Travel Tech Essentialist #43: First, Ten

First, ten.

This is how Seth Godin describes the secret of the new marketing: Find ten people. Ten people who trust you/respect you/need you/listen to you…Those ten people need what you have to sell, or want it. And if they love it, you win. If they love it, they’ll each find you ten more people (or a hundred or a thousand or, perhaps, just three). Repeat.

In this week’s newsletter, learn about a company that has excelled in finding their initial 10 customers (# 1) and a travel unicorn that is doubling in revenues and tripling its marketshare in 2020 by optimizing for customer-centricity instead of for transaction revenue (#2). And in #6, read about what we know about Apple’s possibly launching a search engine to compete against Google.

At the end of this newsletter, I have a favor to ask you. Thanks for your support.

I’d like to welcome Google as sponsor of this week’s newsletter. My professional relationship with Google goes back a long time; it started when I used my credit card to set up the first search campaigns for eDreams using a then new advertising tool called Adwords. That was the beginning of an intense and overall fruitful relationship. But for the first time in almost 20 years, the flow of payment has changed direction 😉. And a special thanks to the Google for Startups program for their work to support startups across the world.

This newsletter has been sponsored by Google

2020 has been full of startup stories worth telling. Google for Startups wants to give visibility to how entrepreneurs have adapted to these challenges and opportunities. In this video (in Spanish), Amuda Goueli (Destinia), Andrea Cayon (Passporter) and Sergio Orozco (Triporate) discuss what the year has meant for travel companies, and how technology can help revamp the industry.

1. The best funding is sales

In my previous newsletter I wrote about Bubble Hotels raising $715.000 in pre-bookings in an Indiegogo campaign. Here’s another one: Tropicfeel is a 26-person sustainability-driven apparel and fashion company based out of Barcelona bringing “the excitement of travel to everyday life”. The company has proved that they can excel in product innovation, but what is amazing is how they’ve funded their product lines directly from consumers through Kickstarter and Indiegogo. The company is responsible for the world’s most funded shoe in 2018 (raising $3.9 million from 39,559 backers), and the 2nd most funded shoe in 2019 (raising $3 million from 29,847 backers). After shipping more than 500,000 shoes to over 142 countries in the past couple of years, Tropicfeel decided to shift their attention to the modern travel backpack, with a goal to get $50.000 in pre-orders. One month later, they’ve raised $2.3 million from 8,101 backers. That’s a new definition for oversubscribed. Not only has Tropicfeel generated sales of over $9 million before they had their product, but more importantly, they have a community of 77.500 engaged backers who are emotionally connected to the brand and have a vested interest in its success. Priceless.

2. The travel unicorn doubling in size in 2020 and morphing into a financial services company

This company will triple its marketshare and double its revenues in 2020 after posting sales of north of $1 billion in 2019. Around 75% of its revenues do not come from travel transactions. They come from financial products that help customers make better travel decisions. Oh, and it doesn’t rely on Google for traffic. I’m talking about Hopper, an OTA founded in 2007, headquartered in Montreal, and built on the premise that the combination of big data and AI could fundamentally change the way people plan and book travel. I was going to simply link to a 1 hour interview with its founder that I found very insightful, but decided to write a summary of the main conclusions so that you can read it if you have 7 minutes. It’ll be worth your time.

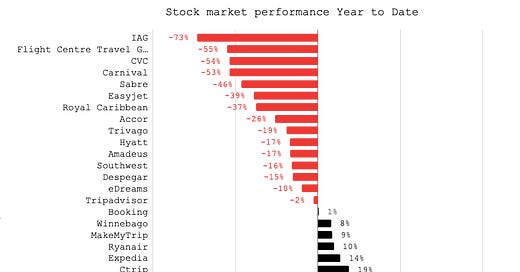

3. Stock market performance year to date 2020

Ranges from -73% (IAG) to +103% (Camping World)

4. More on Airbnb

I linked to my post on Airbnb vs Booking in my last newsletter. If you’re interested in reading more on Airbnb, these are some interesting posts:

Is Airbnb’s IPO listing this week worth your investment? Written by Howard Yu, who was a doctoral student of Clayton Christensen while at HBS.

