growth (259% and 169%, respectively).

I hope you’ve enjoyed this year’s report. We’ve had a few new companies making their public market debuts, so I will add a few new companies to next year’s report.

Subscribe to the Travel Tech Essentialist newsletter to receive every two weeks an email with the top 10 trends in the travel technology sector.