Travel Tech Essentialist #50: Movement

If you notice a change in branding in this newsletter (I hope you like it), it's thanks to Sensa, a strategy, design and technology studio with clients that range from startups to billion-dollar companies. Plus, co-founder Manu Gamero and the rest of the Sensa team are absolute first-rate people in addition to first-rate professionals.

This issue brings plenty of news on subscription models, loyalty programs, and other trends (and startups) that seem to be increasingly relevant as travel makes its way back. I hope you enjoy it. And thanks to all of you who send me great content and ideas, some of which I end up sharing here.

This newsletter has been sponsored by

Do you know what your customers are seeing when they type 'Flights to...' into Google? xCheck does. Radar is the first retail intelligence platform built for airlines. It uses machine learning to report on the prices your customers are seeing at the start of their customer journey. It's a window into your customer journey that can help you make more informed choices - and it's free for airlines.

See the demo here: Radar, by xCheck.

1. Remote work has started a hospitality subscription-living movement

With hotel occupancy rates low, some hotels are switching their focus to flexible monthly subscriptions instead of marketing overnight stays. Here are some examples of startups at the center of the emerging work-from-anywhere movement.

Micro-apartment hotel Zoku opened in Amsterdam in 2015 specifically for remote workers and digital nomads. It is now expanding to new locations and going all-in on a subscription business model, with a vision of remote workers spending time at Zoku properties in different cities throughout the year. Zoku’s initial offering costs €2,750 for 30 days, with discounts for bookings of multiple months.

Another remote worker focused hospitality startup, Selina, recently launched a co-living subscription for stays across South and Central America, starting at just $300 per month.

Hospitality startup Oasis is also tapping into remote workers’ desire to explore and stay in destinations for long periods. In October 2020, it launched the Oasis Passport, which allows users to pay a monthly fee to stay in different residences around the world over a 3 to 6-month period. A three-month pass start at $1,625 per month for Latin America and $2,150 per month for Europe. The company says, “why stay in NYC year-round if you can spend three to six months between Barcelona, Paris and Buenos Aires?”

2. The future 100: 2021

Wunderman Thompson Intelligence has published The Future 100, a 217 page report that previews 100 trends and changes to track this year across ten categories. Among the 10 trends in the travel & hospitality category:

Member-based services. Luxury travel embraces the membership model.

Hospitality redesigned. Hotels are rethinking their offering as consumers look for safe stays while also yearning for connection.

Travel bubbles. Travelers are staying closer to home.

Subscribed stays. Hotels are reimagining the subscription model to attract customers and appeal to a growing clientele of digital nomads.

Informed journeys. Transportation apps are giving users information on making their journeys as safe and sustainable as possible.

3. Airlines are adapting their loyalty programs to appeal to younger consumers

Millennials are the largest generation of air travelers, accounting for 25% of passengers globally. US airlines such as Spirit, American and United are adapting their loyalty programs around their behaviors and preferences. Read + WSJ.

4. Corporate - Startup collaboration by the numbers

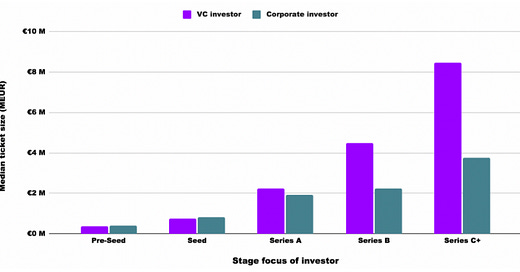

This analysis looks at corporate-startup collaboration in a comprehensive manner, based on data from 3500 startups. It addresses and answers questions such as the share of European funding rounds that feature a corporate (growing consistently from 10% in 2015 to 22% in 2020), which verticals are particularly dependent on corporate investments (mobility is particularly high), at what stage corporates are likely to invest (more active in later stages), and how VCs and corporates compare in valuations (corporates are valuing companies more conservatively at the pre-seed and seed stage, they become significantly more generous than VCs beyond Series A).

5. What founders should know before going to a VC for money

These are some of the questions discussed in an insightful conversation with EQT Ventures’s partner Ted Persson:

What do VCs expect to see, from Seed to scale?

How much should founders look to raise, from whom, and at what valuation?

How to put together an impactful and convincing investor pitch?

What does the investment process look like from the initial “hey” to investment decision?

