Travel Tech Essentialist #62: Reporting

Luxury travel, subscriptions, hotel direct booking benchmarks, airline data, VC investments in travel startups, plenty of fundraising activity, and some tips on how to bend luck in your favor. I hope you enjoy it.

This newsletter has been sponsored by ZYTLYN

Are you interested to know where travelers are, where they want to go, and their willingness to pay? ZYTLYN Technologies has a unique solution that accurately predicts unconstrained, contextual and real-time demand and elasticity for travel. The granular forecasts are driven by a wide range of external data to ensure predictions are contextually aware, leveraging data from search engines, airlines, agencies, governments, and other macro data, including origin-destination COVID immunity index, to name a few. The forecasts can be provided directly to analysts, or integrated in existing workflows.

1. VC investments in travel and transportation startups

I wrote last week a post called VC Investments in Travel and Transportation Startups in 2021, an X-ray look at 100 investments in travel startups. Some highlights

14% of rounds went to Asia Pacific startups, but they represented 46% of the total amount invested

Top travel startup countries: USA, Germany, England, Spain

Top cities: London, San Francisco, Berlin, Barcelona

A few of the top investors: SoftBank, GIC, Gaingels, K FUND, Slow, Andreessen Horowitz, Thayer Ventures, Plug and Play, JetBlue Technology Ventures

Top macro categories: B2B, Transportation, Booking Engines

2. Second quarter 2021 results

A few publicly traded Online Travel Agencies and Metasearches have announced Q2 2021 results. The fact that there is triple digit growth compared to Q2 2020 is a non-story. All of them are still below Q2 2019, except Airbnb.

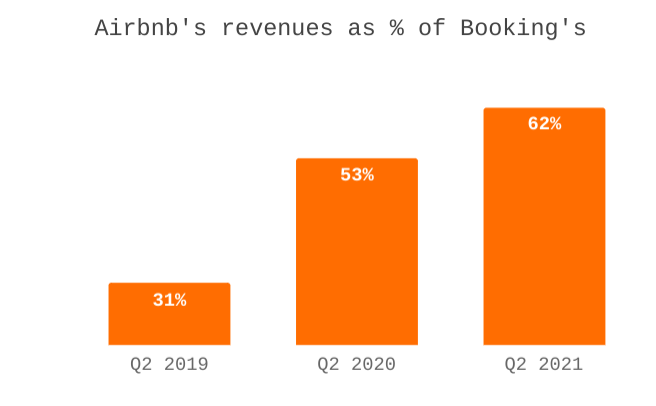

And Airbnb’s revenue levels are fast approaching Booking Holdings’

3. Subscription models and luxury travel

Luxury travel is positioned to surpass $1 trillion in market value. Brent Handler, founder and CEO of Inspirato, writes about how technology is enabling the machinery of luxury travel planning to work efficiently and effectively. Handler sees subscription-based innovation increasingly addressing the affluent consumer’s desire for seamless, efficient travel experiences, while at the same time making it possible for owners, operators, brands and B2B providers to gain greater efficiency, higher occupancy, improved economic utilization and increased RevPAR. Read more.

4. Reassuringly expensive

Luxury travel brands should’t hide what they are. George Mack specializes in how mental models influence our thinking. He notes that brands that are honest about their flaws are able to build consumer trust, and they will be more listened to when highlighting their strengths. An example is Stella Artois. Most expensive brands would try to avoid their “flaw” (how expensive they are). Stella Artois, instead, leans on it.

5. Hotels direct booking report - Direct booking key metrics and benchmarks

The Hotels Network released its BenchDirect Insights Report, a global hotel analysis with direct booking key metrics and benchmarks: website traffic acquisition channels, funnel conversion rates, conversion rates by traffic source, price disparities with OTAs (and which), visitor profile, visit and conversion rates by device, etc…. Lots of great information here. The report also includes commentary and key takeaways so that hoteliers are able to use the insights to improve their direct booking strategy. Here is one of the many charts included in the report:

The Hotels Network’s BenchDirect interactive analytics platform allows hotels to compare their performance against the market and direct competitors across more than 30 key metrics. It’s free for hoteliers, forever. More than 10.000 hotels are using it already.

6. Airline data…lots of it

Jay Sorensen just published the 2021 edition of the Big Book of Airline Data. The information is presented in multiple formats to create user-friendly access to the data. The first part of the report contains passenger traffic results for 180 airlines. The second part contains revenue results for 152 airlines, and the the final section provides membership data by 42 frequent flyer programs.

