Travel Tech Essentialist #55: 100% Open Rate

Andrew Chan's Law of Shitty Clickthroughs states that over time, all marketing strategies result in shitty clickthrough rates. The first banner ad ever, on HotWired in 1994, had a CTR of 78%. Today's CTRs are 1500X worse. There is one marketing strategy that escapes this law (#2). In other news, as vaccination spreads, so does Zoom fatigue. The CEO of the largest bank in the US has had it with Zoom calls and some of the largest companies are now heading back to the office (#3). If you’re interested in OTAs, check out my comparative overview based on 2020 results (#1). And those of you thinking of going through a fundraising process, make sure to look at the fundraising playbook guide in #6.

This newsletter has been sponsored by

Have you ever thought about why the booking data flows in milliseconds via API but its corresponding payment takes time, cost and work to settle? We did.

PayParc provides the most innovative B2B payments platform for the travel industry, streamlining the payment process and making real-time transfers. PayParc recently partnered up with TravelgateX to offer a plug-and-play solution to all travel companies within their platform.

Find out more at PayParc.com and contact us for onboarding at hello@payparc.com

1. The State of Online Travel Agencies — 2021

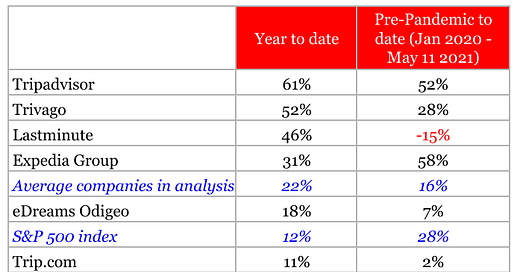

Every year I write a report on the previous year’s results of publicly traded OTAs and metasearches. Read report. By the way, the 10 publicly traded travel companies included in the report have, on average, a market cap 16% higher today than pre-Covid. Expedia and TripAdvisor are now worth 58% and 52% more than in January 2020, in spite of seeing their revenues decline by roughly 60%, their EBITDA drop by more than 85% in 2020, and travel restrictions still being the norm. I wonder if, in the absence of a pandemic that devastated the travel sector, share prices would be as high as they are today. That is a somewhat strange question to consider.

2. The only marketing channel with a 100% open rate

In travel, our job doesn't stop when the purchase happens. A customer “unboxes” a travel product when they experience the product, be it walking into a hotel, resolving a flight disruption or learning how to get the best out of a recently purchased B2B solution.

3. “I’m about to cancel all my Zoom meetings. I’m done with it”

That statement by Jamie Dimon, CEO of JPMorgan, should be welcome news for business travel. Top banks are telling their employees to get ready for a return to office:

Goldman Sachs executives revealed a plan to get US staff back at their NYC desks by June 14 and UK staff back at their Hogwarts desks by June 21.

JPMorgan wants 50% of its staff back in the office (at least part-time) by July.

Deutsche Bank is preparing to move its NYC staff into its new headquarters starting in July.

Google was one of the first companies to offer working from home, but it is also now encouraging its employees to come back to the office. In locations where Google offices are already opened, nearly 60% of Googlers are choosing to show up. In many regards, the much touted new normal is increasingly looking like the old normal.

4. “Travel is back” - CEO of @MorningBrew

Another manifestation of the old normal peeking back

5. Travel startups are getting billions in VC funding again

Pent-up demand is materializing and travel companies are seeing renewed investor interest. Funding to venture-backed travel startups amounted to around $4.8 billion across 629 deals in 2020 (both a five-year low) after hitting a record high of $10.8 billion in 2019. So far this year, companies in the sector have raised about $3.4 billion, on pace for a great year, and maybe even a record year. Read more.

6. A playbook for fundraising

Marc McCabe, Partner at Oyster Capital and formerly at Sequoia, provides a comprehensive and actionable guide on the startup fundraising process. The guide contains highly relevant and actionable advice, particularly for founders who have raised their seed round and are thinking forward to their next fundraise. It’s most relevant for Series A, but a lot of the same concepts apply for seed rounds, Series B, and to a certain extent Series C.

7. Hotel and Vacation Rental comparative analysis

In this report, Amadeus and Transparent combine their hotel and vacation rental datasets to highlight how booking trends compare between these two verticals (occupancy, pricing, booking window, length of stay, etc…). A few conclusions:

Hotel reservation volume outweighs vacation rental volume by 3.5 times

Both are seeing shifts towards slightly longer booking windows, suggesting growing consumer confidence

Average daily rate impact is greater in hotels

Current occupancy is similar

8. Global OTAs face being squeezed by twin forces in Southeast Asia

Oliver Rippel, Founding Partner at Singapore-based investment firm Asia Partners, thinks that global OTAs will struggle to meet the localisation and regionalization capabilities of smaller firms. He identifies two major emerging trends. First, the trend towards lifestyle super apps, where travel services become just one offering among many. This is easy to do for standardized products like flights (I don't agree with this...it's easy to do it but very hard to do it well), but less straightforward for other products. This in turn gives rise to the second trend, which will be greater specialization in non-standardized services. The lesson for OTAs is that they must continue to reinvent themselves to stay relevant, or they risk being squeezed by both increased generalization and deeper specialization. Read more.

9. Biometric digital ID in air travel

Digital ID and biometrics are big technology changes for airports and airline customers. This article by Iyad Hindiyeh (Amadeus head of strategy for Airport IT) calls for the need to properly integrate digital identity solutions between airport and airline systems. He highlights some scenarios where the end-to-end passenger experience can lack the level of attention needed in the transition to biometric identity.

10. Deals and Funding

Deals

Hospitality company Sonder will merge with a SPAC for an IPO at a $2.2 billion valuation. Here you can see Sonder’s investor presentation in which they detail how they are building “the hospitality brand of tomorrow”.

TeamABC is a new €30 million VC fund focused on early-stage travel companies. The fund is headquartered in Dublin with additional offices in Vienna, Dubai and Mexico City. Its first investment was in Yeildin, a French airline revenue management startup.

Expedia will sell its corporate business arm Egencia to American Express Global Business Travel. Expedia’s B2B unit, which includes Egencia, saw revenue sink 64% to $942 million in 2020, making up 18% of Expedia’s total revenue.

TripActions acquired high-end travel management company Reed & Mackay, from Palo Alto California, its first acquisition. Read +.

Booking Holdings acquired Flyiin to further develop its flights business, which Booking anticipates will represent an increasing mix of their overall business in the coming years. The German-based startup raised a €2.4 million round in January 2019.

Funding

Vacation rental search engine startup Holidu raised $45 million in a Series D round led by 83North. The new investment brings the German company’s total funding to more than $120 million since its foundation.

London-based travel payment startup Fly Now Pay Later secured an additional £10 million in funding bringing its Series A round to £45 million.

Paravision, a San Francisco-based provider of face recognition and computer vision technology, raised $23 million.

If you find this newsletter valuable, consider sharing it with colleagues and friends, or subscribing if you haven’t already.

Gracias,

Mauricio