Travel Tech Essentialist #102: Getting Real

It's tough to make predictions, especially about the future. — Yogi Berra

This is my last newsletter of the year. Thank you for your great support in 2022 and see you all in 2023!

This week’s newsletter is sponsored by

The MOVE Group, founded in 2016, combines industry expertise with proprietary technology to reinvent the holiday package search and booking experience. We are operating the industry’s first machine-enabled personalized dynamic holiday package booking platform, launched earlier this year. Based on an inspiration-driven search logic, we currently operate two B2C brands; holidayfinder in Israel and the recently launched holidayheroes in Germany

1. Two Airport Tech startups to watch in 2023 🙃

I’m sure that by now, you’ve all seen countless articles on the 10 or 25 predictions that will define 2023, a few of them recycled from previous years. To not fall behind, I thought long and hard on this one and could only come up with two trends and startups that I feel comfortable predicting.

AirB is a new Airport Tech startup that brings you an inflatable bed to your gate. It uses ML and AI to predict when your flight will be delayed and brings you an inflatable mattress to your gate to make your wait more bearable and to make your fellow passengers envy you. This BaaS startup launched with a Freemium model. The free version includes an uninflated mattress. Paid versions include additional features such as a manual air pump, automatic air pump, slippers, and in-flight hammock.

Exraydia is a promising startup that combines two trends to watch in 2023: Airport Tech and Medical Tourism for the value-conscious traveler.

2. Growth metrics benchmarks for B2B companies

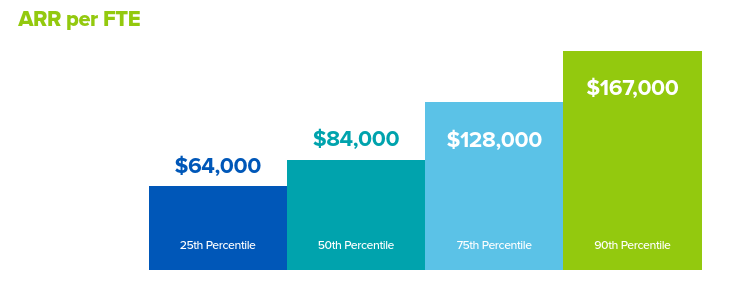

Andreessen Horowitz built out a dataset using quarterly and annual operating and financial data from hundreds of startups from 2014 through 2021. They then aggregated, standardized, and anonymized the data and benchmarked the 25th/50th/75th/90th percentiles of the most significant indicators of growth, efficiency, retention, and margins.

In the dataset, you can respond to three simple questions (vertical, sales motion, revenue scale) and you’ll find out how you’re performing at the different percentiles for various benchmarks on growth, retention, margin, sales efficiency, and business efficiency. Check here how your numbers stack up.

3. Aviation value chain

The global aviation value chain comprises a diverse set of sectors. Some sectors generate significant profits, while others may struggle to maintain profitability. Since 2005, McKinsey and IATA have looked at value creation across the aviation value chain to understand what drives performance and how to enhance value creation. The 2022 edition of the report examines the ways in which the pandemic affected each sector in the aviation value chain and looks at performance before, during and after the pandemic. Read + McKinsey

4. How Airbnb uses AI text generation models to reshape customer service

Airbnb has heavily invested in AI text generation models for its community support products, enabling many new capabilities and use cases. This article by Gavin Lee (leading AI customer support efforts at AirbnbA) discusses three of these use cases in detail.

5. Southwest Airlines seat-saving debate

Southwest, which handles more domestic passengers than any other US airline, has an open-seating policy. Travelers are free to pick any empty seat when they board. This can lead to high-stakes drama and tactics. Read + WSJ.

6. 52 Things Learned in 2022

Great post of 52 interesting learnings in 2022. The author publishes a list of learnings annually, which is a great tradition. I’m more a fan of learnings than predictions. Among the learnings:

In the UK and Australia, people tend to turn left when entering a building. In the US, they turn right. It’s important to remember if you’re booking a trade show booth.

Older travellers use airport toilets to hear flight announcements, because acoustics are much clearer.

YouTuber Mr Beast employs a team of six people to make thumbnails for his videos. Thumbnails are planned before the video is shot.

Fees from music playing on Peloton are “a top 10 account for pretty much all major record labels right now.”

