Today’s eCommerce Leaders Will Be Tomorrow’s Dominant Advertising Platforms

How Amazon, Expedia and Booking are emerging as advertising powerhouses.

How Amazon, Expedia and Booking are emerging as advertising powerhouses.

Market leading online retailers are replacing Google as the entry point for consumers to search for products. With dominant positions in both search and booking, these retailers are building up powerful advertising businesses that are growing at a faster pace than their core businesses.

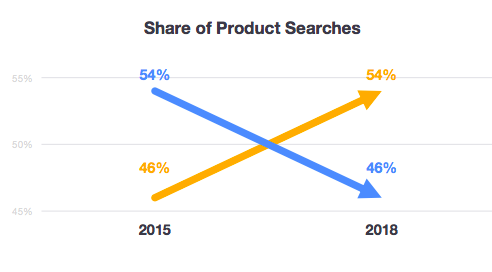

A number of data points indicate that Amazon has overtaken Google as the starting point for product searches among online shoppers in the US. According to a May 2018 report, 47% of online consumers start their product searches on Amazon, versus 35% on Google. Jumpshot states that product searches initiating on Amazon went up from 46% in 2015 to 54% of in Q2 2018.

Source: Jumpshot

And of course, we all know about Amazon’s stronghold in eCommerce. Its share of the US eCommerce market has grown from 43% in 2017 to a formidable 49% in 2018. Very soon, consumers will be spending more money online on Amazon than on all other retailers combined. The leading shopping path among digital shoppers in the US is searching and buying on Amazon (41%). The second most frequent path (28%) is searching on Google and buying on Amazon. (Feb 2018 Salsify Survey).

Since 2010, the share of eCommerce has grown from 4% of total retail sales in the US to 10% in 2018. It seems counterintuitive that as more people are searching and buying online, the search interest in Google for certain products decreases. Product searches for keywords such as “batteries”, “cameras” or “printer ink” are down to 1/4 of what they were 8 years ago. However, searches for “Amazon” have multiplied by 10 on Google during the same period of time. This trend seems to reinforce that consumers are thinking less about Google and more about Amazon when it comes to search and buy products online.

Source: Using Google Trends data. Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for each term. A value of 50 means that the term is half as popular.

Amazon’s dominance in product search and product purchases positions the company as a natural and powerful advertising platform. Advertisers value eyeballs and wallets, and Amazon attracts both in masses. As a result, advertisers are turning their advertising budgets. In a six year period, Amazon went from experimenting with digital advertising to becoming the 3rd largest advertising platform with 4% of the entire US digital advertising market. Google and Facebook are still considerably larger, with 37% and 21% of the digital advertising market, but Amazon is fast approaching, growing faster than both.

Source: Amazon, Google and Facebook annual and quarterly statements. Using Amazon’s “other revenue” which primarily includes sales of advertising services.

Amazon‘s advertising revenue is becoming increasingly relevant. It’s growing at a faster pace than Amazon’s core eCommerce revenue and Amazon Web Services revenue. In the first 9 months of 2018, Amazon advertising revenues amounted to $6.7bn, equivalent to 6% of its eCommerce revenues (up from 1.8% in 2015) and 37% of AWS’ (up from 27% in 2015).

Source: Data from Amazon Annual and Quarterly statements. Advertising = Other Revenues. eCommerce = online stores and 3rd party revenues.

In the US alone, consumer brands pay offline retailers $200 billion in trade spending for prime shelf space and promotions. When we think about the 50% market share that Amazon already commands in eCommerce (and more than 90% across a variety of product categories), and the influence that contextual product positioning has on purchase decisions, it is hard not to conclude that the more than $6 billion in Amazon advertising revenue is just the beginning of what will become a formidable advertising empire.

Amazon’s success in advertising could not be sustainable unless it was generating profitable results for brands and product advertisers. As we see below, the conversion rate of advertising clicks in Amazon is 3 to 4 times higher than in Google, which points to a higher and more immediate purchase intent of Amazon searchers. And conversions are also more easily attributable on Amazon. Advertisers can track a click or a view of an ad to items sold on Amazon with more reliability than on Google, where search and purchase happen normally across various sites. It is no surprise that 80% of Amazon advertisers plan to increase their spending in 2019.

Source: Merkle Q3 Digital Marketing Report

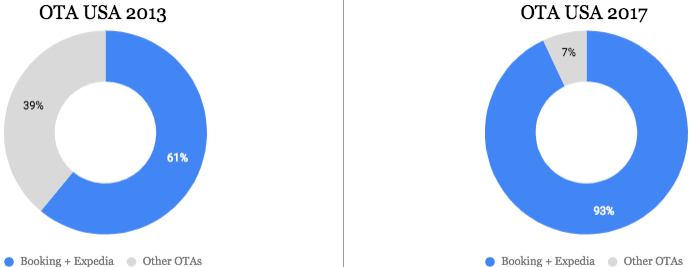

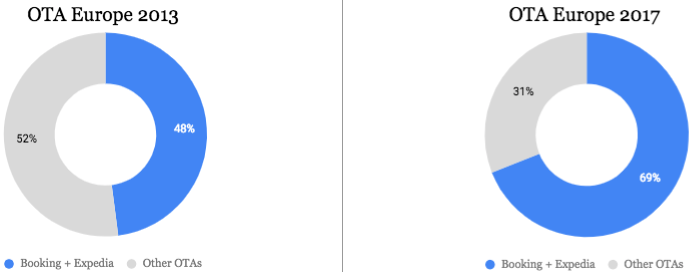

Something similar is happening in the travel sector. Online Travel Agencies (OTAs) are responsible for more than 50% of online hotel sales in the US and 70% in Europe, Asia and LATAM. Two OTA players — Booking Holdings and Expedia Group — are concentrating an increasingly large piece of the travel pie. They continue to grow at a considerably faster pace than the rest of the online travel players, gaining market share from OTAs and direct suppliers across all travel product categories.

Data from Phocuswright

With an inventory of millions of properties reaching the most remote corners in the world, visitors that search in Expedia and Booking in all likelihood will find a property that matches their needs.

Expedia and Booking’s commanding market power positions them as an enticing advertising platform. Just like with Amazon, customers who search have a high intent of also booking right then and there. Amazon is becoming the first place where people search for products. Expedia and Booking are becoming the first place where people search for travel. Showing an ad in the right spot at the right time will influence consumers. Expedia and Booking (and most other OTAs) are building up strong advertising capabilities that are nearing $1 billion in annual revenues each, representing an increasing share compared to their core travel revenues.

Source: Expedia Group and Booking Holdings Annual Revenues

By building an advertising infrastructure, online retailers such as Amazon, Expedia and Booking are able to capture value both in the backend (advertising) as well as the frontend (transaction). And as the likes of Amazon, Expedia and Booking continue to aggregate consumer demand in the form of searches and bookings, brands will find it hard to bypass retailers as advertisers, suppliers or both. With all the risks it entails.