Travel Tech Essentialist #63: Motion

Apologies for the delay in sending this newsletter, but it’s been a couple of weeks full of involuntary traveling around since Hurricane Ida hit New Orleans. We had to evacuate, spent some time in Houston, then Dallas, then back to New Orleans, then Houston again, and now Mexico. I hope you’re doing well and back in the swing of things.

This newsletter has been sponsored by PSGR Pro

Quarterly newsletter on everything that matters in travel tech from Eastern Europe brought to you by Aviasales, one of the world’s leading travel metasearch platforms.

Subscribe now and share the newsletter with your peers.

1. Investing in travel post-pandemic

Chris Hemmeter is the founder of Thayer Ventures, one of the most active VCs in the travel ecosystem. He recently wrote an assessment on investing in travel post-pandemic: where are we now and what do the next 18 months hold. He highlights specific opportunities within the alternative accommodations, outdoors tourism and the remaking of the hotel tech stack. He also writes about how the travel technology as an investment category has now come into focus as a magnet for SPAC, private equity and greater venture investment.

2. What do Gen Z travelers want from online travel brands?

More Gen Z travelers booked air, hotel and car via an OTA than any other online channel like direct websites, metasearch or retail travel agent websites. More than 1/3 Gen Z travelers booked a dynamic package in 2020, the highest occurrence of any generation. Beyond OTAs, Gen Z travelers are more open to other intermediary options such as booking via Google or travel subscriptions. Nearly one in 10 Gen Z travelers reserved a hotel room in 2020 through Google's booking function and 46% say they are likely to spend up to $100 annually to join a travel subscription service. Read more.

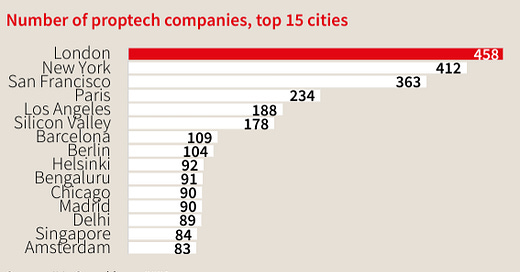

3. Proptech startup funding on track to break industry records in 2021

The expansion of accommodation models has given rise to new technologies and startups that address new needs by owners, property managers and other parties in the hospitality industry. Data released today by JLL suggests that opportunity abounds in the sector’s startup landscape, with over US$9.7 billion of funding activity in the first half of 2021, the most active first half on record. The number of startups across the real estate industry has grown in the past decade from under 2,000 to nearly 8,000. Access the detailed report (58 pages) here: Transform with technology - Shaping the future of real estate.

4. The Sequoia Guide to Pricing

A lot of startups treat pricing as a math problem or, worse, an afterthought (the average SaaS startup spends just six hours on its pricing strategy, according to Price Intelligently). Pricing is as much an art as it is a science, one that relies as much on marketing and psychology as it does on classical economics. This Sequoia Guide to Pricing covers strategies that can help you figure out the right price for your product—and end up with happier customers and more profit in the process. The guide offers actionable tips and a worksheet can help you assess your product's perceived value and the accuracy of its price.

5. What exactly is AirAsia up to with its super app ambitions?

AirAsia continues on its quest to become one of Southeast Asia’s leading super apps with the launch of AirAsia Ride in Malaysia. AirAsia now offers food delivery, ride-hailing, flight ticket booking, grocery shopping, and an e-commerce platform for beauty products. Its new product lines are operating in Malaysia, Singapore and Thailand, with aspirations of rapid expansion into other countries, as AirAsia super app’s head of commerce Lim Ben-Jie explains in this interview with Tech Wire Asia.

6. Ads, privacy and confusion

Cookies are going away, but we don’t know what online privacy means or what happens next. The consumer internet industry spent two decades building a complex and chaotic system to track and analyze what people do on the internet, and we’ve spent the last 5 years arguing about that. Between unilateral decisions by some big tech platforms and waves of regulation from all around the world, all this is going to change. But we don’t have any clarity on what that means, or even what we’re trying to achieve, and there are lots of unresolved questions. Read more - Benedict Evans.