7. Delta (the airline…) launches Air+Rail program in Europe

Another example of an airline launching a multimodal solution to adapt to consumers’ need for convenient travel. Delta just launched a new Air+Rail program in partnership with Thalys high-speed trains to provide fast rail connections between Amsterdam and the Belgian cities of Brussels and Antwerp, enabling customers to seamlessly transfer between plane and train at Amsterdam Airport Schiphol with one ticket booking. This program is just the beginning. The airline will look to expand its Air+Rail program to and from other European cities.

8. Increasing your surface area of luck

George Mack (again) shares 3 thought frameworks that can be used to attract more luck into our lives.

Avoid boring people (and avoid being the boring person in the room). The more interesting you are, the more interest you get, the more interesting people you will meet, the more opportunities that come your way. Flywheel.

Have a Luck Razor. Occam’s Razor states that if all other factors are equal, you should choose the most simple option. George proposes a Luck Razor: if all other factors are equal, choose the path that feels the luckiest.

Have a Poker Mindset. Roulette is a game of luck because you can’t control the outcome. Poker is a game of luck and skill, in which you can control the outcome. The luckiest people have a poker mindset — they are obsessed with finding a way to hack the system. Better to play roulette with a poker mindset than poker with a roulette mindset.

Another concrete advice to bend luck in our favor comes from Nik Sharma (investor and operator to some of the fastest growing D2C brands): “Who’s one person who could help change your personal or professional life? Send them a cold email today. The more cold emails you send, the “luckier” you get”. Nik attributes 99% of his luck" to good cold emails.

9. M&A, IPOs

Hyatt entered into a definitive agreement to acquire Apple Leisure Group, a luxury resort-management services, travel and hospitality group for $2.7 billion in cash.

HotelPlanner.com, which is the parent company of Meetings.com, will go public through a merger with OTA Reservations.com and SPAC Astrea Acquisition Corp. The combined entity will keep the HotelPlanner name. The transaction is expected to close in Q4 2021 and values the company at $567 million and is expected to raise more than $120 million. Read more.

10. Funding

UK-based events unicorn Hopin raised another $450 million in funding, valuing the company at $7.75 million just months after closing a previous round.

US Low Cost airline Breeze Airways raised a $200 million Series B round. Breeze had raised $100 million and began flights in late May. Itis now serving 16 US cities and 39 routes.

OTA and Fintech company Hopper raised a $175 million Series G (its Series F was closed earlier this year), bringing its total raised to date to nearly $600 million, with the company now valued at over $3.5 billion.

Travel Funders Network raised at least $50 million. The company, run by the co-founders of Hotels.com and Getaroom, is a “unique hotel distribution network” in the US that provides “mostly 3-star hotels a minimum revenue guarantee”.

Revinate closed a $39.2 million Series E round

TrovaTrip, an Oregon-based trip planning marketplace that matches travel group hosts with travelers closed a $5 million round.

Proptech SaaS platform TurnoverBnB, which helps vacation rental hosts manage cleaning for their properties, raised a $4.5 million Series A.

TravelLocal, the UK-based platform for tailor-made trips, merged with Berlin-based Trip.me and raised a $3.4 million Series A extension.

Una Travel, an app which curates collaborative itineraries for individual travelers and groups primarily based on interests, raised $3.25 million.

Tripbtoz, a South Korean hotel booking platform and trip recommendation service, raised $2.7 million.

Mabaat, a Saudi vacation rental property management startup, raised $2.4 million in seed funding.

London-based camping platform HolidayFox raised £1.17 million in pre-seed funding.

Elude an app built around a “budget-first” search engine raised $2.1 million.

Wheel the World, a platform for travelers with disabilities to book places to stay, things to do and multi-day trips, raised $2 million in its seed round.

Chicago startup Out Of Office, a trip planning app based on recommendations from your friends raised a $1.6 million pre-seed round

Travel Tech Essentialist job board

Some of the amazing jobs on the board

Impala: Talent Acquisition Manager (Remote)

Impala: Senior Backend Engineer (Remote)

The Hotels Network: Sales Development Rep - France (Barcelona)

The Hotels Network: Sales Development Rep - USA/Canada (Remote)

The Hotels Network: Sr Front-End developer w/ a passion for UX (Barcelona)

Twitter: Sr Client Account Manager, Travel (LA, SF, Seattle)

Amazon: Principal Travel & Hospitality Industry Advisor (Atlanta)

Browse many more open roles (or add your own open roles) at Travel Tech Essentialist Job Board

If you’re finding this newsletter valuable, consider sharing it with colleagues and friends, or subscribing if you haven’t already.

Have a great week,

Mauricio