Travel Tech Essentialist #44: Realism & Optimism

Welcome to Travel Tech Essentialist. Every two weeks, I send ten insights with the objective of shedding some light in the present and exploring the new frontiers of travel. Thanks for being a subscriber. If you’re not, please consider joining us.

“You must never confuse faith that you will prevail in the end—which you can never afford to lose—with the discipline to confront the most brutal facts of your current reality, whatever they might be.” — Admiral James Stockdale (who was held as a prisoner of war in Vietnam for nearly 8 years)

The Stockdale Paradox was coined by Jim Collins and it refers to the duality of balancing realism and controlled optimism as a key to success no matter how devastating the situation may be. This applies well to business and leadership, particularly in times like the ones we are living.

In the Travel Tech Essentialist newsletter, I try to strike a balance between what’s going on in the present, but also trying to explore where the new frontiers of travel are moving towards. In this issue, we have a mix of both. Maybe leaning a bit more to the latter category.

A few housekeeping items…

If you see this newsletter a bit different than previous ones, it’s simply because I am using a different newsletter platform. If you experience any issues, please let me know by replying to this email.

In last week’s newsletter I wrote about Hopper, the travel unicorn that will triple its marketshare and double its revenues in 2020. But unfortunately I forgot to include the link to the summary I wrote on an insightful interview with the founder and CEO. Apologies for that, I didn’t mean to be intriguing. Here is the link.

Thank you to so many of you who took the time to respond to my quick questions in the last newsletter. Your input helps me to improve the content and my approach with this newsletter. Those of you who have not, please consider taking 1 minute of your time to answer these 2 quick questions.

This newsletter has been sponsored by Google

2020 comes to an end and Google for Startups is looking back to share the stories of this unique year. You can now check Google for Startups 2020 yearbook (in Spanish), including testimonials and interviews with almost 30 startups, that share how this year has been for them, which challenges they had to face, and the opportunities they found along their journey.

Would you want to sponsor Travel Tech Essentialist? More information here.

1. Airbnb valuation history: from $0 to $50 billion in 11 years; from $50 billion to $100 billion in 1 hour

It took Airbnb 11 years to gain its first $50 billion in value and 1 hour for its second $50 billion.

2. Which tiny/nonexistent markets today will be trillion dollar markets in 10-20 years?

Sam Altman, CEO of OpenAI and the former president of Y Combinator, asked this insightful question on twitter and it’s led to more than 1.4k replies. Some of the recurring answers impacting our sector: high speed transportation, driverless travel, virtualization of travel, space economy including space travel and remote living services.

3. The Third Wave

Somewhat related to the previous topic, I highly recommend reading The Third Wave, by Steve Case (co-founder of America Online and CEO of Revolution). Steve Case predicts that the next wave of legendary companies and entrepreneurs will be those that are able to transform major “real world” sectors (like health, education, transportation, energy, and food) and in the process change the way we live our daily lives. It seems like Covid has accelerated the arrival of the Third Wave to the travel industry. Soon, some of the fastest growing and largest companies in travel may well be insurance, real estate, security, healthcare, IoT, logistics, data, education or aerospace companies as well. It is clear that there are big shifts taking place within society and in a variety of sectors that will lead to rapidly expanding markets for the travel industry.

4. The future of transportation, brought to you by Amazon

Zoox, the self-driving startup acquired by Amazon this summer for $1.2 billion, unveiled its version of the future of transportation: a fully autonomous 4 passenger electric vehicle with no steering wheel, capable of operating 16 hours between charges with a maximum speed of 120 km/hour. The company plans to launch ride-hailing services internationally but confirmed it wouldn’t happen in 2021. Amazon could also potentially use the vehicle for product deliveries. Read +.

5. An aviation outsider is building a supersonic passenger airplane

Twenty years after the retirement of the Concorde, Boom Technology is developing a passenger plane that will fly twice as fast as today’s commercial planes, and will also be more comfortable. It’s still years away from paying customers. Blake Scholl, Boom’s founder, is a computer scientist who previously worked on advertising and social networking at Amazon and founded a mobile tech startup which was acquired by Groupon. After leaving Groupon in 2014, in his mid-30s, he wondered why no one had tried to build a commercial supersonic aircraft in decades. After taking an airplane design class and studying physics via Khan Academy, he followed his curiosity. His journey is inspiring and highlights the power of curiosity and human spirit. Read +.

6. Travel market macro data

The Phocuswright 2020 conference took place online from November 11th through the 19th. In this post, I consolidated and summarized some of the data that Phocuswright analysts mentioned their market presentations (total travel size by region/country, online penetration, product segmentation, etc…). Sometimes this type of information is scattered all over, so I hope this consolidation helps you.

