Legendary companies, and people with legendary careers, create new things. They don’t fight over old things — Christopher Lochhead

Pattern sponsors this newsletter:

Pattern provides a platform that enhances consumer experience in booking and registration businesses by effortlessly embedding relevant protections in the customer journey. Pattern customers include technology providers such as sports registrations, hotel booking platforms, and travel and booking agencies that provide their customers with personalized insurance products powered by Pattern.

Pattern learns consumer preferences through machine learning processes to deliver the most meaningful, personalized propositions. Pattern customers benefit from a single easy integration to offer multiple products that are controlled via a no-code backend and optimized conversions. Contact Pattern to learn more.

0. The most clicked link in the previous newsletter

The most clicked link in Travel Tech Essentialist #124 was the world's oldest hotel, which has been in continuous operation for 1318 years.

1. Better Vs. Different

Chris Lochhead (former 3x public tech company CMO, advisor to over 50 VC-backed tech startups) is the godfather of category design. Check out some of his great content at Category Pirates. His Better Vs Different post is worth a careful read.

"Better" (almost always) loses

"Different" (almost always) wins

"Different" forces a choice

"Better" forces a comparison

Chris points out that those who play comparison games are in a race for commodity. Those who play different games design and dominate new categories by creating new things instead of fighting over old things. They move the world from the way it is, to the way they think it should be by reimagining a known problem and then creating the potential for a radically different solution. And they also get the bulk of the value created. In tech market categories, on average, one company (the category creator) earns 76% of the total value created (as measured by market cap) by designing and creating a different category. So by choosing to be better in a category with an existing leader, we are essentially deciding to compete for the 24% remainder of the category value.

2. DAM the Demand

How do you capitalize on existing demand without falling into the product-comparison race to the bottom? Chris Lochhead’s answer is to “DAM the demand”. DAMing the demand is not a product-to-product comparison. It is a category vs. category debate. It’s about interrupting customers when they are shopping and then educating them on the advantages of heading in a new and different direction. (“You think you want X, but you really need is Y!”). It’s moving buyers in the category FROM the old TO the new:

It’s not a car. It’s an electric car.

It’s not a hotel. It’s an Airbnb.

It’s not soap, it’s liquid soap.

It’s not a watch. It’s a smart watch.

It’s not a computer. It’s a personal computer.

It’s not software. It’s cloud software.

It's not AI. It's generative AI.

Chris highlights examples of failures by competing (even with better features) in a pre-existing game of comparison designed by someone else:

Facebook’s Threads (despite having had the greatest distribution advantage of any new piece of software ever launched and being the fastest-growing online platform in history reaching 100 million users in five days, the “twitter killer” dropped to 13 million only weeks later).

Amazon’s Fire phone.

Red Bull Cola

Microsoft Stores (Steve Balmer’s marching orders were: "Go to the Apple Stores, study everything they're doing and let's copy it exactly.")

3. Airline industry transition: from old to new

This 74-page report by OAG explores the impact of technology on key airline business functions, with in-depth analysis and examples, and highlights some of the leading startups driving the change in each of the following areas:

Revenue Management: From dynamic offers to continuous pricing. Among the startups featured are Zytlyn, Flyr, 3Victors, Volantio.

Distribution: From traditional GDS-led Distribution to NDC. Some of the leading NDC-enabling startups mentioned include AirGateway, Duffel, Aeronology, Kyte.

Inventory: From network agreements to virtual interlining. The share of self-connecting passengers is estimated between 6% to 15% of global airline passengers. Some of the virtual interlining specialists featured include Kiwi.com, Dohop, Tripstack, Airsiders.

Payment innovation: From fixed to flexible paym,ent schemes. By improving payment methods with approaches like Price Freezes, Subscription Models, and Buy-Now-Pay-Later schemes, airlines can prevent further disintermediation. Some of the innovative startups in this area include Caravelo, Uplift, Hopper, Kabuk.

The unstoppable rise of ancillaries: From up-selling to right-selling. Some of the airline ancillary startups mentioned are Plusgrade, Gordian Software, AtYourGate, GuestLogix

4. Board meetings

Felix Campano, founder & CEO of bag-tracking startup Bob, mentioned the benefits of having effective Board Meetings. He highly recommends following Sequoia's advice on building company board meetings. In Preparing a Board Deck, Sequoia shares important advice and provides a general structure and timings for board meetings at early-stage startups.

5. The new SaaS: Silence as a Service

A survey asked 1,500 American adults if there should be child-free areas on planes and trains. 59% agreed that a child-free zone would be a positive thing, while 27% disagreed and 14% were unsure. Younger people were particularly supportive of the idea. In the age group 18-24, 61% said they'd like to see child-free zones on a flight, while 69% of 25-34-year-olds agreed.

Turkish Airlines-owned Corendon Airlines is the first European carrier to offer “child-free zones”, following the lead of some international carriers like AirAsia and Scoot. The company will begin offering the service on flights between Amsterdam and the Caribbean island of Curaçao this November. The child-free area will be located at the front of the plane and will have 93 seats reserved for travelers over the age of 16. To purchase a seat in the Only Adult area, passengers must pay an extra €45 one way. Never let a good ancillary opportunity go to waste. Read +.

