The State of Online Travel Agencies — 2021

Full year 2020 results for 10 publicly traded online travel companies: Booking, Expedia, Airbnb, Trip.com, eDreams Odigeo, Despegar, Lastminute, MakeMyTrip, TripAdvisor, Trivago

NOTE: I have already published The State of Online Travel Agencies - 2022

In the first quarter of 2020, some of the largest and most powerful travel companies in the world saw their valuations fall by 60% or more in a matter of days.

Online travel agencies (OTAs) and the travel sector in general suffered the consequences from the pandemic more than other categories. OTAs and metasearch revenues dropped by more than half in 2020 and they are not expected to regain their former size for some time. Yet, their valuations suggest otherwise. The 10 publicly traded travel companies included in this analysis have, on average, a market cap 16% higher today than pre-COVID. Expedia and Tripavisor are now worth 58% and 52% more than in January 2020, in spite of seeing their revenues decline by roughly 60%, their EBITDA drop by more than 85% in 2020, and travel restrictions still being the norm. I wonder if, in the absence of a pandemic that devastated the travel sector, share prices would be as high as they are today. That is a somewhat strange question to consider.

Compared to March 2020, these 10 companies have seen their share prices go up by 133% on average (lowest is Trip.com with +62% and highest is Expedia with +252%). That’s higher than the increase in the S&P 500 and Euro Stoxx 50 indices in that same time period.

Subscribe to the Travel Tech Essentialist newsletter to receive every two weeks an email with the top 10 trends in the travel technology sector.

1. 2020 results

In summary, all companies saw their revenues and EBITDA crater and their marketing and costs in general slashed. It is somewhat tricky to go too deep into analyzing results for a year in which the only driver was Covid and external factors dominated corporate results like never before. I will not do too much analyzing. I will simply show these companies’ revenues, EBITDA and marketing (the largest cost line for an OTA) and the evolution for the past few years in an attempt to see some underlying trends. And hopefully in next year’s post we can get back to talking about growth and recovery.

1.1. Revenues

No surprise that revenue decreased for the 10 companies in 2020. Year on year revenue decreases ranged from -30% (Airbnb) to -75% (Despegar). If we zoom out and compare 2020 revenues to 2016, we also see sharp decreases except Trip.com which is flat. (No data available for Airbnb in 2016). It is noticeable that companies more exposed to Europe and Latin America were relatively more impacted than companies with a bigger exposure to larger domestic markets such as the US and China. Also, those OTAs that are more flights-reliant fared relatively worse than those that are more accommodations focused (Airbnb, Expedia, Booking).

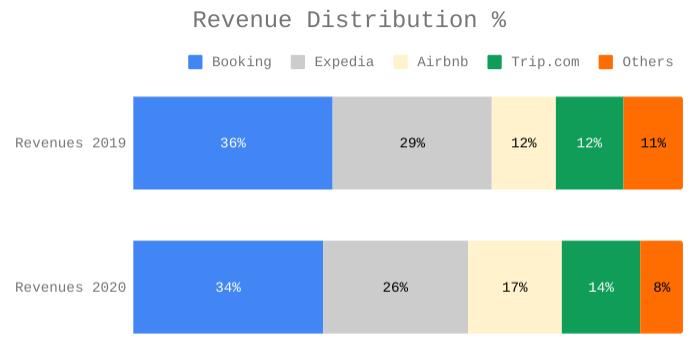

Booking and Expedia’s share of total revenues of the 10 online travel companies in this report went down from 65% in 2019 to 60% in 2020. Airbnb increased its share from 12% to 17% and Trip.com also increased from 12% to 14%. The remaining 5 competitors (Tripadvisor, Trivago, eDreams Odigeo, MakeMyTrip, Despegar and Lastminute) saw their overall share of revenues decrease from 11% in 2019 to 8% in 2020.

When we look at the universe of the “Other” 7 players, Tripadvisor went up 5 percentage points of revenue market share in 2020, while Trivago, Despegar and Lastminute lost 3, 3 and 1 percentage points respectively.

