Travel Tech Essentialist #101: Planning

Today’s episode centers around building a plan under an environment of increased headwinds. How to shift, improve agility, and perhaps grow an even stronger business. I hope you enjoy it.

This week’s newsletter is sponsored by

Winner of Mobile Breakthrough Award for 2020-2022, CELITECH helps travel companies (incl. OTA’s, hotels, airlines) offer co-branded int’l cellular data plans using one-click eSIM technology. CELITECH’s proprietary platform enables its partners to offer eSIM as a new, highly converting ancillary and generate new revenues & mobile engagement while helping int’l travelers save 80% on data roaming.

Reach out to learn how our connectivity can “rock your world”: www.celitech.com

There are a few remaining sponsorship slots in 2023. If you are interested in sponsoring one or more newsletters, please complete this very short form.

1. Revenue targets and 2023 planning

In a Lenny’s podcast conversation last week, Sahil Mansuri, CEO of Bravado (the world’s largest online sales community), shared some numbers based on Bravado’s realtime tracker of how sales teams are performing.

% of sales reps missing their quota

- Q1 2022: 46%

- Q2 2022: 54%

- Q3 2022: 63%

% of companies missing their sales targets

- Q1 2022: 51%

- Q2 2022: 59%

- Q3 2022: 73%

- Q4 2022 estimation: 80%

In a world in which the vast majority of sales reps and companies are missing their forecast, it raises the question of how to plan 2023 while avoiding the risks of being unreasonably conservative. Sahil suggests setting a conservative plan and then having short term milestones that unlock the ability to lean into growth and spend based on hitting those targets. Let’s say that you did $10 million in revenue in 2022. You can plan as if you’ll be down to $9 million in 2023, but if in Q1 you hit $2.5 million, then you can revise up your targets for the rest of the year and unlock additional budget. If you hit below $2 million, you revise down.

2. Move your best sales people to customer success

Based on that same realtime data from 300,000 sales professionals, Sahil Mansuri says that deal sizes and big enterprise deals are falling: “Who in tech today is saying, ‘Wow, I can't wait to sign a multi-year contract with a new vendor we've never tried.’? Nobody's doing that. If people are signing things, they're signing for three month pilots”. Under this environment, he suggests to move the best sales people to customer success and tell them that their job is to make sure that all current customers "“never, ever, ever leave”.

3. Adapting sales teams compensation

More from the conversation between Sahil and Lenny…

If acquiring new customers is getting harder and retaining customers is becoming more important, then building a modern sales compensation plan that incorporates renewal rates, retention and customer acquisition efficiency should also be a priority.

An OTE (On Target Earnings) is how much a sales professional makes if they hit their quota. The most common ratio in SaaS is a 50-50 split. If your OTE is $200,000, your base salary is $100,000 and you add a $100,000 commission if you reach your quota. The ratio between OTE and quota is typically 5 to 1, so in this example your quota is $1 million. When you exceed your quota, you normally hit accelerators, so if you sell $1.5 million, you wouldn't make $300k (using the 5 to 1 ratio), you could make $400k.

Let’s look at a hypothetical scenario of 2 Sales Reps.

Sales Rep A: closed $1.5 million in business from 15 deals and ends up making $400,000.

Sales Rep B: closed $1 million from 10 deals. Sales Rep B ends up making $200k.

If 10 of the 15 customers that Sales Rep A brought churn next year, Sales Rep A's compensation is not affected. Meanwhile, if all of Sales Rep B’s 10 clients end up renewing and 5 of them upsell and sign multi-year contracts, Sales Rep B’s compensation and performance is not affected either.

Most companies (99% of SaaS companies, according to Bravado’s data) compensate sales people on new business coming in, regardless of what happens to it afterwards. This might make more sense in a world in which companies are growing, capital is cheap, customers are open to trying new things, and sales reps are consistently hitting their quota, but the data is pointing in a different direction now. Companies should have a solid understanding of what are the metrics that matter and allign those metrics to the compensation and incentive structure of the sales organization.

4. Surviving and thriving afterwards

The conventional wisdom advice that most founders are getting from their boards is to plan in the most conservative way possible. In #1 above, I wrote that there are risks in being unreasonably conservative. The following research gives some historical context to this.

A 2010 Harvard Business Review article “Roaring Out of Recession” found that during the recessions of 1980, 1990, and 2000, that 9% of public companies didn’t simply recover in the three years after a recession—they flourished, outperforming competitors by at least 10% in sales and profits growth. A 2018 analysis by Bain reinforced that finding. The top 10% of companies in Bain’s analysis saw their earnings climb steadily throughout the period and continue to rise afterward. A third study, by McKinsey, found similar results.

The difference maker was preparation. Among the companies that stagnated in the aftermath of the Great Recession, “few made contingency plans or thought through alternative scenarios,” according to the Bain report. “When the downturn hit, they switched to survival mode, making deep cuts and reacting defensively.” Many of the companies that simply survive through a recession are slower to recover and never really catch up.

How should a company prepare in advance of a recession and what moves should it make when one hits? Research and case studies shed light on those questions. In some cases, they cement conventional wisdom; in others, they challenge it. Walter Frisk writes about it in a 2019 Harvard Business Review Article. Read + HBR.