6. Exploding Travel

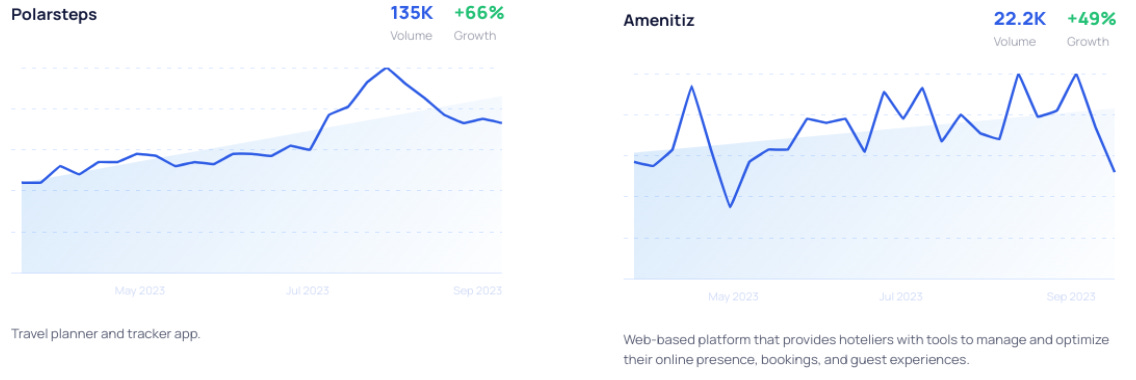

Exploding Topics uses a trend-spotting algorithm that analyzes millions of signals across the internet to “identify under-the-radar industries, products, and categories months or years before they take off.” I did a search for the Travel category in the last 6 months. See below the top 10 companies ranked by growth. Notice that 5 out of the 10 are SIM card companies.

Note: Exploding Topic defines “growth” as follows: “We use our proprietary trend-finding technology to identify trends early on. % growth represents growth over the time period selected”.

7. Expedia’s Fall Release 2023

In its "Fall Release 2023," Expedia introduced an array of new features and products (inspired by Airbnb'summer and winter releases?). Among the novelties are:

EG Labs, a platform where travel enthusiasts and industry professionals can experiment and test early-stage products and AI-driven innovations. The first beta product available to test in EG Labs is Project Explorer, an experimental generative AI-powered solution that uses traveler preferences to recommend destinations and create personalized itineraries.

AI-powered insights built on Expedia’s data and machine learning capabilities to help supplier partners make better decisions.

Trip Planner simplifies group travel coordination, enabling travelers to collaborate with friends and family.

Travelers can now change or cancel eligible flights directly in the Expedia app (available on the Expedia APP in the US only).

8. Hotel guest experience benchmark

ReviewPro analyzed over 3 million reviews and 9 million review comments from 9,500 hotels around the world and published the results in their 155-page Guest Experience Benchmark global and regional report. Some of the key findings:

Hotels continue to recover review scores, with Asia Pacific leading the pack

Booking.com's share of hotel reviews dropped to 39% in Q2 2023 from 48% in Q2 2022. Google's share rose from 27% to 32%. Booking.com maintained its dominance in Europe, with 64% of market share. Google had a larger share than Booking.com in Latin America (44%), Asia Pacific (31.5%), and Africa (42%).

Google reviews have the highest average score, whereas Booking.com’s

relatively low score is growing.

Room and cleanliness have the highest negative impact on review scores; experience has the highest positive impact.

Hoteliers respond to 61.6% of reviews, led by the Middle East and Africa.

The report also zooms into 50 cities around the world and provides a ‘City Hotel Ranking’ for each region and a snapshot of the top 60 hotels (as ranked by their Global Review Index) in New York, Dubai, Cape Town, Sydney, London, and Rio.

9. More with More

I saw this chart this week being shared accompanied by claims that with AI, this chart will soon get to 0.

But technology has not translated into a zero-sum game, where the output is constant and the number of employees decreases. The graph below shows the market cap of the top 20 S&P 500 companies in 1990 and 2023. The total market cap has increased from $449 billion in 1990 to $12 trillion in 2023, a 27X increase (or 12X adjusted for inflation). The largest company’s market cap in 1990 ($62 billion, or $145 billion adjusted for inflation), would not have been anywhere near the top 20 in 2023. The employee count in the US has also increased. In 1990, there were 98.67 million full-time employees, increasing to 132.25 million in 2022.

10. Funding and Deals

Caravelo, a company that provides subscription solutions to the travel industry, closed a €3.5 million Series A round.

Tripla, a Japan-based hospitality technology company, has acquired distribution solutions provider BookandLink for $6.8 million.

Fans of Netflix's Emily in Paris can now take Emily-themed trips to Paris with Dharma, a travel startup that offers exclusive trips hosted by iconic people and brands. Read +.

Travel Investor Network

Travel Investor Network is a private platform launched by Travel Tech Essentialist for investors and innovators to discover innovative travel startups. In the first 12 cohorts (October-September), I’ve recommended 104 startups from 29 countries.

→ If you are a startup looking to raise a round (from pre-seed to Series D), maybe I can help (for free). Please start by completing this form.

Travel Talent Network

If you’re a candidate looking for new opportunities, apply here to join at no cost to you and get introduced to hiring companies.

Featured job openings

GetYourGuide, B2B Communications Lead (Berlin)

Airalo, Growth Director, APAC (Singapore, Remote)

Xeni, Full Stack Developer - MERN (Remote)

View all jobs here

📢 Do you want to post your job here to reach qualified candidates with deep functional expertise? Complete this form or join the Talent Network as a hiring company

Sponsored notes

News, tools, offers & more from around the community

Stay22 is seeking M&A targets. If your startup (or that of someone you know) aligns with the following criteria, and you're open to an exit opportunity, reach out to andrew@stay22.com:

- Categories: Content creation, bloggers, influencers, affiliation

- Preferably B2B

- Team size: fewer than 20

- Valuation: $500,000 - $2.5 million

If you like Travel Tech Essentialist, please consider sharing it with your friends or colleagues. and if you’re not yet subscribed, you can do so here:

Thanks for trusting me with your inbox,

Mauricio

Great edition ! loved this so much.

Thanks for the insights.