If we just look at the 8 OTAs in this analysis, the 4 largest (Booking, Expedia, Airbnb and Trip.com) concentrated 97% of total revenue in 2020. Only Airbnb and Ctrip gained revenue market share among the 8 OTAs, most notably Airbnb, which went from representing 12% of the combined revenue in 2019 to 18% in 2020.

1.2. Marketing

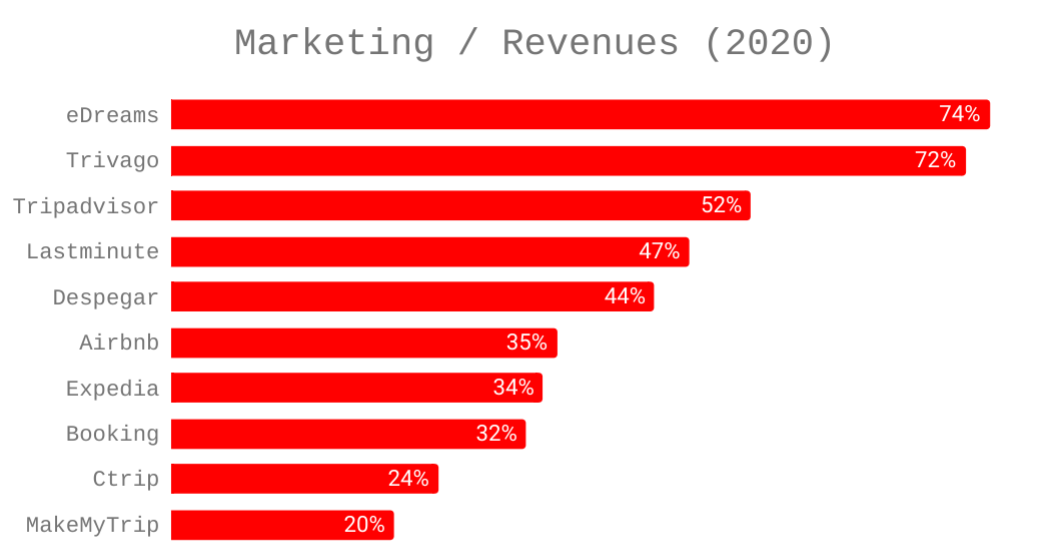

Ranging from -28% for Airbnb to -79% for MakeMyTrip, every single company lowered their marketing costs in 2020 vs 2019 to adjust for the sharp decline in travel activity. These ten companies combined for around $6.6 billion in marketing costs in 2020, down from more than $15 billion in 2019.

The marketing over revenues ratio can point to the relative efficiency of marketing spend. The higher the ratio, the more marketing pressure the company requires to drive sales, although we also need to take into account the nature of the product. Travel companies slashed all non-essential marketing investments in 2020. The largest 3 OTAs (Booking, Expedia and Trip.com) and MakeMyTrip saw reductions in their marketing/revenues ratio. Airbnb was unchanged and the rest of the companies had increases in this ratio.

At 74%, eDreams Odigeo had the highest marketing/revenues ratio. This is somewhat surprising as we would expect that their much touted Prime subscription program launched in 2017 should be showing some impact by now in their traditionally high marketing / revenues ratio.

1.3. EBITDA

Naturally, the bottom line for all travel companies suffered in 2020. Four of the 10 companies managed to have positive EBITDA in 2020: Booking.com, Tripadvisor, Trip.com and eDreams. With $880 million in 2020 (down from $5855 million in 2019), Booking.com had the largest EBITDA by a wide margin. The six remaining companies (Lastminute, Trivago, Despegar, Airbnb, Expedia, MakeMyTrip) had negative EBITDA in 2020. In the time period of this analysis, it was the first time that Lastminute, Despegar and Expedia had a negative EBITDA. It is worth highlighting that MakeMyTrip has not had a single year of positive EBITDA contribution in the entire time period of this analysis (since 2013). On the other hand, Booking.com, Tripadvisor and eDreams have managed to not have a single year of negative EBITDA.

EBITDA margin (EBITDA/Revenues) is an assessment of operating profitability. The impact of the pandemic from 2019 to 2020 is very clear on this chart. The only company with a double digit ratio this year was Booking. MakeMyTrip continues to dominate the low end of this graph year after year.

