Travel Tech Essentialist #28: Charging Ahead

Much is written about how CV19 will change “_____” forever (#5 in this issue, for example). Recency bias could be playing a role. If we rewind 100 years, the 1918 flu pandemic killed 50 million people and 1/3 of the world population and lasted until the summer of 1919. What came afterward was the Roaring Twenties, a period in which tourism, hospitality, travel, cinemas, restaurants, leisure and urbanization gained an enormous boost. I’m not suggesting that we will have a Roaring Twenties 100 years later. Recovery post CV19 will take time, but it will come, and it’s likely that “_____” will not have changed forever.

1. Thayer Ventures has $80 million to invest in new early stage travel startups

Great interview with Chris Hemmeter of Thayer Ventures, in which he discusses how CV19 is not changing his overall investment strategy but it is affecting the kind of metrics considered when making new investments. He addresses the categories he is optimistic about in the short and long term: productivity, automation, air, alternative lodging, group travel…In terms of consumer behavior: “I honestly don’t even think that people are going to be obsessing about cleanliness in two years. They’re not going to be wearing masks”. Read more - PhocusWire.

2. Travel recovery insights dashboard

BCG has launched a dashboard for the travel ecosystem to view the trends that are shaping how and how quickly travel demand is returning. In a highly interactive and customizable way, we can interact with the data to visualize a multitude of trends in products, geographies and customer behavior. Go to dashboard.

Example of data visualization: evolution of YoY domestic (blue) and international (green) airline ticket sales in all countries, Jan - April 2020

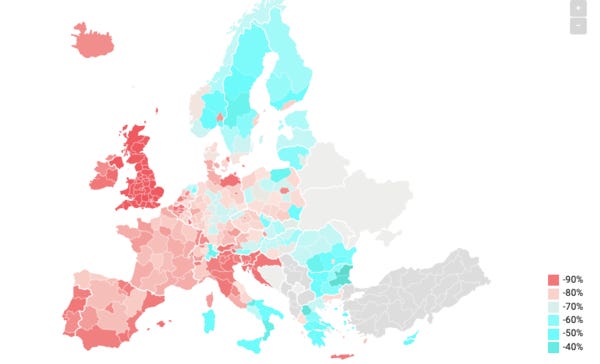

3. Some short term rental markets are recovering

Some good news from short term data provider Transparent. Many short-term rental markets seem to have reached the inflection point and are getting out of the 0 demand zone. Southern Italy, the Nordics, Eastern Europe & the Midwest in the US seem to be on the road to recovery. Read more.

% change year on year in short term rental reservations from April 19th to May 2nd. Source: Transparent

Year on year drop in weekly reservations by major OTA platform seems to have touched bottom a few weeks ago (although not much additional room to go further down), and are showing a slightly positive trend, with Airbnb showing the most market improvement, from a -93% year on year on week 14 (March 30th - April 5th) to -75% on week 18 (April 27 - May 3rd). Read more - Transparent.

% difference 2019 vs. 2020 in weekly short term rental reservations by OTA - weeks 1 through 18. Source: Transparent.

4. Spaniards are dreaming of flying

The Spanish government has started a gradual easing of restrictions to be completed by end of June. Hotels will be allowed to reopen on 11 May, but one of the last restrictions to be lifted will be travel between regions within Spain, which is expected at the end of June at the earliest. Domestic flight searches are increasing for departures in Q3 and Q4, with a big jump for 2021 departures. A positive indication that people at least are dreaming of traveling. Sojern - Insights on Travel Impact, Europe.

Change in year on year domestic flight searches in Spain for departure months April through February. Source: Sojern.

5. Expect to see behavior change at scale for some time to come

According to Accenture, CV19 has forever changed the experience of being a customer, an employee, a citizen and a human. In 5 new human truths that experiences need to address, the company outlines the major human implications to expect from people’s new behavior and the practical steps organizations should take to address them. Among them:

The erosion of confidence will make trust way more important than ever before.

The virtual century. Anything that can be done virtually will be.

Every business is a health business.

6. Why CV19 could catapult Google past the OTAs

OTAs’ position as the apex predators in the travel distribution food chain was reinforced in past downturns such as 9/11 and the 2008 global recession. Drew Patterson gives some compelling arguments on why this time it will be different. He thinks that unlike past shocks, OTAs will be weakened by the CV19 crisis and Google will extend its dominance over the industry. Read more.

7. If domestic travel is the first to come back and stays like that for a while, which countries stand to benefit?

This is the question Rafat Ali addresses using data from Bernstein Research. Looking at the winners and losers from a staycation boom if all international travel demand was redirected domestically, Spain and the US would be on the losing side of the spectrum, while China and the UK would be the best off. Read more - Skift.

Elaborated from Bernstein data in Skift article

8. Some major layoff announcements

Not the type of content I’m looking for these days, given that we get continuously bombarded with these sort of news across all media outlets already. But in short:

TUI targeting 30% reduction in costs and staff (up to 8,000 jobs impacted) and aims to accelerate digitalization. More.

Airbnb lays off 25% of staff (1900 jobs), cuts back investment in hotels and transportation. More.

TripAdvisor lays off 25% of its global workforce (900 jobs impacted), closes some offices, and discontinue its SmarterTravel brands. More.

Trivago looks to reorganize with ‘significant’ job cuts. More.

9. The future of travel in 14 questions

Can airlines keep people apart and make a profit? Will people get back on the boats? Where will travelers go first? What’s important to families now? Will social distancing kill home sharing? Is cleaning the new hotel amenity? These are some of the questions that the NYT asked a dozens of experts, from academics to operators to airport architects in order to understand how the travel landscape might change. Read more - NYT.

10. Funding

Skift announced that Selina has raised an estimated $60 million in funding to get through the crisis. Before this, Selina had raised $225 million in venture equity. Read story.

Futurestay closed a $2.4 million round, reaching $6.5 million raised to date. The New Jersey-based startup is a solution for vacation rental entrepreneurs to connect to guests, listing channels, payments and their direct brand.

Austin Texas-based Key raised $2.4 million, reaching $18 million in funding to date. Key is a technology-enabled concierge service which creates personalized itineraries through their network of curated local vendors.

N.B. Special giveaway

Wellness and reducing anxiety at airports is now on top of traveler’s minds. Sanctifly offers access to wellness, relaxation, fitness and leisure facilities at over 130 airports worldwide. Sanctify is giving away, among our Travel Tech Essentialist subscribers, 5 blue memberships (100$ value each) and 1 silver ($245 value). If you’re interested in entering, please follow these steps:

Download the Sanctifly app (free)

Forward the welcome email from the app to ‘hello@sanctifly.club’ replacing the subject line to ’Travel Tech Essentialist’

At the end of May, Sanctifly will choose 6 winners at random and will notify them directly.

————

If your company wants to extend an exclusive offer (discount, freebie…) to our community of Travel Tech Essentialist readers, please reply to this newsletter and let me know what you have in mind.

————

👍 If you like this newsletter, I would appreciate if you forward it to a friend or colleague. And hit reply to send me feedback, ideas or suggestions.

Mauricio

Were you forwarded this newsletter? Sign up here