Venture Capital in Travel Tech

Tens of billions of dollars are flowing to travel startups from Venture Capital, CVC and travel players. Let’s find out who, what, when, where and why.

Travel startups are on the rise. There is a growing number of startups encompassing a wider range of travel subcategories and attracting a greater share of venture capital investments. These are some of the reasons that explain this trend:

A greater challenge. We are moving from the transaction era, where OTAs ruled, to an era where the traveller is demanding a seamless experience in the various phases of the travel journey: planning, booking, during the trip and post-trip. This is a tremendous challenge and entrepreneurs are focusing on the opportunities to add value throughout the chain.

An expanding market. Travel’s sphere of influence has expanded well beyond its traditional borders. Transportation is migrating towards integrating various modes of transportation, which is why subsectors such as ride-hailing or micromolity can be associated to the overall travel experience. Now we can see travel-related startups in real estate, social networking, media, robotics, security, connectivity, mobility, logistics, etc…

A greater interest by corporates. Suppliers and travel operators have realized that business as usual will no longer cut it. They are investing heavily in innovation to compete more effectively against new entrants, increase direct bookings, provide more unique experiences and increase revenues. This means that some of the world’s largest travel brands are now not only actively working with B2B and B2C startups, but actively investing in them as well.

Rise of the Rest. Investors and entrepreneurs are no longer concentrated in Silicon Valley, nor in the United States as a whole. New tech hubs are enabling entrepreneurs to launch companies all over the world, closer to wherever business opportunities exists.

Unicorns. A significant number of travel startups have joined the unicorn ranks in the last couple of years. A certain level of success (if measured by valuation) breeds additional interest in the space from both entrepreneurs and investors.

Megarounds. Funding rounds are getting larger as VC firms successfully raise larger funds from investors wanting to benefit from the possibility of finding the next unicorn, and as travel startups expand their scope into neighboring sectors and new markets.

In this post, I will explore the Venture Capital activity in the travel startup ecosystem (section 1) and then I’ll analyze some findings from a subset of 62 VC fundings in travel startups in 2019 and 2020 (section 2).

__________________________________________________

Sign up to Travel Tech Essentialist, my brief newsletter sent every two weeks with my pick of the top 10 news on the online travel ecosystem.

__________________________________________________

1. Evolution of investments

Venture Capital investment in Travel & Mobility has skyrocketed. In the 6 years from 2013 to 2019 venture capital funding has multiplied by 22, from $1.4 billion to $30.3 billion, according to data from the Lufthansa Innovation Lab.

Data from Lufthansa Innovation Lab, Pitchbook, Crunchbase as presented at DLD Conference

VC money to travel startups is increasing, and so is the share that Travel & Mobility Tech represents in overall VC funding. In the 5 years from 2013 to 2018, Travel & Mobility’s share of total VC funding has gone from 2% to 18%.

Data from Lufthansa Innovation Lab, Pitchbook, Crunchbase as presented at DLD Conference

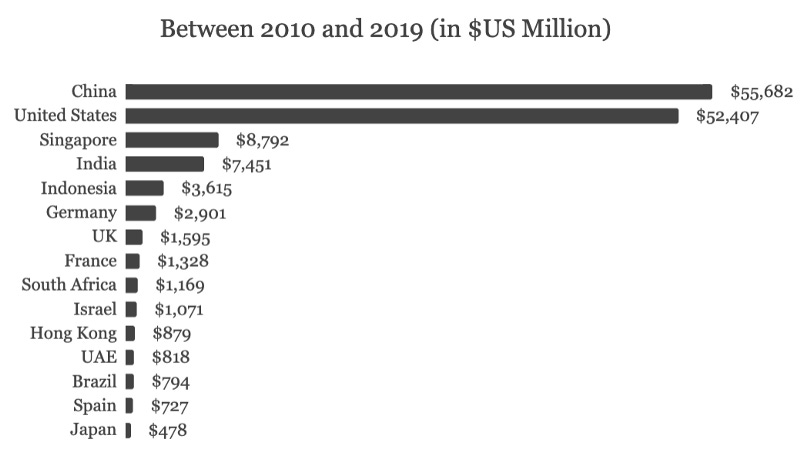

VC Investments by geography

US travel startups received 68% of the aggregated VC funding in travel & mobility in the 2010–2014 period, followed by Asia with 20% and Europe with 9%. In the period between 2010 to 2019, we see a very different story. Asian travel & mobility startups took 56% of VC funding (vs 20% in 2010–2014), US 38% (vs 68% in 2010–2014) and Europe 5% (vs 9%). The decade ended with China as the largest destination of VC funding to Travel and Mobility startups. This is according to data from the Lufthansa Innovation Lab, and I am just looking at the universe of the top 15 countries receiving the most VC investments.

Data from Lufthansa Innovation Lab, Pitchbook, Crunchbase. Taken from LIH infographic

The Growth of Travel Unicorns

The last two years have seen a large number of new travel unicorns (valuation > $1 billion). 13 of the 34 travel and mobility unicorns that exist today reached unicorn status in 2019, and 23 reached it in 2018 and 2019.

