Travel Tech Essentialist #70: Time

Time is what we want most, but what we use worst. — William Penn

This might be the last newsletter of 2021. In case it is, I’d like to thank you for being here and investing your most precious resource: your time. This newsletter is only successful if it leads to a better use of your time. I will continue to strive for this in 2022.

And if you are getting value from this newsletter, I would greatly appreciate if you can share it with a colleague or two. This is what keeps it sustainable :)

This newsletter has been sponsored by Selfbook. Congrats to our sponsor for being selected as one of The Information’s 50 Most Promising Startups (#5 among the list’s fintech startups). By the way, they are hiring (see the Travel Tech Essentialist job board at the end of this newsletter).

With more than half of global hoteliers expecting 2022 to bring occupancy back on par with pre-pandemic levels, the hospitality industry is set for a revival. Hotels worldwide are harnessing Selfbook’s forward-thinking transaction engine to drive direct bookings and maximize revenues during the travel boom projected for the New Year. Schedule a demo with Selfbook’s Customer Success Team to make seamless direct bookings, one-click payments, and digital wallet support a reality for your hotel during the busy months ahead.

1. Pricing your SaaS product

Patrick Campbell, CEO of ProfitWell, is widely regarded as one of the smartest minds on SaaS pricing strategy. He has a great post on the foundation of a SaaS product monetization and pricing strategy (Link). He gives a step by step guidance on how to determine the two elements that matter the most: your value metric and your ideal customer profiles and segments. The post also provides tactical advice with metrics such as:

Value propositions matter a lot. In B2B value propositions can swing willingness to pay by 20%. In DTC it's ±15%.

Don't discount over 20%. The size of the discount almost perfectly correlates with higher churn.

Annual contracts greatly reduce churn (1 purchase decision / year instead of 12). To upgrade to annual, offering % discounts does not work as well as discounting whole dollar amounts (ie. "1 month" works better than "X% off")

Ending your prices in “9” evokes a discount brand, making the customer feel like they're getting something. Ending in “0” evokes luxury or premium.

Social proof is important. Case studies can boost willingness to pay by 10-15% in both B2B and in DTC.

Great design can help increase willingness to pay by 20%.

Localize your pricing to the currency (revenue/customer is 30% higher when using the proper currency symbol) and willingness to pay of the prospect's region.

2. A love-hate dependency

This Financial Times article reports that some travel companies (mainly intermediaries) say it’s unfair that they have to buy a paid slot if they want to appear above Google’s proprietary accommodation and flight search. They say they are losing out because of the dominance of paid-for ads and Google’s growing proprietary services. Many of these companies happen to be some of the biggest Google advertisers over the years and have generated significant growth as a result. These companies are calling for more regulatory restrictions on Google: “all the money we spend on Google, we don’t spend on better products and better service”, said the secretary-general of trade body EU Travel Tech. I’d reverse that and say that other companies are precisely spending money on better products, better services and newer business models to that they don’t have to be dependent on Google or advertising-based models for growth. The article also mentions that parts of the industry (mainly direct providers) have welcomed Google’s ability to funnel customers their way.

3. Vacasa goes public via a SPAC…

Four months after announcing plans to go IPO via a SPAC, vacation rental management platform Vacasa began trading last week with a valuation of $4.4 billion and more than $340 million in gross cash proceeds. Vacasa had a strong Q3 earnings report, with revenue of $330 million and adjusted EBITDA of $57 million. Read +.

In 2021, we’ve seen a large number of travel companies going public or planning to go public via a SPAC: Vacasa (IPO Dec 7th), HomeToGo (IPO Sept 24th), Joby Aviation (IPO Aug 11th), American Express Global Business Travel, Selina, HotelPlanner, Inspirato, Tiket.com, Sonder.

4. …and so will American Express Global Business Travel

American Express Global Business Travel will become a publicly traded company through a SPAC deal with Apollo Strategic Growth Capital at an expected market capitalization of $5.3 billion (9.5x Enterprise Value to 2023E Adj. EBITDA). The transaction will provide proceeds of around $1.2 billion, of which $335 million will come from new investors (including Sabre and Zoom Communications) who will join existing shareholders American Express, Expedia and Certares. According to GBT’s investor presentation, the company had $39 billion in TTV in 2019, 40% larger than its next closest competitor BCD Travel. Revenue in 2019 was $2.8 billion and adjusted EBITDA was $502 million. 2021 TTV vs 2019 has been recovering consistently from 10% on week 1 of 2021 but it’s still below 50%.

5. eDreams or Bitcoin?