2. Company Quick Notes

As mentioned earlier, 2020 is a bad year to try to analyze corporate trends and results. When the macro environment takes all the oxygen in the room, zooming into the micro aspects could be irrelevant. So, the following quick notes on individual companies are simple observations, some of them referring to pre-2020, and breakdown of revenue sources.

2.1. Expedia Group

The revenue distribution by product remained similar in 2020 compared to 2019. If we look at the distribution by segment, we see the B2B business (which includes Egencia), more heavily affected than its retail one and making up 18% of Expedia total revenue in 2020 (down from 21% in 2019). In May 2021, Expedia announced that it will sell its corporate business arm Egencia to American Express Global Business Travel.

During the pandemic, the accommodations sector fared better than flights and the US better than countries with smaller domestic markets. This is reflected in Expedia’s results, as their US revenues went from 57% of total revenues to 68% in 2020. Likewise, Lodging went from 69% of total revenues in 2019 to 78% in 2020.

2.2. Booking Holdings

Room nights and rental car days dropped by a similar rate in 2020. Airlines tickets did relatively better, but this product still does not represent a meaningful business for Booking. The share that Booking.com’s merchant model (where Booking receives payments from travelers) represents of total revenues has been growing consistently. Merchant revenues were almost 1/3 of total revenues in 2020.

2.3. Trip.com Group

Transportation revenues used to be Trip.com’s largest revenue line, but accommodations revenues have now caught up with a 39% share of total revenues in 2020. “Other” revenue primarily consist of online advertising services and consumer financing services, and it now accounts for 10% of total revenues.

The growth that the International share of revenues was experiencing in prior years was halted in 2020 as a result of the pandemic.

2.4. Lastminute Group

Lastminute’s revenue share changed considerably in 2020, with ancillaries becoming the top revenue source in 2020. Ancillary revenues include insurance, additional luggage or parking fees. The share of sales of travel services was reduces by 20 percentage points from 2019 to 2020. With 46% of total revenues, flight revenues regained a dominant share of revenues in 2020, with Dynamic packages and Tour Operator revenues being the lines that lost the most share.

2.5. TripAdvisor

TripAdvisor’s Experiences and Dining segment continues to gain in share of total revenues.

In the fall of 2020, TripAdvisor announced its new subscription program TripAdvisor Plus, which is still in beta. Customers pay a membership fee of $99 / year with the benefit of accessing deals and perks from the hotels that are part of the program. The company believes its new subscription product could become a new business line generating more than $1 billion a year.

So far in 2021, progress in the United States single-handedly drove sequential revenue improvements in Tripadvisor’s business in February, March and April. However, persistent lockdowns across Europe and challenges throughout international markets remain significant drags on the company’s results.

2.6. eDreams Odigeo

eDreams has stated repeatedly for the last 6 years its objective to expand the weight of non-flights revenues. Up to 2018, the company reported its non-flights revenues, and results did not seem to show much success on this front (non-flights revenues went from 20.1% in 2015 to 20.3% in 2018). In the last 2 fiscal years, the company has not provided its flights vs non-flights revenue breakdown.

eDreams Odigeo does provide a breakdown of revenues that shows an increase in what they call “diversification revenues”, which includes flight ancillaries (reserved seats, additional check-in luggage…), flight insurance, as well as certain commissions and incentives directly received from airlines. As such, these “diversified revenues” continue to depend on the company’s ability to drive flight bookings. And also, these type of revenues follow a general market dynamic in flight pricing towards debundling that is not particular of eDreams. To understand whether eDreams Odigeo is indeed succeeding in its objective to expand its revenue beyond flight-dependent products, hopefully the company will start showing what their non-flight business (hotels, vacation packages) looks like. The only non-flight business that eDreams gives details on is advertising and meta, whose share of overall revenues has gone down over the years to the current 4%.

eDreams has succeeded in growing its Prime membership program. In Dec 2020, the program reached 758.000 subscribers, an increase of 268.000 subscribers from Dec 2019. This large base of subscribers should eventually result in a combination of the following three outcomes: increase the rate of repeat purchases, lower marketing costs, and improve EBITDA margin. However, 4 years into the launch of eDreams Prime, we have yet to see any noticeable impact in any of those three categories. But in any case, their success in growing the program a very positive signal and a step in the right direction to reduce its strong dependency on performance marketing.