7. Two other travel IPOs last week that you probably didn’t hear about

A bit lost within all the Airbnb IPO buzz were two other important IPOs in the travel industry. Thayer Ventures Acquisition (a SPAC tied to Chris Hemmeter of VC Thayer Ventures) raised $170 million, and Altitude Acquisition (a SPAC run by Gary Teplis of Teplis Travel), raised $300 million on their respective IPOs that took place the day after Airbnb’s. Their next step is to search for companies to acquire. Both will target the travel and transportation technology sector. A special purpose acquisition company (SPAC), or blank check company, is a shell company with no operations but created to acquire or merge with another company. 2020 was the year of the SPACs, with 235 launched in the US (4 times more than in 2019) targeting a variety of industries. It is likely that in 2021 we will see dozens of Private Equity and VC-backed companies entering the US public markets through a reverse merger with a SPAC.

8. Remote-work visas could shape the future of work and travel.

This path is becoming more common: work from the office → work from home → work from anywhere. Same applies for education. The future of work and future of education are having an impact on the population of digital citizens. Some countries like Barbados and Bermuda have recently launched visa programs that encourage remote workers to stay for long periods of time. Other countries, like Portugal and Germany, have had similar arrangements in place for years. These programs are becoming more appealing for host countries and potential visitors. You can read about 16 destinations welcoming remote workers and about the specific requirements needed for each. Selina, which just raised an additional $50 million (see #10), is a good example of a company targeting this growing segment, offering the possibility for digital nomads to live, work and explore in 20 different countries.

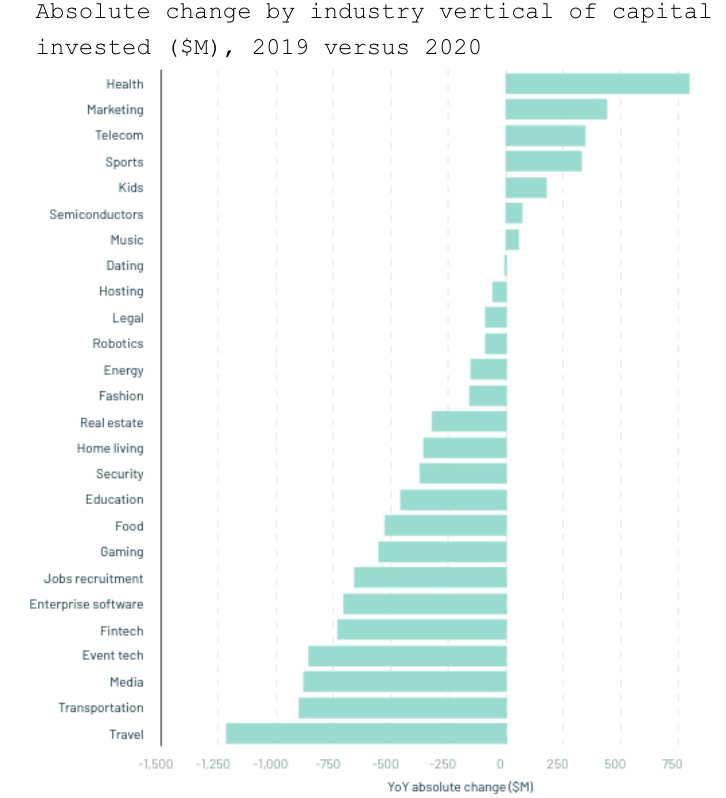

9. $1.2 billion less invested in travel in 2020

According to The State of European Tech 2020 report, the European travel tech sector is expected to see 62% less capital invested in 2020 relative to 2019. The two industry verticals that will have seen the largest drops are transportation and travel. It is a bit surprising that more professional investors did not see this reset year as an investment opportunity. It seems like many investors were hit by a case of recency bias. After all, the timeline from Venture Capital and Private Equity investment until exit is in the 5-8 year range. Investors and entrepreneurs who bet on travel in 2020 will be proven right.

10. Shorts, deals and funding

Israeli startup Zenner offers a disruption management solution for corporate travelers. During the holidays, Zenner is welcoming individual travelers too, and for free. Great opportunity for anyone flying over the next two months to get free flight tracking, trip intelligence and travel advice.

IDB Invest provided a $50 million mezzanine facility for Selina to support the continuity of its expansion plans in Latin America. Read +.

United launches on-demand customer service at airports via text, voice or video call, eliminating the need to speak to someone in person at the gate or counter for services such as seat assignments, upgrades and rebooking. Not sure how different this is from regular customer service or self service. I’ll have to try it to figure it out.

Accor launched short-term vacation rental booking platform Apartments & Villas, with an inventory of 50,000 accommodations from the company's 15 extended stay hotel brands and from its high-end Onefinestay brand which Accor acquired in 2016.

I would love to hear from you. You can reply to me directly or leave a comment for all to see. Thank you!