I’ve never been more excited about anything at Salesforce, maybe in my career - Marc Benioff (referring to Salesforce's AI tools)

Forget virtual reality, the next big thing is actual reality - Greg Isenberg

As AI reshapes how travel is planned, booked and sold, there's also a renewed focus on authentic, in-person connections. The beauty of the travel industry lies in that both trends offer powerful tailwinds for growth.

Thanks to Equeco for sponsoring this edition of the newsletter:

Equeco is the fastest-growing full-service performance marketing solution for the travel industry, leveraged by leading brands from Blablacar to Marriott. Hotels, OTAs, tour and activity providers, and airlines trust Equeco to manage and grow their PPC campaigns, from bidding to audience targeting and ads. Equeco uses a blend of human expertise and automation to fuel complex travel ad campaigns at scale. Claim your free diagnostic today.

0. The most clicked link in the previous newsletter

The most clicked link in Travel Tech Essentialist #157 was Jose Luis Vilar’s adaptation of MrBeast’s playbook to the airline industry: MrBeast’s Airlines Manual.

1. Opportunities ahead as AI shifts from fast to smart

This article by Sequoia highlights how generative AI is evolving from "fast thinking" (pre-trained responses) to "deep reasoning" (inference-time compute). This shift allows AI to "stop and think," creating smarter applications that reason in real time.

Models like OpenAI's GPT-4 and Google's Bard deliver rapid, pre-trained responses, which are ideal for routine tasks that require speed, like answering questions or generating content.

Slower, reasoned responses from models like OpenAI’s o1 (Strawberry) take time to compute. They simulate possibilities before deciding, making them ideal for complex problems like strategic planning or dynamic travel itineraries.

With AI reasoning capabilities expanding, a new wave of agentic applications is set to disrupt industries. The big question is: who will build the first $1 billion AI-powered travel app that combines fast thinking for routine tasks and deep reasoning for complex decisions?

2. Salesforce is looking to revolutionize AI in travel (and beyond)

Marc Benioff (founder/CEO of Salesforce), says he’s never been more excited in his career, referring to the potential of Agentforce, Salesforce’s new AI platform. He believes it will drive a transformation as significant as the cloud, mobile, and social revolutions.

At Dreamforce 2024, 10,000 customers tested Agentforce, and Benioff predicts over a billion AI agents will run on it within 12 months. He sees this new AI as a game-changer across industries like travel, healthcare, media and financial services by automating complex tasks and improving customer experience, productivity, and revenues. Benioff contrasts this with Microsoft's approach, stating Agentforce is what AI was meant to be. He criticized Microsoft's AI product Copilot, comparing it to Clippy, the virtual assistant from Microsoft Office in the 1990s, known for being unhelpful and intrusive. Read +.

This agent revolution is real and as exciting as the cloud revolution, the social revolution, and the mobile revolution were. It will provide a level of transformation that we’ve never seen. We are in a truly incredible moment. — Marc Benioff

3. Silicon Valley veterans discuss Expedia’s fit within Uber

Last week’s All-In podcast episode discussed Uber’s possible acquisition of Expedia (episode). Chamath Palihapitiya immediately dismissed the idea as "stupid," arguing that paying $30 billion for a UI layer on top of licensed publicly available travel data would be dangerous in an era where AI could disrupt traditional OTA models, pointed to Perplexity's new direct booking features as evidence of this threat.

David Friedberg outlined the bullish case, which focused on financial synergies. With Expedia spending $8 billion annually on marketing and Uber's 150 million monthly active users, the deal could potentially double Expedia's EBITDA to $6 billion by lowering marketing by around 30% ( cross-selling to Uber’s users) and through cost cuts. The enterprise value of around $22 billion (after accounting for Expedia's cash) could make it an attractive four-times EBITDA multiple.

David Sacks offered a product-focused critique, arguing that MBA-style thinking about cross-selling ignores user behavior. He pointed out that Uber's success comes from immediate gratification (you want a ride now, food now) rather than the longer-term nature of vacation planning.

Jason Calacanis noted that Uber CEO Dara Khosrowshahi's history as Expedia's former CEO and current board member adds an interesting dimension, as few people know Expedia like he does. He highlighted VRBO's potential under Uber and Uber's success with adjacent services like Uber Eats.

They pointed to three possible futures: the rise of super apps that do everything, the continued dominance of specialized apps, or AI agents becoming the new intermediaries for travel booking, making traditional OTA interfaces less valuable.