2.7 Airbnb

The newcomer in this group is also the one with the smallest year on year revenue drop. At the depth of the pandemic, Airbnb forecasted that 2020 revenue could be less than half of what it was in 2019. In the end, total revenue decreased only by 30% compared with 2019, which was the smallest decrease of all 10 companies in this analysis.

In response to COVID-19, Airbnb decided to fully focus on its core business. As a result, it paused its incipient transportation business and scaled back its efforts to list traditional hotels on the platform. It also suspended performance marketing altogether. Brian Chesky stated that in Q4, more than 90% of Airbnb’s traffic was direct or unpaid. He is confident that this will continue in the future: “What the pandemic showed is we can take marketing down to zero and still have 95% of the same traffic as the year before. So we’re not going to forget that lesson."

It remains to be seen if Airbnb is able to continue its lesser reliance on paid marketing and if it translates into profitability in the near future. As I wrote in Airbnb vs Booking Holdings, when it’s time again to push on all cylinders, it remains to be seen if direct and organic traffic is enough to drive the company’s growth expectations.

2.8. Trivago

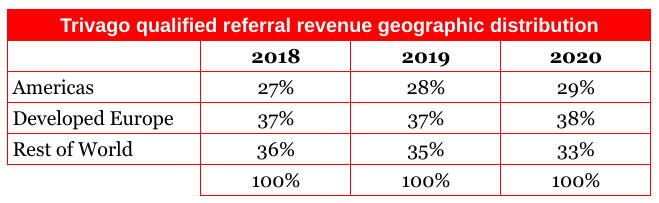

Trivago’s revenue decreased by 67% in 2020. The decrease in revenues came as a result of a 54% drop in Qualified Referrals (1 QR = Trivago visitor clicking on an OTA or supplier direct product offer) coupled with a 37% decrease in Revenue per Qualified Referral (metric that measures how effective Trivago is in monetizing the leads sent to advertisers).

Trivago continues to generate the majority of its revenues from the largest two OTA groups: Booking Holdings and Expedia Group (majority shareholder of Trivago). Expedia Group’s share decreased significantly relative to Booking’s which was responsible to almost half of Trivago’s 2020 revenue.

2.9. Despegar

Despegar suffered the sharpest percentage revenue and EBITDA drop of the 10 companies in this analysis.

In 2020, Despegar announced the acquisition of Best Day, an OTA with presence in Mexico, Argentina, USA, Colombia, Brazil and Chile. Best Day derives 1/3 of its revenues from B2B white label partnerships with airlines, hotels, retail stores and banks. Best Day contributed with 20% of Despegar’s 4Q20 Gross Bookings.

Mobile transactions accounted for 50% of total transactions in Q4 2020 (30% in 2017, 36% in 2018, and 41% in 2019).

2.10 MakeMyTrip

MakeMyTrip had the largest percentage decrease in EBITDA in 2020 and the lowest marketing / revenue ratio. It is the only company in this analysis that has posted negative EBITDA every year since 2013.

Looking at Q2–Q4 2020, Air Ticketing overtook Hotels and Packages as the largest product line, with 39% of total revenues. MakeMyTrip’s hotels and packages share of total revenues has gone down year after year, from 67% in the Q2-Q4 2017 period down to 36% in 2020.

Subscribe to the Travel Tech Essentialist newsletter to receive every two weeks an email with the top 10 trends in the travel technology sector.

I really believe Airbnb's low drop compared to the other OTA's is based on the fact that their products are homes, apartments, self-catered accommodation, and not hotel rooms. Once people start feeling more and more confident with sharing spaces this might change... do you think this has to do with it?

Awesome content as always!

Do you have any hypothesis for the market cap increase in despite of the drop in revenues and the whole covid scenario?