A geographical breakdown of the number of unicorns, their % share of the unicorn’s total combined valuation and the average valuation per unicorn shows interesting regional differences. China’s average unicorn valuation is $10 bn, while Europe’s is $1.8 bn, although both have a median value of $1.5 bn:

Source: Travelandmobility.tech and CB Insights Note: I am excluding autonomous vehicle unicorns.

Here is the full list of travel and mobility unicorns:

Some of the data coming from Travelandmobility.tech and CB Insights, in addition to my own research. Note: I am excluding autonomous vehicle unicorns.

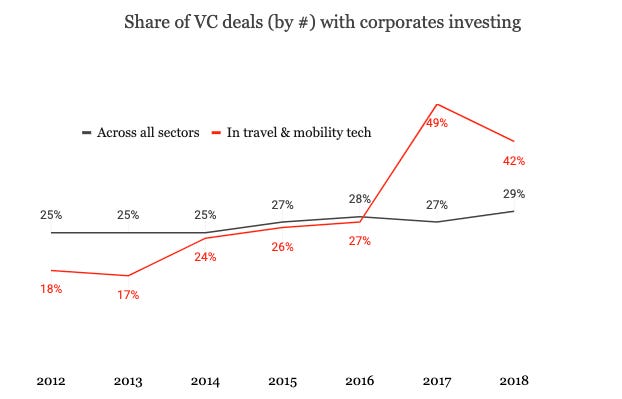

Corporate Venture Capital and travel players are increasingly participating in travel startup financing rounds

Startups can be a source of acquired innovation for large companies. Incumbent companies in the travel space have realized the value that startups can bring to their businesses, both in terms of potential commercial and investment opportunities.

Corporate Venture Capital (CVC) activity has boomed as a result. Lufthansa Innovation Hub produced an analysis showing that almost half of travel & mobility investment rounds had at least one CVC in 2017, and 42% in 2018. On those two years, CVCs have had a greater share of participation in travel & mobility investment rounds than across the rest of sectors.

Data from The State of Travel & Mobility Tech, elaborated by Lufthansa Innovation Hub using sources: Lufthansa Innovation Hub / travelandmobility.tech, PitchBook, Crunchbase, Press Research (Note: this analysis includes autonomous vehicles)

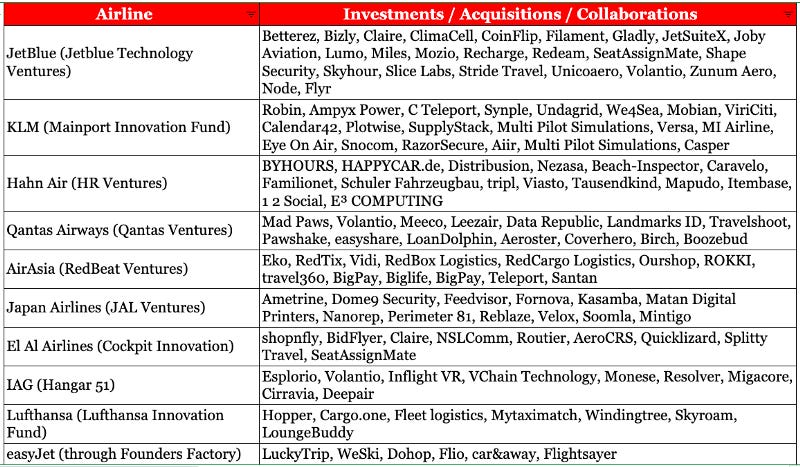

Airlines are actively investing in startups and many of them have launched innovation platforms through which they work closely with the travel startup ecosystem. The top 5 most active airlines (and their investment vehicle) are JetBlue’s JetBlue Technology Ventures with investments in 23 startups, KLM’s Mainport Innovation Fund (19 startups), Hahn Air’s HR Ventures (15), Air Asia’s RedBeat Ventures (13) and Japan Airlines’ JAL Ventures (12).

Note: Qantas dropped its venture activity at the end of 2018

Hotels, GDSs, OTAs, and others are also accessing innovation and growth through startup investments. Some of the most active have been AccorHotels (18 startups), Booking Holdings (15), Amadeus’s Amadeus Ventures (14), Expedia Group (13) and Boeing’s HorizonX Ventures (13). Airbnb also shows a startup investing appetite with 9 startups mostly in the hospitality and local activities space.

I am certain that the list of startups and corporates mentioned in the previous two tables is incomplete so please let me know of any missing startups so that I incorporate them.

2. Analysis of 62 VC funding rounds in travel startups

Since I started sending my Travel Tech Essentialist newsletter, I’ve gathered a list of 62 travel startup funding rounds from January 2019 to February 2020, for a total raised of $6.8 billion, equivalent to close to 25% of the VC funding in the travel & mobility sector in 2019. I have only tracked rounds of at least $1 million. This list is by no means exhaustive but it does represent a sizeable share of VC investments in travel tech startups, so hopefully the conclusions can be directionally relevant.