4. Growth but lower value

Similar to Chamath's concerns about AI disruption, Peter Syme argues that OTAs will continue growing, but their value will decline as AI agents transform how people book travel. In the future, users will rely on AI to handle bookings, bypassing OTAs' interfaces altogether. This shift will reduce the importance of OTAs' user experience and web real estate, as AI will prioritize data, making OTAs just another layer in the process. Additionally, hotels, airlines, and other suppliers will increasingly bypass OTAs by going direct-to-customer through AI agents. As a result, OTAs will need to shift from aggressive growth to defensive strategies to adapt to this AI-driven world or risk losing relevance. Read +.

Many fewer people are going to be visiting your websites. Many more bots are going to be visiting your websites. — Peter Syme

5. What about Amazon + Expedia?

Alex Bainbridge (founder/CEO of Autoura) also wrote about AI's growing role in the travel industry in his analysis of Uber + Expedia. Traditionally, Uber and Expedia have succeeded through high-frequency transactions (Uber much more so, though), but the rise of AI agents and autonomous vehicles is changing the landscape. AI agents could bypass OTAs like Expedia by booking directly with hotels, while Uber has shifted from a service provider to a retailer for autonomous vehicle platforms. Bainbridge argues that Expedia must innovate around AI to stay competitive, which weakens its position as a likely target for Uber. Instead, he sees Amazon as a more suitable buyer. Amazon could leverage its AI technologies, like Alexa and Zoox robotaxis, to create an integrated travel experience, making Expedia a valuable addition to its ecosystem. Read more.

