The Travel Tech Essentialist community is growing. This week, I have a couple of requests to leverage the power of this community. First, I’d like for us to come up with a collective idea of which could be the next set of travel tech multi-billion dollar companies (#1 in this newsletter). Second, I’d appreciate if you share with me any piece of content that you come across that you think would be relevant and interesting to share on Travel Tech Essentialist. If I use it, I will make sure to give you the appropriate shout-out (as in #5). Thank you for all your input and contributions.

This newsletter has been sponsored by xCheck

xCheck’s collaboration with Smartvel has received some incredible press since its launch two weeks ago. “For a company like ours – who’s output is normally invisible to the customer – it’s humbling to see a review of your product pop up on Points Guy. Even better when he calls it ‘seamless’.” Said xCheck CEO, Tim Underwood.

Learn more, and use the tool for yourself here: Maps, by xCheck

1. Which startup will be the next travel tech multi-billion dollar company?

I’d love to do an experiment and come up with a collective answer to this question by having you send me your answer. The answer could be either a relatively small company today or a current “unicorn” that has the potential to significantly increase its present value in the years to come. Oh, and please do not respond with your own company or company in which you have a significant financial interest in. Submit your answer on this Typeform (anonymous) (https://form.typeform.com/to/mSYlrHX5)

Hopefully many of you will respond. The more the better, so feel free to forward this newsletter to your colleagues. I will aggregate the data and report back to you the results in the next newsletter. Thank you!

2. Travel tech startups are experiencing an amazing turnaround…

Here are some examples. Sonder is planning to go public through a SPAC in a deal that would value it as high as $2.7 billion, more than double the valuation of its last private funding round in June 2020. Andreessen Horowitz and other investors paid nearly 18% more for shares in business travel firm TripActions in January than they did last year, valuing the company at about $5 billion. This, in spite of the prevailing view that business travel will take longer to bounce back. Hopper also raised hundreds of millions of dollars this year at a higher valuation than last year. Inovia Capital, a Canadian VC, invested more than $100 million in travel startups over the past year, its most ever for a single year. Read more.

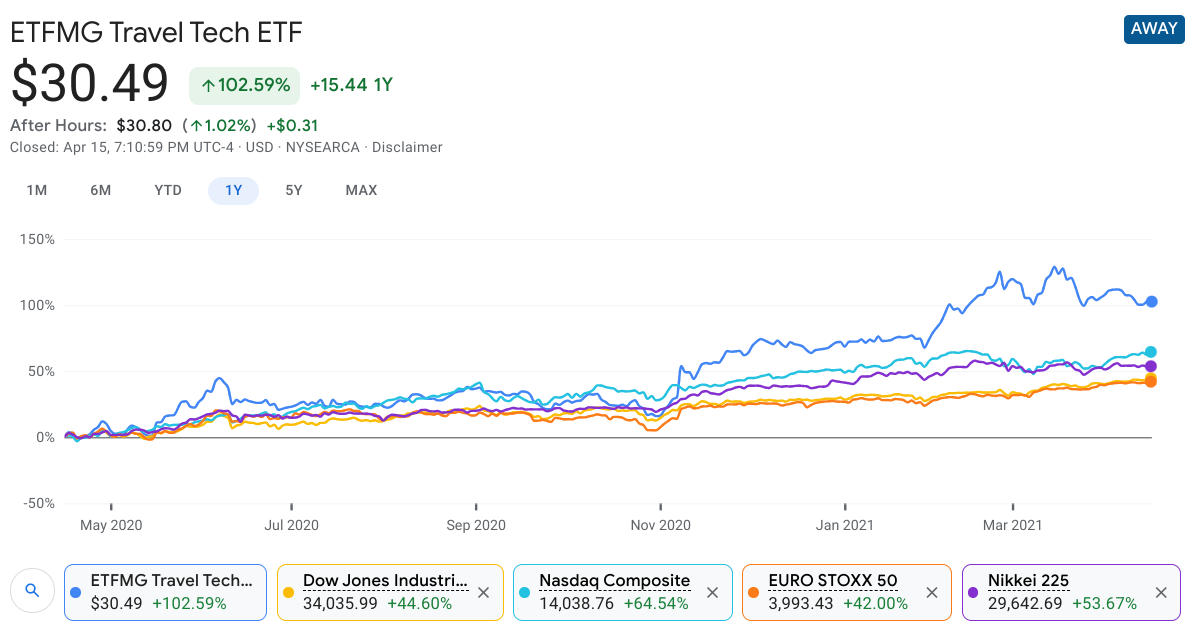

3. Publicly traded travel tech companies are also heading up, way up

It’s not only privately owned startups that are seeing a recovery. Publicly traded travel tech companies are experiencing a hyper growth in their valuations (and stock prices) since the end of last year. Airbnb’s market capitalization is now north of $100 billion, 4 times its valuation on the private markets. AWAY is an Exchange Traded Fund investing in technology-focused global travel and tourism companies (Booking, Expedia, Airbnb, Despegar, Tongcheng-Elong, Trivago, Tripadvisor, etc…). In the last 12 months it has soared by 103%, eclipsing the Nasdaq (up 65%), Nikkei (up 54%), Dow Jones (up 45%) and EuroStoxx (up 42%).

