Travel Tech Essentialist #38: Luck Surface Area

If you’re going through hell, keep going - Winston Churchill

You know the sector is going through adversity when this Churchill quote is used as a motivational tool, as Mario Gavira does in his article on the drivers behind airline distribution (story 6). Two consulting giants -McKinsey and Accenture offer their best guesstimates of how the travel industry will evolve and give founders and executives on how to plan today for some of the likely outcomes (stories 4 and 5). Although VC investment in travel is down 73% year on year (story 2), there are some deep pocketed SPACS looking for acquisition and merger opportunities in travel (story 3). And Jason Roberts reminds us the importance of making our own luck by expanding our Luck Surface Area (story 1). Good advice for good and bad times.

1. Increase your Luck Surface Area

The amount of serendipitous opportunities is directly proportional to the degree to which you do something you’re passionate about combined with the total number of people to whom this is effectively communicated. It’s a simple but powerful concept because it implies that you are in direct control of the luck you receive. In other words, you make your own luck. Entrepreneur Jason Roberts came up with this concept and formalized it into the equation L = D * T, where L is luck, D is doing and T is telling. The more you do and the more people you tell about it, the larger your Luck Surface Area will become. Read More.

2. 2020 VC investments in travel

According to Pitchbook data, as of Sept. 21:

Globally, VC investment in travel dropped from 354 deals ($6.6 billion) in 2019, to 144 deals ($1.8 billion) in 2020 year to date.

In the US., investment dropped from 100 deals ($2 billion) in 2019, to 44 deals ($600 million) in 2020 year to date.

As we could see from Airbnb’s record business over the summer, people are still traveling, but they are traveling with different consumer dynamics. It will take some time for VCs to adapt their investments to the changes in travel. And in an environment where many markets have nearly disappeared, reaching Product Market Fit will take time. Some VCs, like Howzat Partners’ upcoming $120 million travel fund, are revving up their engines to bet on the next batch of travel giants.

3. Two companies with $800 Million in their wallets are looking for acquisitions in the travel sector

A special purpose acquisition company (SPAC), or blank check company, is a shell company with no operations but created with the purpose of raising money through an IPO in order to acquire or merge with another company. Altitude Acquisition filed to raise up to $300 million in an IPO to buy B2B or B2C travel, travel technology and travel-related businesses (SEC S-1 filing). The Atlanta-based company is the latest SPAC targeting travel opportunities, but not the only one. In August, Go Acquisition Corp executed a $500 million IPO to acquire or merge with “travel-related and travel-adjacent businesses, with either all or a substantial portion of its activities in North America or Europe, that have attractive growth-oriented characteristics and strong underlying demand drivers”. Be on the lookout in case you get a call or email from them. Or call them up yourself.

4. Which travel future will you start planning for?

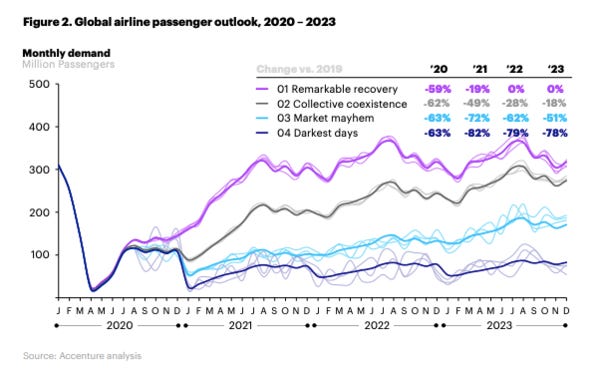

To help travel industry executives navigate and plan amid the current uncertainty, Accenture developed four future travel scenarios based on key external factors that influence global travel demand: vaccine availability and virus containment; governmental and societal response; consumer sentiment and behaviors; global economic climate.

Remarkable recovery: Global airline passenger volumes and hotel occupancy recover to 2019 levels by 2022.