6. Europe’s fastest growing companies

It’s a bit strange that the Financial Times publishes its newly released 2021 ranking of Europe’s 1000 fastest growing companies based on revenue growth rate between 2016 and 2019. But let's pretend that the pandemic didn't happen and that having updated numbers doesn't matter. For the first time, Italy is the country with the most entries on the list, with 269, followed by Germany (204) and France (162). There are 25 companies in the travel & leisure categories. The top three:

Swapfiets - Netherlands - Subscription-based bicycles and urban mobility - ranked #10 - 284% yearly growth - €22.7 million in 2019 revenue

MyCamper - Switzerland - Campers, RVs, vans and caravans P2P rental marketplace - ranked #53 - 171% yearly growth - €3.1 million 2019 revenue

Bizaway - Italy - Business travel - ranked #88 - 146% growth - €3.3 million revenue

7. Travel startups that Amadeus Ventures is watching

As the industry contemplates and explores ways to rebuild travel, Amadeus is looking to partner with startups that will contribute to the industry recovery and help people to feel confident enough to travel again. This post looks at 14 startups that Amadeus Ventures is watching , among which are some startups that we have featured in previous newsletters:

Troop optimizes meetings and events planning through data to figure out where is the best location to meet.

Questo provides a marketplace for gamified tours that create city exploration games.

Gamitee has created a “social shopping” platform embedded on travel booking websites to enable users to easily share, plan, discuss and book in groups.

CitizenPlane acts as a marketing carrier for distressed inventory of airlines.

Airside is a provider of digital identity solutions.

Airobot is an automation platform to maximize productivity, automated check-in, cross-sell ancillaries, and claim compensation to improve online booking and post-sales.

8. Joby Aviation goes public in a $6.6B SPAC deal

Santa Cruz-based eVTOL startup Joby Aviation is merging with Reinvent Technology Partners, a “blank check” company (or SPAC) run by LinkedIn co-founder Reid Hoffman and Zynga founder Mark Pincus. The new company will have a post-money valuation of $6.6 billion and is on track to launch passenger flights in 2024. According to the company’s investor presentation, Joby expects each aircraft to cost $1.3 million to manufacture and generate $2.2 million in revenue, assuming that 7 hours a day in flight with an average of 2.3 passengers per trip. Joby was founded in 2009 and operated in relative obscurity until 2018, when it announced it had raised $100 million from Intel Capital, Toyota Ventures and Jet Blue Technology Ventures. Read + The Verge.

9. Fundraising

German-based eVTOL and Urban Air Mobility pioneer Volocopter raised €200 Million in Series D funding round from BlackRock, Avala Capital and Tokyo Century among others. Cumulatively, Volocopter has raised €322 million. Read + PR Newswire.

Harvest Hosts raised $37 million in funding for its membership program that lets RV campers stay overnight in wineries and other cool places. Stripes led the investment in the Vail, Colorado-based company. Read + VentureBeat.

London-based SaaS “Experience commerce” platform Easol raised $4.5 million to prepare for a boom in activities demand as destinations recover. Notion Capital led the round. Read + Phocuswire.

Ireland-based campsite search and booking startup Campsited raised €600,000 from Motley Fool Ventures and Enterprise Ireland and plans to close a further €3 million round in the next three months. Read + Phocuswire.

10. Product launches, M&A and Partnerships

The future of air travel includes a non-air travel components. Landline is redefining regional transportation model with bus-to-air travel, and they recently announced a new partnership with United Airlines offering United customers the ability to select Landline bus destinations in Colorado. One-click, one-price multimodal itineraries.

The Hotels Network announced the launch of BenchDirect, a unique benchmarking product for a hotel's direct booking channel. This interactive platform leverages The Hotels Network global network of data so hoteliers can analyze the full user journey and compare their direct channel performance to the market across 30+ key metrics. BenchDirect is available now for hotels to sign up and it's free to use, forever.

Sitecore acquired travel personalization tech provider Boxever (terms were not disclosed) as part of its $1.2 billion growth and product innovation plans. Boxever was founded in 2011 in Ireland and uses a brand's user data and combines it with artificial intelligence techniques to provide customer up-sell and cross-sell opportunities. Its initial clients were in the travel industry (Emirates, Ryanair, eDreams), but has expanded beyond the travel sector. Read +.

Would you want to sponsor Travel Tech Essentialist? There are some remaining dates available in 2021. More information here.

If you like this newsletter, please consider

Sharing it with your colleagues / friends

Subscribing (if you’re not yet subscribed)