4. Building products at Airbnb

Interesting deep dive into the product culture at Airbnb, resulting from interviews with three current Airbnb product managers, and one engineering manager. The article touches a variety of topics, including what product is (it’s not the app, it’s the entire experience of staying at a guest’s home), the importance of storytelling, the relentless focus on experiences, design-centricity, the evolving role of product teams, and the type of PMs that thrive at Airbnb. Read more - Bring the Donuts (thank you Mario Gavira, VP of Growth at Kiwi.com, for sending it my way).

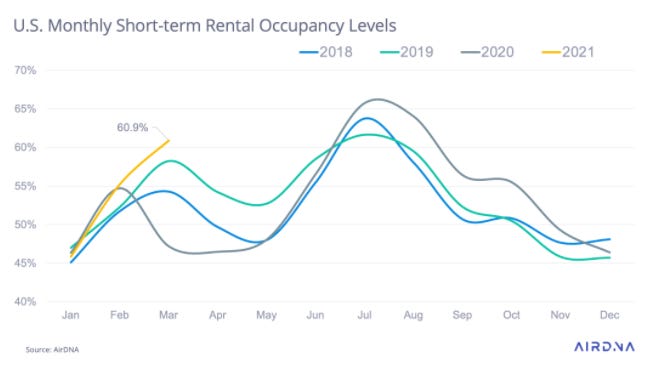

5. Short-term rental occupancy reaches all-time high in the US

Short term rental occupancy in March 2021 reached 61%, a record high. In March 2020 it was 47%, down from 58% in 2019 (the previous all-time high for March). The recovery in demand has varied dramatically by location. Urban areas, for example, have been hit hardest with demand in March 2021 at 55% of its 2019 level. Small city and rural locations, on the other hand, attracted more guests than ever before and are now at 165% of 2019 demand. Read more - AirDNA.

6. Hotels are staying in business by turning rooms into offices

This article highlights how some major hotel groups are leveraging their spaces to convince remote workers to work from their hotels. It looks at the programs and services provided by some of the world’s largest chains (such as Marriott, Hilton, Mandarin Oriental, Hyatt) as well as newer hospitality players like Selina.

7. The best office views and video-conference backgrounds

Hotels are not the only ones wanting to attract remote workers and distance learners. Princess Cruises offers the ultimate workstation by announcing that every Princess cruise ship will be equipped with super-charged internet connectivity (with no signal drops anywhere on the ship) by leveraging a new constellation of satellites, working with its connectivity partner SES, based in Luxembourg. The technology will also improve the entire guest experience, such as wearable devices that trigger personalized and touch-free services. Read more.

8. Busy summer for US Airlines

American Airlines is expecting to operate at 90% of its summer 2019 domestic capacity and 80% international. The airline is adding 150 new routes, both within the US and to international weekend destinations. United is adding 24 new routes by the end of May, Delta is reopening middle seats, and Southwest is recalling 209 pilots as travel demand recovers. Ultra low cost Allegiant said last week that its average daily bookings in March 2021 were higher than in March 2019, while LCC Frontier Airlines announced eight new routes. Read more.

9. Decisions, decisions

You could buy a Louis Vuitton purse shaped like an airplane for $39,000 or a 1969 working and undamaged Cessna for $32,300 (also shaped like an airplane). Read more.

10. Funding and Acquisitions

Funding

Singapore-headquartered MVL, a blockchain ride-hailing startup, raised $15 million to roll out its first three-wheeled electric vehicle tuk-tuks. MVL- short for “mass vehicle ledger” – is a mobility blockchain protocol that records all its networked vehicles data.

Dallas-based NoiseAware, a provider of smart noise monitoring solutions for short-term rentals, raised an $8 million Series A funding from S3 Ventures and Thayer Ventures.

Bob W, an apartment rental “tech driven” hospitality provider from Helsinki that offers an alternative to traditional hotels and short-stay rentals, announced €10 million in seed funding, which included a first tranche of €4 million last year.

Utah-based Bandwango raised $3.1 million. The startup connects businesses with communities by packaging deals that entice locals to support nearby businesses and attractions. Read +.

Saudi Arabia-based micromobility startup Gazal raised a $2 million Seed funding round bringing its total valuation up to $6 million. Read +.

Port, a Singapore-based “remote travel” startup” has secured a “six digit” pre-seed investment from H.I.S. Group. Port's guides can be hired for virtual walking tour of a city or site, or to walk the floor of a trade show or exhibition. Read +.

Acquisitions

Israeli short-term rental property management platform Guesty acquired PMS MyVR, making it “the largest short-term rental property management platform worldwide”, according to Guesty. Read +.

Indian OTA Cleartrip was sold to Flipkart, one of the major eCommerce brands in India. Read +.

Corporate lodging platform HRS acquired Itelya, a Germany-based travel invoice management provider founded in 2010. Read +.

Experiences and transportation company Hornblower Group is rebranding its portfolio as City Experiences and growing its offerings through the acquisition of tours and activities operator Walks, from Austin TX. Read +.

If you like this newsletter, please consider

Sharing it with your colleagues / friends

Subscribing (if you’re not yet subscribed)

Very interesting, I think the next big travel player will come from a market which has in travel a big percentage of their PIB investment. Maybe Mexico with homiefoo.com?