Collective coexistence: Global airline passenger volumes nearly recover to 2019 levels by 2023, requiring significant capacity reduction across the travel industry. The hotel industry returns to modest profit by 2021.

Market mayhem. The airline industry grows slowly over the coming years and passenger volumes are still only about half of 2019 levels in 2023. The hotel industry pain is unevenly distributed. Leisure centric hotels perform well. Business-centric, convention-oriented, and international gateway city hotels face severe challenges.

Darkest days: Global airline passenger volumes remain at only about one-fifth of 2019 levels.

5. McKinsey’s insights, analysis and actions for travel executives

Not to be outdone by Accenture, McKinsey has published a 92 page report for travel executives. It goes in detail with an analysis of the strengths and weaknesses of the various travel sectors (airlines, hotels, OTAs, vacation rentals, tours, etc…), leisure vs corporate, and forecasts by geography.

Some of their key insights:

signs of latent demand for travel.

Travelers are keen to travel but feel restrained.

The working-from-anywhere trend could permanently blur the lines between leisure and business travel.

Nonprice factors have become more important to customers.

4 critical actions for travel companies to take:

Seek to understand their customers as microsegments, not monoliths.

Widen their view of what constitutes the customer journey and design the next set of thoughtful customer-experience interventions.

Design new and unconventional partnerships to restore travelers’ confidence

Seize this reset moment to embrace and preserve their crisis-induced agility and nimbleness for the long trip ahead.

6. What are the forces shaping airline distribution in a pandemic world?

Mario Gavira highlights four powerful forces that are emerging out of the current pandemic that will shape the airline distribution landscape for decades to come:

Customer service. Airlines and intermediaries that are capable of automating their back-office technology stack, expand self-service functionalities for customers and streamline processes around cancellations, changes and refunds, will be able to thrive in a post-pandemic world.

To NDC or not to NDC. The coexistence between the traditional GDS and NDC channels will be a reality for many years down the road, making life for intermediaries especially hard. Aggregators that can harmonize and automatize the end-to-end booking flows across different technologies, offering a flexible and cost-efficient solution for intermediaries, will become serious challengers to the legacy GDSs.

The hyperconnected customer. OTAs might have an edge over airlines thanks to better customer insights, while airlines will play to their strengths by owning the service and controlling the customer experience. Whoever manages to more impactfully engage with travelers across the end-to-end customer journey will come out ahead.

Corporate travel. Network carriers will need to fight harder to capture remaining business travelers while refocusing on the leisure market to fill their planes.

7. Booking.com keeps it simple

Its Connected Trip strategy is being put on hold in order to focus on its core business and specifically on the domestic accommodations business. Of the newly booked rooms nights in April-July 2020, an average of 70% were made in the traveler’s home country, compared to an average of 45% domestic bookings in 2019. Booking.com has also expanded its payment capabilities to better serve local travelers. Read more.

8. Expedia, Agoda, Traveloka, Ixigo on opportunities and challenges post-COVID

The CEOs of the 4 OTAs address a variety of topics such as redesigning the travel product for a local audience, developing new customer acquisition strategies, consolidation and dealing with Google. Read more.

9. How Southeast Asian travel startups are adapting to survive

This joint research between TNMT and Golden Gate Ventures looks at how startups have been impacted and the concrete strategic moves to cope and position themselves for the future. Read more.

10. Startups

There is a growing number of interesting startups out of Andalucía, Spain. Malaga-based Lleego offers leisure, corporate and OTA business solutions for managing air bookings by connecting with GDS, NDC and low cost suppliers. They have some powerful clients under their belt.

Miami-based DayPass allows its members to book luxury pools, cabanas, all inclusive, fitness and spas, driving new revenues, guests acquisition & brand awareness to hoteliers and health clubs managers.

TicTacTrip, based in Paris, is a multimodal ground transportation metasearch (bus, train, carpooling).

👍 If you like this newsletter, I would appreciate if you forward it to a friend/colleague or recommend it on social media. And hit reply to send me feedback, ideas or suggestions. Thank you!

Mauricio