Among the publicly traded OTAs, metasearches and home sharing platforms, only eDreams (+97%), Lastminute (+31%) and Expedia (+21%) have increased their year to date share price in 2021. eDreams has even outperformed bitcoin in 2021 ☉_☉

6. Decoding digital talent

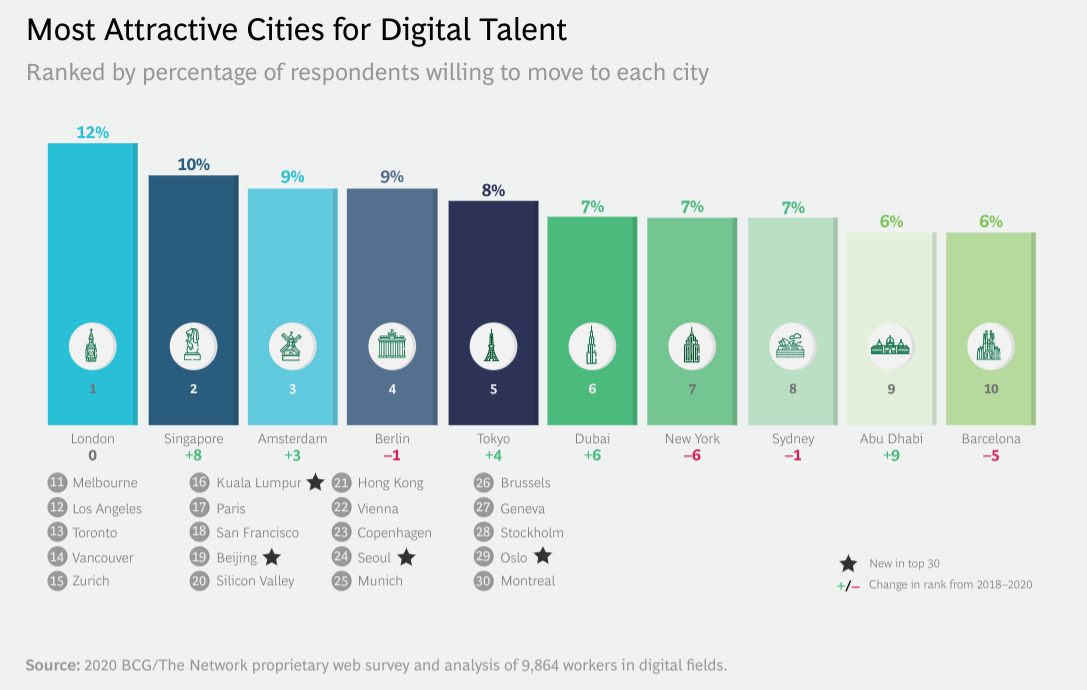

In a global survey, 10.0000 digital workers across 190 countries shared their attitudes about remote work, job change, and what their ideal workplace should offer. Read + BCG.

7. Empowering independent hoteliers in Europe

Point Nine is a European seed-stage venture capital firm focused on B2B SaaS and marketplaces. In this post, Point Nine partner Louis Coppey explains the investment thesis that led them to invest in the recent €6.5 million seed round in the Barcelona-based Amenitiz

8. “No, but we’re working on it”

Pretty funny ad on hotel direct booking and customer experience. Video.

9. Fundraising

London-based experience commerce platform Easol raised $25 million in Series A funding. The round was led by Tiger Global, with Notion Capital, Foundation Capital, Y Combinator and FMZ Ventures also investing.

UK motorhome peer-to-peer rental platform Goboony raised €6 million in a funding round led by Amsterdam-based VC firm No Such Ventures.

Mexico-based GuruHotel closed a $2.1 seed round led by Anthemis Group. The Y Combinator startup is on a mission to become the Shopify of hotels, allowing them to onboard themselves, get a website, and start taking bookings within 1 hour.

10. Deals

Trip.com Group will partner with Hopper for use of its Hopper Cloud fintech products for bookings in North America and Europe beginning in early 2022. In October, India-based OTA MakeMyTrip (which is nearly half-owned by Trip.com) announced a similar partnership. Additional customers for Hopper Cloud include Kayak, Amadeus and Capital One.

Mexican smart lodging startup Casai made its second acquisition in Brazil in the space of five months with the purchase of Florianópolis-based rental startup Roomin.

Travel Tech Essentialist job board (Special Promo!)

As a token of end-of-year appreciation, use promo code FREEPOST to post your jobs for free on the Travel Tech Essentialist job board. Promo valid for all Standard Tier jobs posted from now until the end of the year (they will be visible for 30 days on the job board).

Here are just a few of the amazing jobs seen on the board.

Travala: Chief Product Officer (Toronto, Montreal, Remote)

Selfbook: Head of Product (Remote)

Caravelo: Senior Product Manager (Barcelona)

Wheel The World: CTO (Remote)

Booking Holdings: Director of Business Strategy (Dublin)

Browse more open roles (or add your own open roles) at Travel Tech Essentialist Job Board

One more thing

I recently started a newsletter in Spanish called Blockeando, which explores the present and potential future of Blockchain and Web3 from the perspective of its main protagonists. If you’re interested in signing up, nos vemos allí!

If you're getting value from the newsletter, you can help a whole lot by forwarding it to an entrepreneur, investor, or corporate innovator :-)

If this newsletter was forwarded to you, click the button below and subscribe to the free newsletter.

Have a great holiday season,

Mauricio