Travel Tech Essentialist #48: Investment

Travel companies that survived 2020/2021, in the toughest environment they will ever have to face, will be very well positioned to excel and take off by the second half of 2021 as billions around the world start traveling again with the same enthusiasm and frenzy as they showed when buying toilet paper in early 2020. Those who have invested capital, time and energy in these companies will be handsomely compensated for the grit and resiliency shown by travel entrepreneurs.

One small request. After you finish reading this newsletter, I'd very much appreciate if you can share it or forward it to friends/colleagues that you think might enjoy it. Thanks a lot for spreading the word and helping me reach a larger audience.

This newsletter has been sponsored by

Nethone has partnered with Amazon Web Services (AWS) and Plug and Play to provide a limited time offer. Our most advanced fraud prevention solution is now available with a discount of up to 90% to travel merchants. Fraud prevention in travel requires special attention during COVID-19. Not only are transaction volumes down, but fraudsters are even more active - the % of suspicious transactions attempts has nearly doubled since the pandemic started!

1. Who is investing in travel startups?

I just published a post titled Who is Investing in Travel Startups with the motivation of helping those travel entrepreneurs looking to raise money gain a bit more understanding of who the most active investors in the space currently are. You will find in that post the most active investors by geography, stage and a few other metrics, based on more than 1000 investments since late 2018.

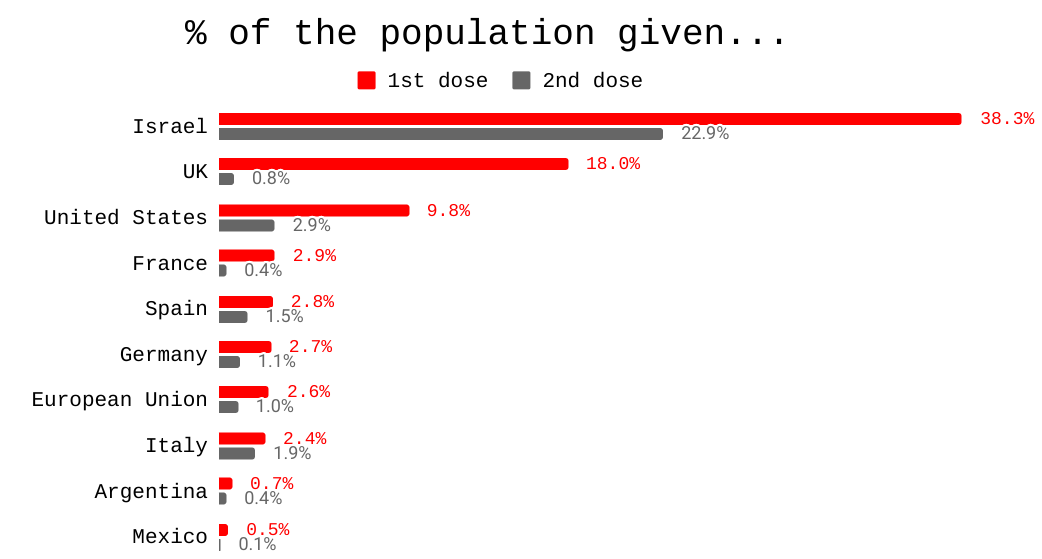

2. Flattening the Covid curve / Steepening the vaccination curve

The biggest vaccination campaign in history is underway. Globally, Covid confirmed cases continue to slow down. 3.1 million were reported last week, the lowest since October. More than 131 million vaccine doses have been given across 73 countries. More people have now been vaccinated (112 million) than have tested positive for the virus since the pandemic began (107 million). Of course, there is much to be done in increasing access to vaccines and improving rollout across the world. Most countries haven’t even given their first shots yet. But many indicators are heading in the right direction, and that is fantastic news for the travel sector.

3. Phuket's private vaccination drive

Phuket, one of Thailand's biggest tourism destinations, cannot afford to wait for the government vaccine rollout that is expected to achieve herd immunity only by 2022. This is why 10 Phuket industry associations including hotel, tourism and chambers of commerce have pooled their private resources to procure vaccines and vaccinate at least 70% of the island population by October 1st 2021, in time to open for the winter peak season (read + Bloomberg). In the face of incompetent vaccine rollout by the ''competent authorities'', we can expect to see more of these type of initiatives emerge around the world. Worldwide, 44 countries rely on the travel and tourism industry for more than 15% of their total share of employment. Ten countries have more than 50% of employment tied to the travel sector, with Antigua & Barbuda and Aruba topping the list, with 91% and 84% respectively (read + Visual Capitalist).