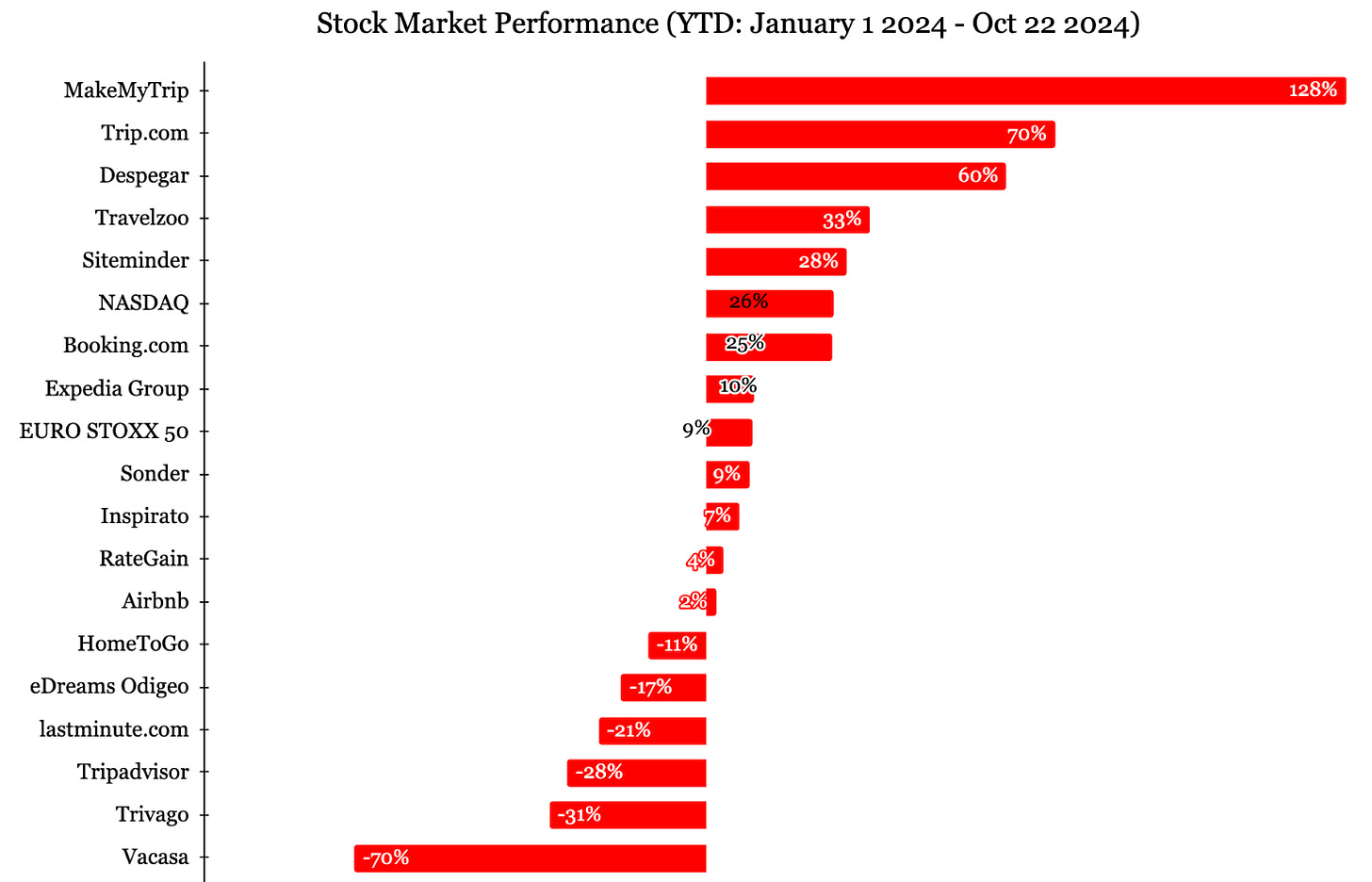

6. Publicly traded travel stock market and market cap growth

7. Terrell Jones on why startups fail

In his recent posts, Terrell Jones (founder of Travelocity and founding Chairman of Kayak.com) shares vital startup advice, focusing on the top reasons startups fail. Here are his first three:

No market need. Jones highlights that 47% of startups fail due to a lack of demand. Entrepreneurs often build products based on personal problems without market validation. Prototyping, testing, and proving demand before committing and launching is essential.

Running out of money. Financial mismanagement is another common reason for failure. He advises frugality and the need to pivot quickly if a product isn't gaining traction.

Wrong team. He emphasizes the critical role of having the right team. Founders should hire based on skills and passion, not friendships, and focus on building a core team of "A" players.

8. Corporate retreats fuel hotel revenue growth

In a past newsletter, I wrote about how in-person events are making a comeback. This WSJ article on corporate group travel confirms this trend. Companies are prioritizing in-person meetings to foster team cohesion and business connections. Hotel revenue from group bookings (bookings of 10+ rooms at prenegotiated rates) was up 6.8% for the first eight months of this year compared with the same period in 2023, outpacing inflation and revenue from smaller groups and individual travelers, which was up less than 1%.

Fortune 500 companies are driving this surge, booking conferences and retreats to strengthen face-to-face interactions. Hotels like Omni and Ryman are benefiting from this and from a slowdown in new development of larger hotels, as rising interest rates have made it difficult to finance large projects in recent years. Though occupancy hasn’t fully returned to pre-pandemic levels, strong demand is forecasted through 2027.