7. Exploring the role of cryptocurrency in travel

The fact that the travel sector has many layers of intermediaries makes it a potentially interesting space for companies to come up with new models and approaches using cryptocurrencies and blockchain technology. In this interview with PhocusWire, Rohit Talwar (CEO of foresight consultancy Fast Future) explores the potential for cryptocurrencies to create new opportunities for the travel industry. Talwar highlights some of the emerging crypto experiments in the travel sector and gives his view on who will be the winning brands and players.

8. Travel + Leisure Group launches a new subscription service

Wyndham Destinations rebranded to Travel + Leisure Co after its acquisition of Travel + Leisure in January 2021. It just launched a new subscription service called Travel + Leisure Club, offering members access to preferred pricing on itineraries inspired by Travel + Leisure magazine, concierge services and exclusive experiences for an introductory rate of $9.95 per month (regular pricing is $19.95). Savings average 25% off retail rates on more than 600,000 hotels and resorts as well as exclusive pricing on more than 345,000 activities, car rental and flights. The platform is powered by a “secret sauce” made possible through Wyndham Destinations’ $92 million acquisition of travel tech platform ARN in 2019 which includes supplier direct and third-party aggregated inventory. “That’s the reason we acquired ARN. That’s the core of our tech stack” said Travel + Leisure Group president. Read + PhocusWire.

9. Y Combinator travel startups

According to Marc Andreessen, General Partner of Andreessen Horowitz, “Y Combinator is the best program for creating top-end entrepreneurs that has ever existed.” The likes of Airbnb, Stripe, Dropbox, Coinbase and Rappi are alumni. Looking at the companies that are going through Y Combinator today could point to the leading companies (or categories) in the future. These are the Y Combinator travel and transportation companies since the beginning of the pandemic:

Ancana (Mérida, Yucatán, Mexico) - Marketplace to buy managed vacation homes through fractional ownership

Stayflexi (San Francisco) - Modern operating system for hotels and vacation rentals

Newzip (Nashville, USA) - Neighborhood advice from local experts

Tilt (Bengaluru, India) - Bike-share for Indian campuses

zingbus (Gurugram, India) - Platform for bus travel across Indian cities

Tippi (Mexico City) - Convert any Airbnb or hotel room into your next office

Ribbon (San Francisco) - Ticketing and payments for experiences

10. Funding

Kocomo, a Mexico City-based proptech startup, raised $56 million in debt and equity. Kocomo leverages technology to create a marketplace to purchase, own, and sell co-ownership interests in dream vacation homes.

South Korean H2O Hospitality, a hotel technology specialist, raised more than $30 Million in Series C funding. Its Series B investment of $7 million was announced 18 months ago.

MaaS Global closed a €11 million Series B, bringing its total raised so far to just under $75 million. The Finland-based startup is the creator of Whim, a planning app for ground transport services including buses, taxis and e-scooters.

Tickitto raised a seed round of $4.5 million. The UK-based startup offers an API for accessing tickets to events and other activities.

Montreal startup Angel Host closed a seed funding round of $5.2 million for its vacation rental technology.

Thatch, a mobile app that helps travel content creators monetize their content, closed a $3 million seed round.

Bay-Area trip planning startup Wanderlog attracted $1.5 million in seed funding from General Catalyst.

Group adventure travel startup YouTravel.Me secured a $1 million funding. The startup uses a matchmaking algorithm to connect like-minded travelers for small group adventure trips organized by travel experts.

FLYR Labs acquired Faredirect and xCheck, two startups specialized in ancillary revenue and airfare marketing technology. These two acquisitions further strengthen FLYR Labs’ revenue management solutions for airlines. Congrats to these three companies, and particularly to xCheck and founder Tim Underwood, to whom I’m thankful for his sponsorship and support of this newsletter. Read more.

Travel Tech Essentialist job board

Here are just a few of the amazing jobs seen on the board…

Katanox: Frontend Software Engineer (Amsterdam)

Hotelbreak: Senior backend Developer (Ruby) (Remote)

Facebook: Marketing Science Partner Manager, Travel (Menlo Park, California)

Amazon: Principal Travel & Hospitality Industry Advisor (Atlanta)

FLYR Labs: Product Marketing Lead (Dallas)

Browse many more open roles (or add your own open roles) at Travel Tech Essentialist Job Board

If you’re finding this newsletter valuable, consider sharing it with colleagues and friends, or subscribing if you haven’t already.

Have a great week,

Mauricio