4. Razors that simplify decisions

Mental models can be important tools in making decisions, particularly in today’s rapidly changing world. In philosophy, a razor is a rule of thumb used to eliminate unlikely explanations or avoid unnecessary actions. In this tweet, George Mack offers a few razors he’s found useful. Some of them:

If unsure who to work with, pick the person that has the best chances of breaking you out of a 3rd world prison (Bezos)

If presented with two seemingly equal candidates for a role, pick the one with the least amount of charisma (Taleb)

If stuck with 2 equal options, pick the one that feels like it will produce the most luck later down the line.

It always takes longer than you expect, even when you take into account Hofstadter’s Law (Hofstadter’s Law)

If you have a project, combat Hofstader's Law by setting a ridiculously ambitious deadline (Elon’s law)

If you have 2 choices to make and it's 50/50, take the path that’s more painful in the short term (Naval)

Simple assumptions are more likely to be correct than complex assumptions (Occam's Razor)

5. Hotel top booking channels

SiteMinder published a report of the top 12 hotel booking distribution channels in 21 countries for full year 2020. A few conclusions:

Sustained growth of direct bookings. Hotel websites were in the top 5 in all destinations and #2 in five markets (Spain, Portugal, Ireland, Netherlands, Ireland, Australia).

Booking.com is the top channel in 17 of the 21 markets, and #2 in the remaining four. Expedia leads in three. The only non-Booking/Expedia intermediary in a #1 position is Agoda in the Philipines.

Increased popularity of Airbnb, especially since April. Airbnb debuted among the top 12 in nine destinations and rose in 5 destinations.

Strengthening of local and regional distribution channels

Continued relevance of wholesalers, with Hotelbeds in the top 12 in all destinations.

6. Air Travel Forecasts

In May 2020, Bain began making monthly forecasts of how soon aviation demand would recover. On their January update, their outlook for 2021 across most G-20 countries worsened due to new national lockdowns, international border closures, and vaccine distribution challenges. Since their previous projections, they now reduced the expected 2021 global airline revenue in the “baseline” scenario by $23 billion to $337 billion—about half of the industry’s total 2019 revenue. I think (and hope) they are wrong. I am expecting a strong second half of 2021.

7. Are Air Taxis ready for prime time?

The Lufthansa Innovation Hub just published a thorough 45 page report on the state of electric vertical takeoff and landing (eVTOL) aircraft (or air taxis), and their vision of short-haul air transportation. This report sheds light on the accelerating innovation dynamics in the air taxi market landscape, investment trends in the space, and the eVTOL platform models of the main startups and corporates competing in this sector. SPACs seem to be very interested in this space, as I briefly refer to in the next story.

8. SPACs are invading Wall Street

Special-purpose acquisition companies (SPAC) are becoming the favorite source of financing for companies going public and a viable alternative to late-stage rounds. More than 70% of all money raised through IPOs on January 2021 came from SPACs, up from 50% in 2020 and 20% on 2019. Of the more than 300 SPACs raised in 2020 and 2021, about 250 are still searching for target companies across the world (most have two years to find one before the money goes back to investors). Many of them are looking for targets in the technology, leisure and hospitality sectors. In previous newsletters I've written about the SPACs raised by Thayer Ventures ($170 million) and Teplis Travel ($300 million) that are now in the search stage. Skift recently wrote that Joby Aviation may go public soon by merging with a SPAC. Helicopter taxi service Blade and Virgin Galactic went public through SPACs in late 2020 and 2019 respectively.

9. TCV closes a $4 billion fund to invest in travel (and other sectors)

TCV, the venture capital firm behind Airbnb, closed a record $4 billion fund. The plan is to continue backing existing portfolio companies, as well as make new bets, both in areas that have shown to be very strong winners in the last year (e-commerce, education, cloud) but also investments in areas that may not be doing as well right now, but TCV will believes will return, like travel. “We have to take a long term view. In areas like travel, you’ll still see startups get funded at up rounds. Besides, who will be better positioned to grow and take advantage of a world that’s now more digital? That is a huge opportunity in the long term.” —Parter John Doran. TCV has been an active investor in the travel sector on a global scale in the last few years, with investments in companies such as FlixBus (Germany), KLOOK (Hong Kong), and Sojern (San Francisco).

10. Partnerships, funding

Accor begins digital key rollout, plans 500 hotels in 2021 and 50% of all rooms within five years. The digital key is a partnership STAYmyway, a Spanish company providing digital access solutions for hotels and private accommodations.

TripAdvisor teamed up with tourism authorities in Abu Dhabi to create what it claims is the world's fist virtual destination voice tour for Amazon Alexa devices.

Getaway, a Brooklyn, New York-based company that leases cabins in the woods, raised $41.7 million in Series C funding to expand cabin leasing options within two-hour drives of major urban centers.

If you like this newsletter, please consider

Sharing it with your colleagues / friends

Subscribing (if you’re not yet subscribed)