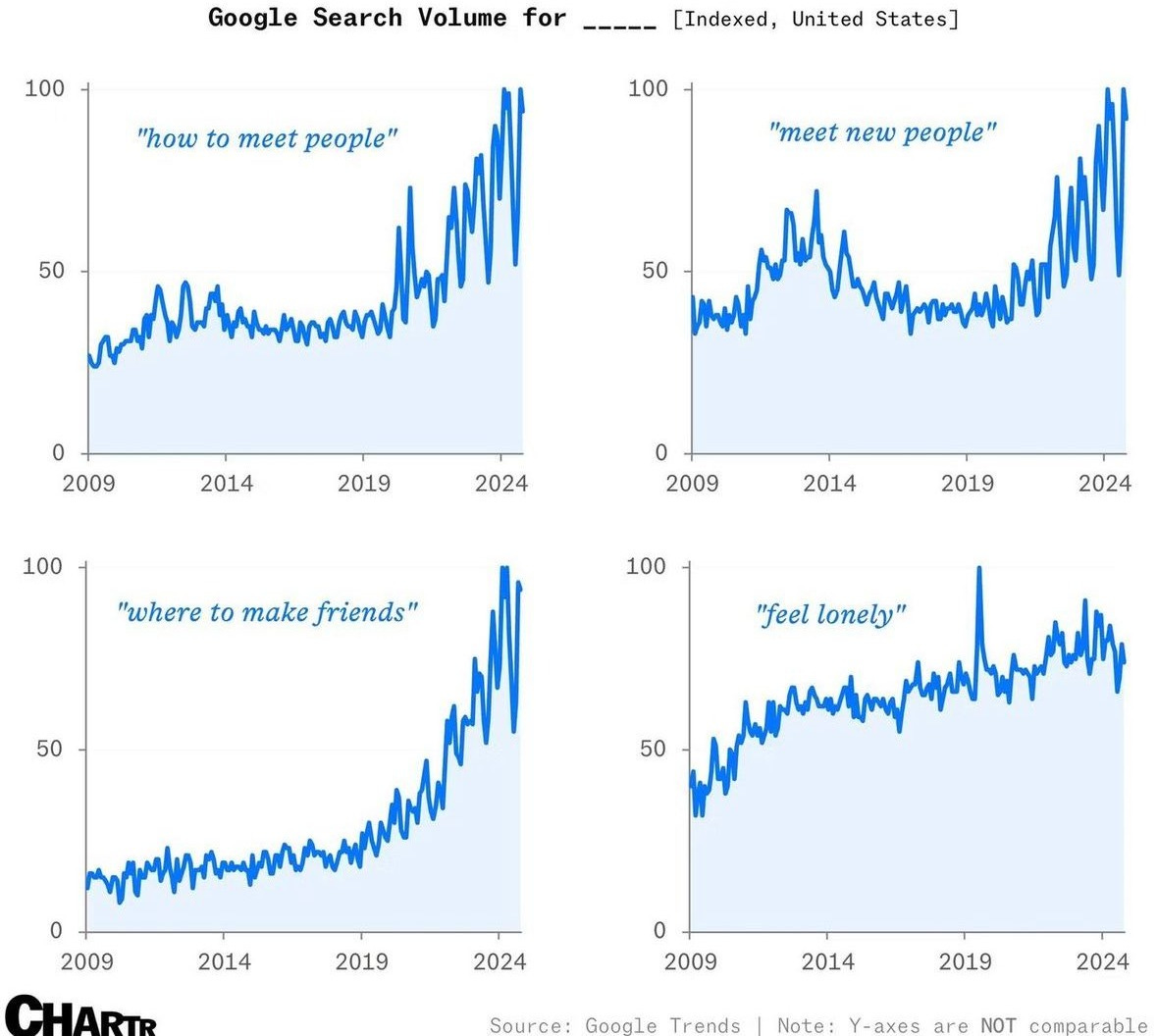

9. People are searching for friends

Greg Isenberg notes that searches for ways to meet people and make friends are rising, indicating renewed interest in in-person socializing. There is some irony in people turning to technology to relearn basic social skills. Maybe the next big app will teach us how to chat at parties, with reminders to "blink and nod."

10. What not to do when pitching to investors

Uri Levine, founder of Waze and other startups, shares his insights on what not to do when pitching to investors, drawing on his personal experience and data from Marc Andreessen and other VCs. Relevant advice given the fierce competition for funding (only 1% of startups succeed in raising funds. These are the 7 common mistakes to avoid, according to Uri:

Avoid generic emails. Personalize your outreach to investors

Don’t rely on AI-generated impersonal emails

Show genuine interest by tailoring your pitch to the specific investor

Be brief. Skip coffee invitations and focus on key points in 2-3 paragraphs

Provide key information early. Include presentations or videos upfront

Ensure your pitch is simple, clear and concise

Respect a ‘No’. Only follow up if something materially changes

PS.

I have 5 free tickets for the FutureTravel Summit that will take place on November 28th in Barcelona. The event will include an exciting pitch competition with travel startups and industry speakers. If you’re interested in a ticket, please reply to this newsletter and let me know. The tickets will go to the first 5 replies.

2025 Travel Tech Essentialist Newsletter Sponsorship Opportunities

I’m opening up newsletter sponsorship opportunities for 2025. If you want to reach a focused audience of travel tech professionals, please complete this form. These spots usually sell out months in advance, so I recommend acting soon if you’re interested.

Travel Tech Essentialist Job Board

BizAway | Data Analyst | Remote

Propellic | Digital Marketing Manager | Remote

Viator | Strategy Lead | Needham (Massachusetts)

Dharma | Trip Designer | Remote

eDreams Odigeo | Business Analyst - Revenue Management | Barcelona

The Travel Tech Essentialist Job Board has great companies hiring for 1201 jobs. And if you'd like to feature your job openings on the board and in this newsletter, fill out this quick 1-minute form.

Are you fundraising?

If you are a startup looking to raise a round (from pre-seed to Series D), I can help (for free). Travel Investor Network is a private platform where I recommend innovative travel startups to investors and innovators. If you’re interested, please start by completing this form.

If you like Travel Tech Essentialist, please consider sharing it with your friends or colleagues. If you’re not yet subscribed, you can do so here:

And, as always, thanks for trusting me with your inbox.

Mauricio Prieto

Great edition! Agree on Peter Syme’s view on OTAs. Didn’t comment on the Uber Expedia hype in my newsletter as so many have already. And you did it better :-)