Travel Tech Essentialist #51: Spring

With spring comes new life. In newsletter #37 last May, I wrote that anybody betting against the travel industry will be in the wrong side of history in the long run. A few stories in this newsletter prove doubters wrong. There are very positive signals that travel is back, and the more it’s restrained in certain regions (mostly due to inefficient vaccination rollout and/or failed policies), the stronger the rebound will be. This newsletter even includes a slight rant in #4.

This newsletter has been sponsored by

xCheck's latest product combines route, price, and COVID-19 data in one shoppable map.

Airlines can now augment their passenger experience with interactive and shoppable maps that combine the latest COVID-19 entry restrictions with legislation-compliant pricing. The product, called simply Maps, results from a strategic partnership between airfare automation platform xCheck and AI-powered content engine SmartVel.

View the demo here: Maps, by xCheck.

1. Bull travel market

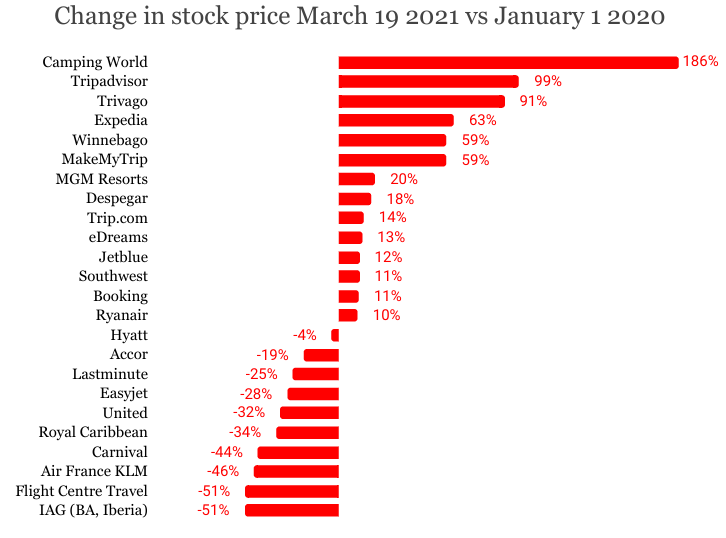

In March 2020, stock prices of publicly traded travel companies were suffering the impact of Covid, which had been declared a pandemic by the World Health Organization (WHO) on March 11. In the last 12 month, the stock price of this selection of travel companies has, on average, tripled (+200%). Much better than the overall market (Dow Jones +62%, Euro Stoxx +56%).

Even when we compare against pre-pandemic times, 14 of the 24 companies in this list are trading well above January 2020 levels, particularly OTAs, metasearches, outdoor travel and US low cost carriers. Companies with more of a European exposure are faring worse.

2. OTA Q4 2020 revenues

Publicly traded OTAs and metasearches have announced their Q4 2020 results. The chart below reflects the Q4 2020 vs Q4 2019, as well as full year 2020 vs 2019. Market newcommer Airbnb has the best results of all in both metrics, while Trivago has the biggest year on year revenue decreases.

3. US airlines see surge in fliers as the number of Americans at least partially vaccinated reaches 25%

After trending steeply upwards the past weeks, the 7 day moving average of domestic US search demand has jumped above the same day level in 2019, marking a positive recovery inflection point, according to data from 3Victors.

US airline executives have announced optimistic results. Delta Air Lines CEO revealed last week that bookings began picking up 5 or 6 weeks ago, adding that the airline is at or "pretty darn close to breakeven" cash burn in March. This time last year the carrier was burning through $100 million a day. Within the past week JetBlue Airways says its package travel site has sold "more vacations than they ever have." The recent increase in bookings has allowed airlines to reopen routes and return more of their aircraft to the skies. American Airlines is planning to fly 80% of its 2019 schedule starting in May. Read +.

The Transportation Security Administration (TSA) screened 1.36 million people at US airport checkpoints on March 20, the 10th consecutive day that more than 1 million people flew. The last time that happened was mid-March of last year, before the WHO declared a world pandemic.

4. Listen to contra-indicators

Local and international regulators, multilateral bodies, federal agencies, academics and interest groups are some of the stakeholders debating the pros and cons of vaccine passports. A perfect recipe for impasse. It took the scientific community less time to come up with a Covid vaccine than what it will take a committee of “experts” to make a decision around vaccine passports.

The World Health Organization’s position is that national authorities and operators should not introduce requirements of proof of Covid vaccination for international travel. Some of the arguments include that vaccine passports could result in inequality and discrimination, and that they could bring a false sense of security and lead to risky behavior and the rise of new COVID variants.