VC funding in travel startups by stage

This table shows high median values for each stage for this sample of 62 VC fundings. These are some of the megarounds behind: seed round of $14 million for Paris-based app Leavy.co (helps millennials pay to travel) was a record for travel tech seed rounds; early venture round of $9.8 million for Refundit, an israeli startup that automates VAT refunds for travelers and retailers; Series A round of $300 million for Chengjia (short-term rentals of apartments); Series A round of $42 million for Beyond Pricing (dynamic pricing tool for vacation rentals); Series C of $590 million for Joby Aviation (electric air taxi); Series C of $319 for Vacasa (vacation rental).

Analysis of 62 VC rounds in travel startups in 2019 and 2020 reported in Travel Tech Essentialist newsletter *Note: does not add up to 62 because I have excluded 1 PE round and 4 rounds with unspecified stages

VC funding by startup country and city of origin

40% of the VC financing rounds in this sample go to travel startups in the United States. Europe is also well represented, with 23 startups (37% of the total), led by Spain (8 startups), Germany (6) and France (4). There are vast differences in the median values (although not statistically significant given the insufficient data points). On the lower end we see median rounds of $3.4 million rounds in Spain, $10 million in Israel and $11 million in France, and on the higher end we have $250 million in China, $65 million in “other countries”, $49 million in Germany and $48 million in the USA. Countries with significant megarounds include Germany with FlixMobility ($500 million) and GetYourGuide ($484 million), and China with Chengija ($300 million) and Mafengwo ($250 million).

Analysis of 62 VC rounds in travel startups in 2019 and 2020 reported in Travel Tech Essentialist newsletter

Zooming in to a city level, San Francisco (including Silicon Valley) leads the chart with 11 startups, but five of the top eight cities with the largest number of financing rounds are European cities: Paris, Barcelona, Berlin, London, and Madrid. Same as with the country table and with the same caveats, the cities show different dynamics in terms of median size of funding round. At $3.3 million, Madrid has the lowest median round and New York the highest with $85 million.

Analysis of 62 VC rounds in travel startups in 2019 and 2020 reported in Travel Tech Essentialist newsletter

VC funding in travel startups by sector

We’ve all seen the explosion in investments and startup creation around the accommodations space and in tours & activities. Something less discussed is the growth of startups around transportation. The 62 travel startup funding rounds shows that, indeed, the accommodations category is the largest one, with more than 50% of the VC rounds in the travel space. Transportation startups however, have already surpassed tours & activities ones in terms of investment received. We are seeing an increasing diversity in transportation options that result from looking at the transportation challenge with a “getting the job done” lens. Travellers want to get from A to B, not necessarily from the airport closer to A to the airport closer to B. This is why businesses based on interlining and multimodal transportation are emerging as big opportunities. We also see that corporate travel has become an important target of VC investment.

Analysis of 62 VC rounds in travel startups in 2019 and 2020 reported in Travel Tech Essentialist newsletter

VC funding in travel startups by VC or corporate investor

As travel startups tackle greater markets and problems, we begin to see VCs that specialize in the travel and hospitality space. A few examples: Mairdumont Ventures, a German VC that only invests in travel, with 12 investments so far; Convivialité Ventures, Pernod Ricard’s venture arm, investing in services and experiences within the “conviviality” space, including hospitality and entertainment; Thayer Ventures, based in San Francisco and investing in only travel startups, with 26 investments so far.

Let’s now look at the VCs and corporates with multiple investments within our 62 VC funding round subset:

Invested in 5 startups

- Airbnb (San Francisco): OYO, Lyric, Zeus Living, Tiqets, Atlas Obscura

Invested in 4 startups

- SoftBank (Tokyo) : OYO, FlixMobility, Klook, Domio

Invested in 3 startups

- JetBlue Technology Ventures (Silicon Valley): Joby, Flyr, Stride

- Prime Ventures (Amsterdam): Blueground, Holidu, Leavy.co

- Thayer Ventures (San Francisco): Life House, Beekeeper, Meus

- K Fund (Madrid): Exoticca, Bob, BeOnPrice

- Sequoia Capital (Silicon Valley): OYO, Klook, Tourlane

Invested in 2 startups

3L Capital, Amadeus Capital Partners, Andreessen Horowitz, August Capital, Benchmark, Booking Holdings, Comcast Ventures, Convivialité Ventures, DST Global, GGV Capital, Greenoaks Capital, Harbert Growth Partners, Highland Capital Partners, Holtzbrinck Ventures, Lightspeed Venture Partners, Index, Mairdumont Ventures, NFX, Qiming Venture Partners, RXR Realty, Spark Capital, Swisscanto.

I hope that this analysis is useful for you. Please feel free to share your thoughts, feedback, suggestions or corrections.