What the travel industry can learn from a unique marketing playbook, by Mario Gavira, former eDreams Odigeo France MD and currently VP of Growth at Kiwi.com

Airbnb, the disaster artist, by The Generalist.

5. Pressure on hotels

“If I’m a hotel, I’ve got to worry because of corporate travel being diminished but also competing for leisure because there’s a step change in the number of people being exposed to alternative accommodation.”- Booking Holdings CEO Glenn Fogel . With fewer corporate travelers , hoteliers will need to be more focused on attracting leisure travelers, but the competition for these has become greater as a result of increasing demand for short-term and vacation rentals during the pandemic. And alternative accommodations have made substantial inroads on distribution channels. Private accommodations represented 40% and 33% of new bookings on Booking during Q2 and Q3. This is good for retailers (such as Booking), as the more fragmented the supply, the more need for retailers to aggregate and compare. Plus, it puts distributors in a stronger position as it makes conversations with demand-starved suppliers “a little bit easier”. Read more - Phocuswire.

6. Growing signs that Apple may launch a search engine to compete against Google Search

Apple receives an estimated $8 to $12 billion per year in exchange for making Google the default search engine. As Google faces increasing antitrust scrutiny, there seems to be growing evidence that Apple is stepping up efforts to develop its own search technology. There were already some reports of Apple working on launching its own search engine back in August, and a new Financial Times report (paywalled) has added some additional clues. This report (not paywalled) provides a summary of what we know so far. When nearly half of Google’s search traffic comes from Apple devices, the possible emergence of a formidable new search engine would have serious implications on travel companies.

7. Clearer skies in 2021, but…

Clearer skies may be ahead in 2021, but the head of travel and tourism for Boston Consulting Group predicts that travel won’t rebound to 2019 levels until 2023 or 2024. You can read the drivers and his recovery predictions here. His main point is that, even with a vaccine, it will take time for travelers to recover psychologically and regain confidence in travel. Not sure I agree. I think the vaccine will take care of consumer confidence and there will be a mad rush of leisure travelers in 2021.

8. The race to become the Michelin Guide equivalent for post-pandemic hotel safety standards

There’s a number of companies aiming to be the standard third party impartial verifier for the hotel industry. Digital health company Sharecare is making some good progress with key partnerships. Internova Travel Group recently selected the Sharecare verification system to validate the cleaning, health, and safety procedures at more than 50,000 hotels in the Internova network. While the hotel industry may be the first step in growth, they also have schools, restaurants, live event venues and offices on their radar. Read more - Skift.

9. Shorts, deals and funding

Bizzabo, a platform that helps businesses run hybrid online-offline events, has raised $138 million in a series E round of funding led by New York-based Insight Partners.

Red Ventures buys Lonely Planet. The acquisition price was not disclosed but was estimated in the $50 million range. Red Ventures is becoming a major player in the media business with a suite of companies such as The Points Guy and CNET.

Reposite gets $2.5 million in funding for its workspace platform for the travel industry. The NYC-based startup was developed during the pandemic to help trade partners manage relationships and reduce manual processes.

EasyJet customers who want to use overhead luggage lockers will have to buy more expensive tickets, such as an Up Front or Extra Legroom seat. Everybody else will be restricted to putting a small carry-on bag under their seat.

10. Promising startup

Caravelo is a Barcelona-based startup that enables airlines to boost profitability. They offer three main solutions: Flight subscriptions (with customers including Volaris and LATAM), flight revenue optimization and customer service automation.

🙏 And now, the favor. I’d like to get 1 minute of your time to help me know you a little bit better. This will help me adapt the newsletter and its content in a way that better addresses your interests. Please answer these 2 quick questions.

Mauricio