Just a reminder that at the beginning of the pandemic, the WHO recommended against “any travel restrictions” implying that such actions could “promote fear, stigma or discrimination with little public health benefit”. As late as February 26 2020 (on the same day his own organization reported 81,109 confirmed Covid cases in 38 countries), the Director General of WHO gave a speech in which he claimed that “we are not witnessing sustained and intensive community transmission of this virus, and we are not witnessing large-scale severe disease or death.” WHO officials stated on March 30 2020 that they recommend people not wear face masks unless they are sick with Covid or caring for someone who is sick: "There is no specific evidence to suggest that the wearing of masks by the mass population has any potential benefit. In fact, there's some evidence to suggest the opposite”.

There is a lot of value from an individual or institution that is reliably wrong. That's sometimes called a contra-indicator. When in doubt, listen to what the contra-indicator says, and do the opposite.

When Institutions are opining on important issues, we should also keep Taleb in mind:

5. Tripadvisor opens its Plus platform to hotels

Tripadvisor Plus, announced in the fall, is currently in beta testing. Customers pay a membership fee of $99 / year with the benefit of accessing deals and perks from the hotels that are part of the program. Hotels can now join Tripadvisor Plus for free. Tripadvisor does not take a commission from Plus bookings (hotels can pass on some of the savings to Plus customers as discounts). Instead, it collects the annual membership fee, which then becomes a recurring revenue source. Tripadvisor is testing yet again the OTA waters with this program. Finding the right immediate customer benefits to incemntivize subscriptions will be key for Tripadvisor Plus. eDreams has successfully grown its own membership program to 758k subscribers in large part by making the subscription economically viable for the consumer at the point of first sale.

6. The road to electric mobility is filled with tiny cars

The next phase of mobility isn’t being conceived by Elon Musk or Silicon Valley. It has begun with two guys in Shandong putting paneling around a golf cart. Having decided that the future of mobility is electric, the Chinese government has subsidized sales of standard electric cars since 2010. With close to 1.18 million sold in 2019, China accounts for just over half of electric-vehicle sales globally. Millions of people in China are now embracing tiny, off-brand competitors. A tiny car is shorter than 1.5 meters, and their speed tops out at between 40 and 56 km/h. Read + Rest of World.

7. Fast Company's list of the 10 most innovative travel companies

Among the 10 companies in the list are:

Hipcamp: for bringing camping closer to home

Getaway: for redefining the outdoor retreat

Hopper: for continuing to address new travel pain points

Journera: for streamlining travel by interlocking your reservations

Ennismore hospitality: for creative thinking and staying competitive

8. Product launches, M&A and Partnerships

Kayak is branching out from its metasearch model with the launch of its own travel experiences and the opening of its first hotel in Miami Beach.

Tour operator Intrepid announced a strategic partnership with France-based sports/leisure investment company Genairgy, with the objective of becoming the first $1 billion adventure travel company by 2025.

Vacasa acquires TurnKey. Vacasa is the largest property management company, with 25,000 vacation homes and 2 million guests / year. TurnKey is the second largest full service PM, with 6000 premium homes in 80 destinations across the US. Here’s a good head to head comparison of both.

Aviation analytics company Cirium aquired Migacore, a travel technology start-up that applies advanced machine learning techniques to online data sources to help airlines stay ahead of changes in passenger demand. Read +.

London-based GuestReady acquired The Porto Concierge, the largest short-term rental management company in Portugal. Read +.

9. Fundraising

Optibus got $107 million in a Series C round, bringing the total raised so far to $160 million. The Israeli startup uses artificial intelligence and cloud computing to public transportation networks. Read +.

Berlin-based hospitality startup Cosi Group raised €20 million to accelerate expansion in Europe. Founded in 2019, its technology enables properties to combine the quality of a boutique hotel with the comfort of a private apartment. Read +.

Estonia-based mobility platform Bolt got €20 million in funding from the International Finance Corporation to increase access to affordable mobility services in emerging economies. Read +.

Group travel startup Launchtrip raises a $3.8 million pre-seed round. Read +.

Transreport, a startup that helps rail passengers with reduced mobility, has announced funding of £3.2 million. Read +.

Tripscout, an artificial intelligence-powered platform for travel inspiration and planning, raised $2.3 million in a seed-plus round, bringing total funding to $4.6 million. Read +.

10. Startup Corner

DUNK is a French startup that helps organize trips to unknown destinations for groups of friends or corporate events using teases, suspense and surprises. This is how it was born.

Valpas, which means “thoughtful” in Finnish, helps hotels stay free of bed bugs with its technology and hygiene protocol.

If you like this newsletter, please consider

Sharing it with your colleagues / friends

Subscribing (if you’re not yet subscribed)