5. Bootstrapping

Jesse asks a great question. As fundraising becomes more scarse and expensive, there is an increased focus on unit economics and financial discipline as opposed to growth at all costs. Bootstrapped startups use their own revenue or existing cash flow to fund growth instead of relying on external capital sources. It’s a good time to not only highlight great bootstrapped companies, but also learn from them. Feel free to reach out if you want to share your boostrapping story.

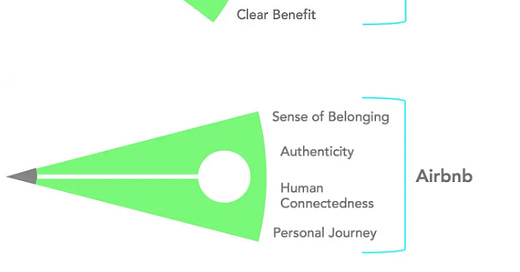

6. Branded vs. Brand-Led

Branded companies have an identity, but consumers truly identify them by their products. When a product supersedes the brand, a company is always at the mercy of the consumer and their needs. Brand-led companies, in contrast, play the long game and require more investment. The identity of the brand supersedes the product and allows a company to resist certain market forces. Branded companies tend to grow quickly and extract a lot of market value early on. Brand-led companies create movements and have more market authority once they find their ideal positioning. In The 16 Rules of Brand Strategy, Concept Bureau suggests that the only wrong option is to not make a conscious decision about which kind of company you are. The 16 Rules is more focused for Brand-led startups that want to define a clear, defensible strategy.

7. Two brand strategy questions

These two questions reveal insightful information about the mindset of a company’s leadership team:

- How is your brand perceived today?

- How do you want it to be perceived in the future?

Jasmine Bina, founder and CEO of Concept Bureau addresses these questions from a travel startup angle. When thinking about what the future (and our future perception) might look like, having a broad perception can lead to being confused with any other travel booking company out there. Having a narrower focus of the future can mean that you are willing to take a bolder stance, to be a far more specific brand that resonates with users. Read +.

8. Hopper’s Social Commerce

Hopper founder and CEO Fred Lalonde is convinced that Hopper will overtake Booking and Expedia by driving social commerce, a model already well-established in Asia. Read or video.

9. eDreams Prime subscriber growth and survey

In its latest quarterly results, eDreams stated that its Prime subscription program is “the #1 travel subscription program in the world”. Its Prime subscribers have grown from 1.7 million a year ago to 3.6 million.

eDreams has been very successful acquiring subscribers. I am interested in learning about the Prime experience from Prime subscribers. If you are or have been a eDreams/Opodo/GoVoyages Prime subscriber, I would appreciate if you can respond to this quick survey (takes less than 3 minutes). I will share the results in a future newsletter. Thanks!

10. Fundraising and Partnerships

Luxury vacation home rental company Le Collectionist raised €60 million. Founded in 2014 , it offers 1,800 homes in 30 destinations, including the French Riviera, the Balearic Islands, Portugal, Italy, the Alps, St Barts and Cape Town, offering guests luxury hotel-like concierge services.

ResortPass raised $26 million in a Series B round co-led by Declaration Partners and 14W, bringing its total raised to $37 million. Celebrity entrepreneurs Gwyneth Paltrow and Jessica Alba also participated in the round. The six-year-old company allows people to purchase day passes to more than 900 hotels and resorts worldwide to access amenities such as pools, spas and fitness centers.

Evaneos raised €20 million. The Paris startup helps travelers go on tailor-made tours with local travel agents.

London-based corporate accommodation platform AltoVita raised $9.5 million in Series A funding.

SION, a SaaS platform that manages commission payments for travel advisors and agencies, raised $3.2 million in seed funding led by TIA Ventures with participation from SmartFlyer and Virtuoso.

Forbes Travel Guide (global rating system for luxury hotels, restaurants and spas) and Jerne (marketplace connecting creators and experience providers) launch a creator economy partnership. As of January 1, FTG’s collection of 2000 properties will integrate with Jerne’s technology to connect and manage relationships with vetted social media influencers and other creators. Read +

Selfbook, a hotel payment software platform bringing direct bookings and modern payment technology to hotels worldwide announced a strategic investment from Amex Ventures. The investment follows a $40 million Series A and A+ round led by Tiger Global.

Travel Investor Network

Travel Investor Network is a private platform for investors (VCs, Corporates, Family Offices, Angels) and innovators in travel, hospitality, and mobility. In the first three cohorts (October, November, December), I’ve recommended a total of 40 startups from 15 countries.

→ If you are a startup looking to raise a round (from pre-seed to Series D), maybe I can help. Please start by completing this form.

→ If you are an investor interested in joining the Travel Investor Network, please complete this form.

Hire and get hired with Travel Tech Essentialist Talent Collective

Candidates are getting job offers and companies are finding great candidates with Travel Tech Essentialist Talent Collective.

→ For candidates looking for new opportunities: sign up (for free) and get warm introductions to over 20 companies that are looking to hire today.

→ For companies: If you’re hiring, join now to meet 100+ world-class hand-curated talent with deep functional experience in the travel sector.

→ For travel companies that have had to lay off employees and want to help them find a job: Share this link with them.

Thanks for your attention, and have a great weekend,

Mauricio