37% of the world’s population, 2.9 billion people, have never used the Internet.

If you want a question answered on the Internet, post a wrong answer first.

7. Seven years walking around the world

Earlier this year, Tom Turcich and his dog Savannah completed a seven-year, 48,000-kilometer walk around the world, becoming the 10th person and 1st dog on record to do so. You can see his amazing photos on his Instagram . What now? "I want to enjoy life without walking and even traveling. I just want to be in one place and get into a rhythm."

8. Three startup pitch deck mistakes that could be red flags for VC investors.

Hunter Walk is partner at Homebrew, a seed stage VC fund. They typically see 3,000+ companies in order to make 10–12 investments annually. He wrote a post on three mistakes he sees in startup decks which he thinks makes most VCs lean towards “PASS”. He recommends to:

Do not put an Exit slide in a seed seck

Focus on milestones you’ll use this funding round to achieve, not just time it buys you

Founder/team bios which feel deceptive

9. Q3 2022 Venture Financing Report

Cooley (one of the largest law firms in Silicon Valley) released their Q3 2022 Venture Financing Report (based on their own activity), reflecting downward trends in deal count, invested capital and pre-money valuations.

VC financing and invested capital in Q3 2022 was the lowest since Q4 2019. VC financing went from 401 in Q1 2002, to 332 in Q2, to 298 in Q3. Invested Capital went from $24.3 billion in Q1 2002, to $16.6 billion in Q2, to $8.1 billion in Q3.

Downward trend in amounts raised during 2022 across all stages of financing, but it is most pronounced in later-stage deals. Changes from Q4 2021 to Q3 2022

Series D+ : from $10.5 billion to $2.2 billion (-78%)

Series C: from $3 billion to $1.1 billion (-64%)

Series B: from $5.3 billion to $2.1 billion (-61%)

Series A: from $3.5 billion to $1.8 billion (-50%)

Median pre-money valuations also declined during Q3 2022 at all levels of financing, with the largest decrease occurring in later-stage deals. The decline was less significant for Series A and seed deals, likely reflecting more stability in early-stage deals due to longer time horizons for exits.

The median pre-money valuation for Series D or later deals dropped from a record high of $3.5 billion in May 2022 to just $527 million in September 2022.

For Series C deals, it dropped from $502 million in June 2022 to $130 million in September 2022, the lowest since August 2020.

For Series B deals, it dropped from $164 million in June 2022 to $90 million in September 2022, the lowest seen since May 2020.

For Series A deals, it dropped from $58 million in June 2022 to $45 million in September 2022, the lowest seen since July 2021.

For seed deals, it decreased slightly over Q3 from $18.6 million in June 2022 to $17.6 million in September 2022. The average pre-money valuation for seed deals has remained relatively consistent since late 2021.

View the interactive visualizations on Cooley GO

10. Fundraising and M&A

Greek Welcome Pickups raised €5.3 million to fuel global expansion plans. The startup offers travelers personalized transfers and coordinates destination-specific sightseeing tours, all guided by a personal driver.

Amadeus invested in Spain-based Eccocar. The startup offers digital solutions for car sharing and micromobility.

Travel API connectivity specialist TravelgateX acquired AI chatbot specialist Quonversa, which will be used to expand capacity and streamline product selection and operations

Talent Network

There have been a lot of layoffs lately. But my talent network currently has companies across the travel tech landscape who are actively hiring.

If you’re open to hearing about new opportunities, apply to my Talent Collective and get introduced to over 20 companies. You can join publicly or anonymously, and leave anytime. Completely free for candidates. Apply here.

If you’re hiring, request access to start meeting world class candidates open to new opportunities. I send out a new drop every two weeks. Learn more or request access here.

Travel Investor Network

Travel Investor Network is a private platform for investors (VCs, Corporates, Family Offices, Angels) and innovators in travel, hospitality, and mobility. In the first three cohorts (October, November, December), I’ve recommended a total of 40 startups from 15 countries.

→ If you are a startup looking to raise a round (from pre-seed to Series D), maybe I can help. Please start by completing this form.

→ If you are an investor interested in joining the Travel Investor Network, please complete this form.

Merry Christmas, happy new year, and see you in 2023!

Mauricio