Travel Tech Essentialist #121: Choosing Change

From airlines adapting to the evolving landscape of business travel and meeting their customers' shifting booking experience expectations to marketers evolving their skills to better attract and connect with consumers, a few of today's stories share the theme of choosing change.

Duetto sponsors this newsletter.

Hoteliers, looking for top tips on boosting your top and bottom line? Duetto, the hospitality industry’s #1 Revenue Management Software (RMS), has compiled advice and case studies from industry leaders into its latest special report: How to Boost Your Hotel’s Total Profitability.

Download today to learn how to measure your property's total profitability by analyzing guest spending, guest behavior, channel management, and how to increase ancillary revenue.

Read about how hotels using Duetto increase their profits by optimizing their revenue strategy. Download now.

0. The most clicked link in the previous newsletter

The most clicked link in Travel Tech Essentialist #120 was The search for meaning in B2B marketing by Doug Kessler from Velocity Partners.

1. Airlines are adjusting to new travel patterns

US carriers are navigating what they say might be long-term shifts in who is traveling, when, and why. Leisure travel, and a growing type of trip combining pleasure and work, have taken on more importance. To match new traveler patterns, Southwest Airlines will be adjusting next year where it flies, what time of day and what days of the week. The largest US carriers have said they expect gradual improvement in corporate travel, especially as offices fill up. Changes in how people work are also facilitating more travel. As Delta CEO said last month, “the less that people are in the office, the more they travel, the more mobile they are.” Read + WSJ

2. Maximizing flexibility in airline payments

Air travelers want booking flights to be as easy as shopping on Amazon, driving airlines and travel tech providers to innovate for smoother and more flexible payment experiences.

OAG explores how payment methods in the airline industry are being redefined by the intersection of travel and fintech. It also features three transformative elements in the air travel payment landscape: price freezes, subscription plans, and buy-now-pay-later schemes. Read + OAG

3. Marketers are becoming technologists and investors

Interesting interview with Emil Martinsek, CMO at GetYourGuide, in which he discusses his views on:

How the role of a marketing leader has changed

The cool trends he sees impacting marketing

How the current economic and market context has impacted his strategy

The right balance between acquisition and brand building

4. Benchmarks on the journey from Seed to Series A in Europe

Based on a Dealroom dataset of ~17k funding rounds of ~13k European companies…

Only 1 in every 4–5 startups (and 1 in 3 startups with a Seed–focused VC) converts from Seed to Series A within 36 months.

The median time from Seed to Series A has consistently been ~24 months.

The median amount of capital raised pre–Series A (including Pre-Seed, Seed, Seed+, and Seed extensions) is $2.75 million.

The detailed methodology, analysis, and findings can be found here.

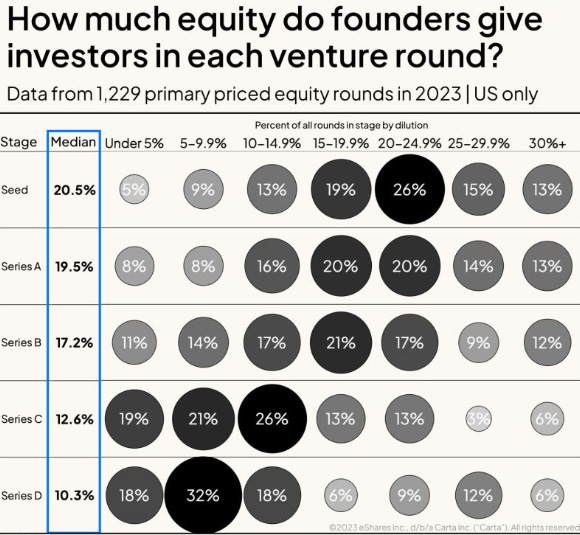

5. Founders’ dilution data

Data from Carta based on 1229 equity rounds in 2023 (US only)

Most common dilution ranges by round…

- Seed: 20% - 25%

- Series A: 15% - 25%

- Series B: 15% - 20%

- Series C: 10% - 15%

- Series D: 5% - 10%

…leaving founders with these stakes

- Seed: 75% - 80%

- Series A: 56% - 68%

- Series B: 45% - 58%

- Series C: 38% - 52%

- Series D: 34% - 49%

Zdenko Zvada put together a simple cap table calculator to play around with the numbers.

6. No return to pre-pandemic in Work From Home

Travel, online shopping, eating out, sports attendance, and many other activities are back to pre-pandemic trends, but Work From Home is 5x above.

7. What’s taking off and what’s next in tourism

This article by Arival explores how trends in tours, activities and attractions are developing in the latter half of this year and into next year, and what this means for operators and suppliers of the in-destination experiences industry.

8. Year to Date stock market performance for travel companies

Stock prices have appreciated so far in 2023 for 12 of the 17 travel companies in this analysis. The only companies whose shares have gone down this year are two metasearch players and three companies that went public via a SPAC in the last 20 months.

9. Made in Spain travel entrepreneurship

This post by BBVA Spark features the opinions of four entrepreneurs: Juanjo Rodríguez (CEO/founder of The Hotels Network), Alexandre Guinefolleau (CEO/founder of Amenitiz), Lluís Vidal (COO of Exoticca), and Iñaki Uriz (cofounder/CEO of Caravelo). They discuss various topics, including user experience, direct sales, new consumption models, AI, and personalization.

10. Fundraising and transactions

Airalo raised $60 million in a Series B round to expand its eSIM-based global roaming marketplace. Check out a couple of open positions further down in this newsletter.

Upgrade, which offers banking, credit and payment products directly to consumers, acquired Uplift, a buy-now-pay-later service used by more than 300 airlines, cruise lines and hotel chains in the US and Canada. The acquisition price was $100 million, paid in cash and stock.

OAG, one of the world’s leading data platforms for the global travel industry, acquired Infare, a provider of competitor air travel data, in a deal valuing the combined entity at over $500 million. Read +.

PS.

I will be participating in WeTravel's Tech & Innovation Summit alongside Stuart Greif from Forbes Travel Guide, Jamie-Lee Abtar from Intrepid Travel, Shane O'Flaherty from Microsoft, and many other industry players. The virtual summit will take place on Thursday, August 10th, 2023. The event is free to attend. You just need to register and save your seat.

Travel Investor Network

Travel Investor Network is a private platform launched by Travel Tech Essentialist for investors and innovators to discover innovative travel startups. In the first nine cohorts (October-August), I’ve recommended 99 startups from 27 countries.

→ If you are a startup looking to raise a round (from pre-seed to Series D), maybe I can help (for free). Please start by completing this form.

→ If you are an investor interested in joining the Travel Investor Network to receive monthly recommendations of travel startup investment opportunities, please complete this form.

Talent Network

The Travel Tech Essentialist talent network has companies across the travel tech landscape that are currently hiring. If you’re a candidate looking for new opportunities, apply here to join at no cost to you and get introduced to hiring companies.

Featured job openings

Airalo, Partnerships Director, North America (Remote)

Airalo, Growth Director, North America (Remote)

Priceline, Director: Business Analytics and Strategy (Winnipeg, Canada)

JP Morgan & Chase: Vice President, Air Product Experience (New York City)

JP Morgan & Chase: Restaurant Critic and Writer (New York City)

View all 200 jobs here

If you like Travel Tech Essentialist, please consider sharing it with your friends or colleagues and hitting the heart button up top (it helps more readers discover it):

If you’re not yet subscribed, you can do so here:

Thanks for trusting me with your inbox,

Mauricio